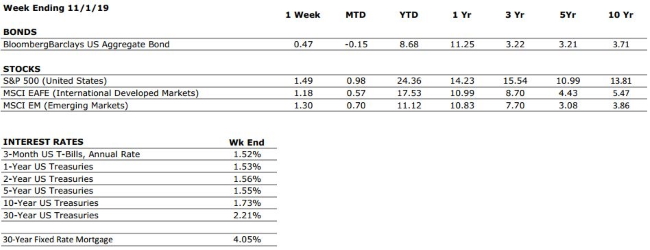

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite a recent decline in retail sales numbers. US consumer confidence remains high, but we will be watching this metric closely over the next couple of weeks and throughout earnings season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

A- |

The Federal Reserve cut its interest rate target by an additional 25 bps following last week. This was the third cut this year, but Chairman Jerome Powell signaled to markets that we this may be the last adjustment to the Fed’s policy target until there is a meaningful shift in the economic data (either positive or negative). |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth has been weak thus far in Q3 as a result of the global slowdown and trade policy uncertainty. Throughout earnings season, we will be paying closer attention to management commentary and updates to forward guidance, which are likely to have a bigger impact on stock prices. |

|

EMPLOYMENT |

A |

The US economy added a healthy 128,000 new jobs in October. Furthermore, there were upward revisions to data from the September and August reports in addition to evidence of strong wage growth. Considering the slew of negative sentiment leading up to its release, this was one of the more uplifting release in recent memory. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Despite the US & China being close to a “Phase One” agreement, we are keeping our “international risks” metric at an elevated level of 7 for now. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.