Year-End (Beginning) Holiday Office Hours

Our offices will close at 1 p.m. on Tuesday, December 24 and re-open at 8 a.m. on Thursday December 26. The following week, we will be closed on Wednesday, January 1. Our entire team wishes all of our clients and friends Happy Holidays and safe and prosperous New Year.

Daily Archives: December 17, 2019

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equity markets pushed higher last week on the back of clarifying results from the UK’s third general election in five years and a preliminary agreement on a phase one trade deal between the U.S. and China.

In the UK, Boris Johnson’s conservative party won a sizable majority in Parliament, enabling him to continue as Prime Minister with a much stronger foothold on guiding his agenda forward. For markets, this represents a far smaller probability of a “no deal” Brexit and sets the stage for the UK to finally leave the European Union early next year. A smooth Brexit transition should improve the outcome for UK domestic companies and improve sentiment in equity markets heading into 2020. However, the uncertainty is not completely vanquished, as Johnson’s next challenge will be the difficult task of negotiating new trade terms with the rest of Europe. If progress in these talks proves more difficult than expected, markets could experience additional Brexit-related volatility even after the official Brexit event has played out.

On the U.S./China front, President Trump and Chinese Vice Minister of Commerce Wang Shouwen each confirmed last week that the two countries have arrived at a preliminary agreement which is said to include the cancelation of tariffs scheduled to take effect this week. China also agreed to unspecified agricultural purchases from U.S. companies, some protections for intellectual property, and to opening its doors to U.S. based financial companies to do business in mainland China. Stocks, particularly in Emerging Markets (of which Chinese equities make up a large fraction of total outstanding market cap), reacted positively to the news. However, it should be noted that while tangible progress should be viewed favorably by global investors, this is far from a comprehensive deal and there remain difficult negotiations ahead. Many of the key issues that the United States is seeking to address cut at the heart of Chinese economic policy, setting the table for uncertainty surrounding the tenuous relationship between the two powers to linger into next year and beyond.

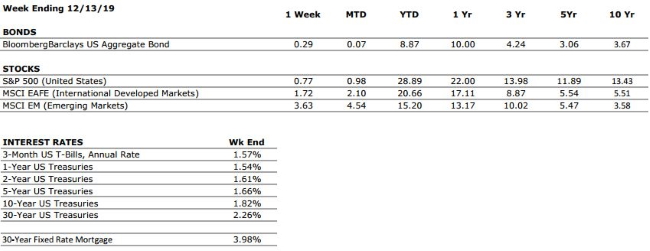

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite recent softening in retail sales numbers. US consumer confidence remains high, and we anticipate a strong holiday shopping season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

A- |

The Federal Reserve cut its interest rate target three times during 2019, but projections in the Fed’s “Dot Plot” following its most recent meeting yielded, on balance, no changes in 2020. We expect this to remain the case moving forward until we see a meaningful shift in the economic data (either positive or negative). |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth was weak during Q3 as a result of the global slowdown and trade policy uncertainty. However, according to Factset, 75% of S&P 500 companies reported a positive earnings surprise, meaning things were not quite as weak as many had feared. |

|

EMPLOYMENT |

A |

November’s headline jobs growth number of 266,000 smashed consensus estimates and provided further evidence that the US economy remains on solid footing. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

6 |

Following progress made last week on two key geopolitical concerns (Brexit and US/China trade relations), we are reducing our International Risks metric to a 6. Other key areas of focus for markets include the rising economic nationalism around the globe and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

OUR VNFA STORY

Valley National Financial Advisors will celebrate 35 years in business in 2020. Our founder, Thomas M. Riddle, CPA, CFP® created the Valley National Group of companies with a mission to help his clients make the right financial choices in pursuit of their goals and dreams. His vision was to create a place where clients could address as many areas of their financial life as possible all in one place, under the supervision of one trusted advisor.

Since 1985, Tom has brought together a trusted team around him to expand the resources available to clients and ensure that his original mission is sustained for generations to come. Tom continues to work with clients as a Financial Advisor, in addition to serving as Chairman of the Board.

Today, our business is run under the leadership of Matthew Petrozelli. Matt has been a part of the team since 2011, serving as a Financial Advisor and Chief Operating Officer before taking on the role of CEO at the beginning of 2018. Over the years, our team has grown to just about 40 employees who are all devoted to our original mission to help our clients with our personalized, one-stop service model.

Throughout 2020, we will be celebrating our past, highlighting the journey to where we are today, and sharing more with you about our future as a VNFA family.

Quote of the Week

“To appreciate the beauty of snowflake it is necessary to stand out in the cold.” – Aristotle

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week Laurie will share her years of experience helping people plan and complete: “Financial New Year’s Resolutions.”

Laurie will take your questions live on the air at 610-758-8810 or in advance via yourfinancialchoices.com/contactlaurie. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.