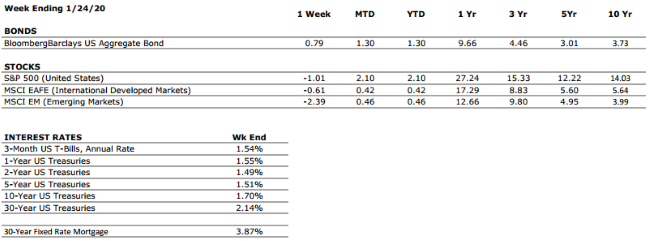

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY POSITIVE |

The consumer has been the bedrock of the US economy through much of the current expansion and we have seen little to suggest that this cannot continue. |

|

CORPORATE EARNINGS |

NEUTRAL |

Corporate earnings growth was weak throughout 2019 as a result of slowing in the global economy and trade policy uncertainty. However, analysts are expecting mid to high single digit earnings growth in 2020, which will be important to sustaining recent levels of equity returns. |

|

EMPLOYMENT |

VERY POSITIVE |

December’s headline jobs growth number of 145,000 missed consensus expectations, though the unemployment rate remained stable at 3.5%; a 50-year low. Despite the softer than anticipated results in December 2019 was an incredibly strong year for the labor market, and it remains the healthiest area of the economy. |

|

INFLATION |

POSITIVE |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

FISCAL POLICY |

POSITIVE |

The Tax Cuts and Jobs Act of 2017 lowered the effective tax rates for many individuals and corporations. We view the cuts as a tailwind for economic activity over the next several years. |

|

MONETARY POLICY |

POSITIVE |

With the Federal Reserve expected to refrain from any further adjustments to interest rates without a material change in the economic outlook, it is unlikely that changes in Fed Policy will disrupt the economic cycle in the near future. Furthermore, the low absolute level of interest rates remains a positive for markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

We have adjusted our assessment of Geopolitical Risks to NEGATIVE as a result of the continued spread of the coronavirus outside of mainland China. The virus poses a threat to economic growth consumer spending in affected regions as a result of the “fear factor” it induces. |

|

ECONOMIC RISKS |

NEUTRAL |

Due to low inflation and weak economic activity, central banks around the world remain in a very accommodative stance. We have seen some recent evidence of modest recovery in places like Germany, but we expect global economic growth to remain modest overall. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.