“Who you spend time with is who you become! Change your life by consciously choosing to surround yourself with people with higher standards!” – Tony Robbins

Monthly Archives: February 2020

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will address: “Listener Tax Questions.” Listeners can call 610-758-8810 during the live show, or submit questions online at yourfinancialchoices.com/contact-laurie

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Our #TeamVNFA is partnering with Northeast Community Center for our 2020 Volunteer Challenge project.

Learn more about the competition and save the date for the Volunteer Center’s largest fundraising event – May 12, 2020. https://www.volunteerlv.org/volunteer-challenge

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equities recorded healthy gains last week as optimism rose that the economy could remain resilient in the face of the new coronavirus outbreak. At this point, the total impact on economic activity remains impossible to quantify, and investors can expect markets to remain jittery until the virus is eventually contained. We have seen little over the last week that would help us to update our current assessments of contagion and severity. The death rate among those infected still sits at around 2%, and while the rate of contagion has also remained somewhat stable, a recent Chinese research report suggests that the virus can spread in multiple ways. Both of these metrics deserve our ongoing attention, as they can help us to assess the potential magnitude of the disease’s impact on the economy, as well as whether the economic effects will largely remain confined to mainland China.

At present, the most impacted areas of the market outside of Chinese equities have been at the sector level. The travel and industrial sectors, as well as some commodity markets have seen more volatility than most other assets as a result of the immediate impacts of quarantines and reduced global travel demand. The technology sector is one that has continued to perform well but could come under pressure if recent containment efforts in China fall short and the virus is able to spread beyond the Hubei Province. One of the biggest differences between the SARS outbreak of 2003 and the current situation is that China is now a much larger component of the global economy, particularly in the technology supply chain. While Hubei province itself is not a major technology hub within China, there are multiple neighboring provinces which contain key production centers for many key inputs in the production of smart phones, TVs, and semiconductors.

The Numbers & “Heat Map”

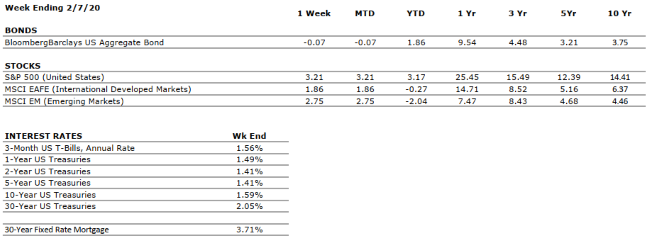

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY POSITIVE |

The consumer has been the bedrock of the US economy through much of the current expansion and we have seen little to suggest that this cannot continue. |

|

CORPORATE EARNINGS |

NEUTRAL |

Corporate earnings growth was weak throughout 2019 as a result of slowing in the global economy and trade policy uncertainty. However, analysts are expecting mid to high single digit earnings growth in 2020, which will be important to sustaining recent levels of equity returns. |

|

EMPLOYMENT |

VERY POSITIVE |

The economy added 225,000 new jobs in January, exceeding consensus expectations. The report also indicated that the unemployment rate ticked up to 3.6% as a result of more people looking for jobs. The expansion of the labor force should be taken as an additional sign of the confidence Americans have in the health of the labor market. |

|

INFLATION |

POSITIVE |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

FISCAL POLICY |

POSITIVE |

The Tax Cuts and Jobs Act of 2017 lowered the effective tax rates for many individuals and corporations. We view the cuts as a tailwind for economic activity over the next several years. |

|

MONETARY POLICY |

POSITIVE |

With the Federal Reserve expected to refrain from any further adjustments to interest rates without a material change in the economic outlook, it is unlikely that changes in Fed Policy will disrupt the economic cycle in the near future. Furthermore, the low absolute level of interest rates remain a positive for markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Our assessment of Geopolitical Risks is NEGATIVE at this time as a result of the continued spread of the coronavirus outside of mainland China. The virus poses a threat to economic growth and consumer spending in affected regions as a result of the “fear factor” it induces. |

|

ECONOMIC RISKS |

NEUTRAL |

Due to low inflation and weak economic activity, central banks around the world remain in a very accommodative stance. We have seen some recent evidence of modest recovery in places like Germany, but overall, we expect global economic growth to remain modest. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Mid-February Tax Reminders

We need each of our tax clients to complete a questionnaire every year as part of our return preparation process. Our team has either sent you a paper copy or a link. Please make sure you complete this and deliver it to us, in addition to your tax documents. Click here to access the online questionnaire.

S Corporation and Partnership returns with a December 31 year-end are due March 16! Send us your information as soon as you have all or most of it together so that we can get ahead of this deadline.

Quote of the Week

“It isn’t the mountain ahead that wears you out; it’s the grain of sand in your shoe.” – Robert W. Service

“Your Financial Choices”

This week, Laurie will discuss: “Important Information Enclosed – Deciphering Tax Documents.”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Meet our tax season interns!

They will be assisting our tax preparation team with document intake and digital set up as well as support on special projects.

All four students were selected for VNFA’s tax season internship program, which is in its sixth year. The program is designed to provide real-world experience for individuals interested in a career that may include tax planning. Tax interns are exposed to and participate in every part of the process, working alongside seasoned CPAs and financial planners in a professional office environment.

Jose is a senior at DeSales where he is a member of the Accounting/Finance Club. Last year, he completed an accounting summer internship at Victaulic.

Shane is a senior at Kutztown where he is also minoring in Information Technology. His internship experience includes Wenz Tax & Financial Services and Central Susquehanna Opportunities.

Jack is a junior at Muhlenberg and is working on the final stages of becoming a Certified Public Accountant (CPA). He balances his studies with on the Muhlenberg football team.

Jeffrey is a junior at Lehigh where his accounting major is focused on an information technology track. Last year, he completed an accounting internship with Historic Bethlehem Museums and Sites.

#TeamVNFA In the News

Financial Advisor Mike Ippoliti, MBA, CFP was featured in a special FISCAL supplement of the Express Times on Sunday – 10 great ways to maximize your long-term wealth.

Our Head of Investments, Connor Darrell CFA, was featured in a Lehigh Valley Business article last week about AI in the financial industry.

“It’s changing the role that an analyst or portfolio manager might have and takes away what might have been a time-consuming task, Darrell said. “I think it augments the process, just having more information at your fingertips. It gives us more tools to choose from.” READ MORE at lvb.com

The Markets This Week

by Connor Darrell CFA, Assistant

Vice President – Head of Investments

Global

equity markets moved lower last week with concerns over the economic impacts of

the coronavirus weighing heavily on investors’ minds. Emerging Markets stocks,

of which Chinese equities are a major component, were hit hardest. Large-scale

business closures and supply chain disruptions are anticipated to negatively

impact economic growth in the near-term, and both stock and bond prices have

begun to reflect that uncertainty. The headlines coming out of China with respect

to the virus have been unnerving, but a look at prior outbreaks suggests that

the market impacts may be relatively short-term in nature. Of course, all

outbreaks are unique, and the scientific community still knows very little

about the new coronavirus, so it is unsurprising that markets have reacted in

the way they have. The situation in China is rapidly evolving, so in order to

help keep tabs on new developments, we will be tracking two primary facets of

the disease over time; contagion and severity. Below we provide some

perspective on both of these key considerations as well as a comparison to

prior outbreaks. We will continue to

provide updates to our assessment in future iterations of The Weekly Commentary.

Severity

There remains little clear information about the true severity of the virus, especially as it relates to the impacts on different age cohorts, whether deaths have occurred primarily in higher risk patients, etc. However, we do know that as of Monday morning, confirmed cases totaled 17,489 worldwide (with about 99% occurring in mainland China). Of those cases, the virus has been connected to 362 deaths, translating to a death rate of just over 2%. For context, the SARS (Severe Acute Respiratory Syndrome) outbreak of 2003 had a death rate of 9.6%, while the death rate associated with the seasonal flu is about 0.05% (according to the World Health Organization). One promising datapoint is that there are over 500 cases of patients who contracted the illness and have since recovered and been released from the hospital.

Contagion

While the coronavirus appears to be significantly less life-threatening than both SARS and MERS (Middle East Respiratory Syndrome), it does appear to spread more quickly. During the SARS outbreak, the World Health Organization identified 8,098 probable cases, and that number has already been surpassed by the new coronavirus. Chinese authorities have responded by placing over a dozen cities under quarantine, and travel to and from mainland China has been significantly reduced. As of now, it is the rising level of contagion that seems to be having the biggest impact on markets.

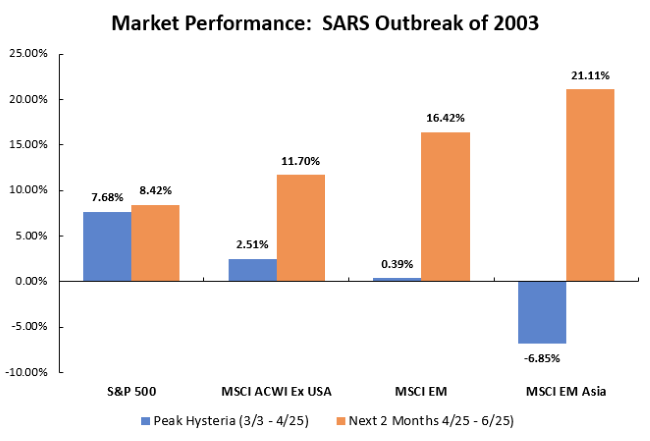

Market History

Evaluating market history can often be a helpful starting point for an assessment of what might be expected in the future. Despite the differences in severity and rate of contagion between the two diseases, the SARS outbreak of 2003 remains the most logical point of comparison for the new coronavirus. During the SARS outbreak (which also originated in China), there was a measurable short-term impact on southeast Asian economies. Economic growth in Hong Kong briefly fell into negative territory, and Chinese economic growth was also impacted. However, the Chinese economy was undergoing a rapid transformation and was exhibiting very high levels of growth during this time period, and so economic output remained quite strong throughout the outbreak. Asian equities sold off during the peak of the SARS hysteria, and other global equity markets also struggled to generate positive returns (though the U.S. market remained quite resilient). Altogether, the outbreak lasted about nine months and both the economy and markets were able to rebound within a relatively short period of time. The chart below summarizes market returns in different regions during the peak of SARS hysteria as well as the ensuing months after authorities began to contain the outbreak. With the SARS outbreak, it is clear that the market impacts were short-lived. However, it will be important to monitor the current situation for further developments, especially as it relates to the rate of contagion and severity of the new coronavirus.