by Connor Darrell CFA, Assistant

Vice President – Head of Investments

Global

equity markets moved lower last week with concerns over the economic impacts of

the coronavirus weighing heavily on investors’ minds. Emerging Markets stocks,

of which Chinese equities are a major component, were hit hardest. Large-scale

business closures and supply chain disruptions are anticipated to negatively

impact economic growth in the near-term, and both stock and bond prices have

begun to reflect that uncertainty. The headlines coming out of China with respect

to the virus have been unnerving, but a look at prior outbreaks suggests that

the market impacts may be relatively short-term in nature. Of course, all

outbreaks are unique, and the scientific community still knows very little

about the new coronavirus, so it is unsurprising that markets have reacted in

the way they have. The situation in China is rapidly evolving, so in order to

help keep tabs on new developments, we will be tracking two primary facets of

the disease over time; contagion and severity. Below we provide some

perspective on both of these key considerations as well as a comparison to

prior outbreaks. We will continue to

provide updates to our assessment in future iterations of The Weekly Commentary.

Severity

There remains little clear information about the true severity of the virus, especially as it relates to the impacts on different age cohorts, whether deaths have occurred primarily in higher risk patients, etc. However, we do know that as of Monday morning, confirmed cases totaled 17,489 worldwide (with about 99% occurring in mainland China). Of those cases, the virus has been connected to 362 deaths, translating to a death rate of just over 2%. For context, the SARS (Severe Acute Respiratory Syndrome) outbreak of 2003 had a death rate of 9.6%, while the death rate associated with the seasonal flu is about 0.05% (according to the World Health Organization). One promising datapoint is that there are over 500 cases of patients who contracted the illness and have since recovered and been released from the hospital.

Contagion

While the coronavirus appears to be significantly less life-threatening than both SARS and MERS (Middle East Respiratory Syndrome), it does appear to spread more quickly. During the SARS outbreak, the World Health Organization identified 8,098 probable cases, and that number has already been surpassed by the new coronavirus. Chinese authorities have responded by placing over a dozen cities under quarantine, and travel to and from mainland China has been significantly reduced. As of now, it is the rising level of contagion that seems to be having the biggest impact on markets.

Market History

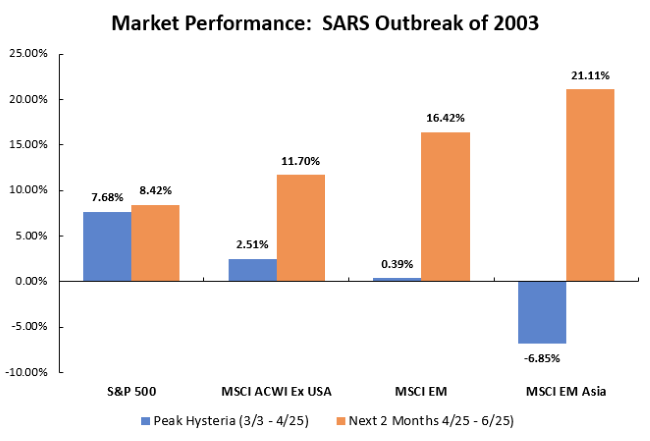

Evaluating market history can often be a helpful starting point for an assessment of what might be expected in the future. Despite the differences in severity and rate of contagion between the two diseases, the SARS outbreak of 2003 remains the most logical point of comparison for the new coronavirus. During the SARS outbreak (which also originated in China), there was a measurable short-term impact on southeast Asian economies. Economic growth in Hong Kong briefly fell into negative territory, and Chinese economic growth was also impacted. However, the Chinese economy was undergoing a rapid transformation and was exhibiting very high levels of growth during this time period, and so economic output remained quite strong throughout the outbreak. Asian equities sold off during the peak of the SARS hysteria, and other global equity markets also struggled to generate positive returns (though the U.S. market remained quite resilient). Altogether, the outbreak lasted about nine months and both the economy and markets were able to rebound within a relatively short period of time. The chart below summarizes market returns in different regions during the peak of SARS hysteria as well as the ensuing months after authorities began to contain the outbreak. With the SARS outbreak, it is clear that the market impacts were short-lived. However, it will be important to monitor the current situation for further developments, especially as it relates to the rate of contagion and severity of the new coronavirus.