In the last several weeks, interest rates have moved to record low levels. As a result, mortgage interest rates (which tend to closely follow long-term interest rates), have also moved to historic lows. According to Freddie Mac: “The average rate on a 30-year fixed mortgage was 3.45% during the week through Feb. 27, down from 4.35% a year earlier. The average rate on a 15-year mortgage fell to 2.95% from 3.77% a year earlier.” With rates trending down, you may want to consider refinancing existing mortgages. This choice will not be right for everyone. Please take the time to consider your individual financial situation and personal factors – for example, if you are at the tail end of your existing mortgage the refinance costs may be greater than the benefit, or it may not be in your best interest if you are possibly planning on moving in the next 5-7 years. Make sure you take all of your planning into account and consult with professionals before making any decisions. A good place to start would be running your numbers through the mortgage refinance calculator on our MyRetirementPro.com website.

Monthly Archives: March 2020

Quote of the Week

“When one door of happiness closes, another opens; but often we look so long at the closed door that we do not see the one which has opened for us.” – Helen Keller

“Your Financial Choices”

This week, Laurie will address more: “Tax Filing, Withholdings, Payments.”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

Laurie will take questions at 610-758-8810 during the live show, and address those submitted online at yourfinancialchoices.com/contact-laurie

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

The Markets This Week

by Connor Darrell CFA, Assistant

Vice President – Head of Investments

U.S.

equities generated their worst week in over a decade as fears that the novel

coronavirus might pose a real threat to economic activity began to spread. In

our view, the market action we observed last week was not based upon fundamentals,

because market participants simply don’t have that type of concrete information

available to them. The selling was, however, unsurprising as the panic that

rippled through the financial system last week was likely amplified by the fact

that equity markets had performed so strongly over the previous year. Throughout

2019, stocks generated strong returns despite minimal growth in corporate

earnings. That happened because the global economy was showing signs of

improvement and the prospects for future earnings growth were increasing. The

coronavirus represents a significant unknown that is eating away at the

positive sentiment that built up throughout last year, and investors should

expect continued volatility in markets as the situation continues to evolve.

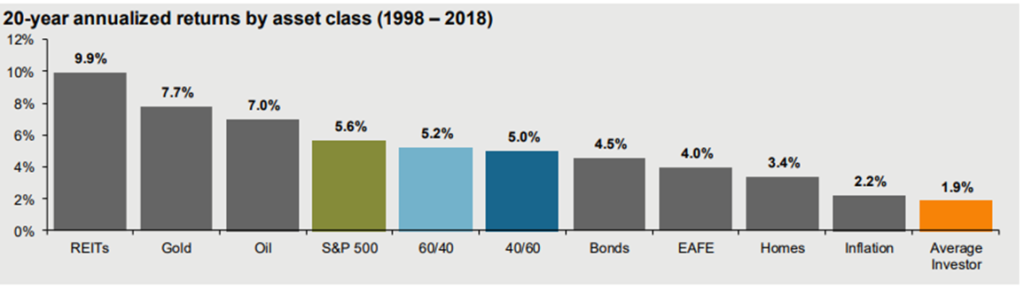

But with all of that said, while the coronavirus itself is new and the public health concerns very real, the fact of the matter is that what we are seeing in markets is not out of the ordinary. Since World War II, there have been a total of 26 stock market corrections (this one makes 27) with an average market decline of 14.3%. Some have been larger, and some have been smaller. What makes this correction particularly difficult is that there are so many details we still don’t know about the coronavirus. At what point will cases reach a peak? How severe might the economic impacts be, and how widespread? The markets have reacted strongly to these uncertainties because investors’ appetite for risk tends to dissipate as more unknown variables enter the equation. In times like these, we like to remind investors that drastic portfolio changes are unlikely to add value over the long-term. In fact, there is overwhelming evidence that most investors make themselves worse off by reacting too strongly to negative news. The below chart from JPMorgan shows the historical performance of the average investor compared to a variety of different asset classes. The average investor has a propensity to act emotionally during periods of market stress and make efforts to time the markets, which has clearly led to significant underperformance. In fact, the average investors’ mistakes have caused portfolio returns to even lag inflation!

The evidence above suggests that investors should consider the amount of fixed income in their portfolios before making drastic decisions to exit equities en masse. For those who have multiple years’ worth of withdrawals that can be funded from bond positions, there is little that should be done to address the pullback.

The Number & “Heat Map”

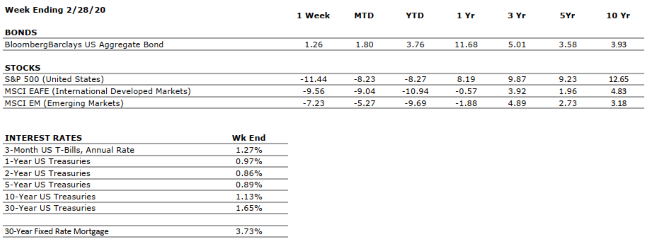

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY POSITIVE |

The consumer has been the bedrock of the US economy through much of the current expansion and we have seen little to suggest that this cannot continue. |

|

CORPORATE EARNINGS |

NEUTRAL |

Corporate earnings growth was weak throughout 2019 as a result of slowing in the global economy and trade policy uncertainty. However, analysts are expecting mid to high single digit earnings growth in 2020, which will be important to sustaining recent levels of equity returns. |

|

EMPLOYMENT |

VERY POSITIVE |

The economy added 225,000 new jobs in January, exceeding consensus expectations. The report also indicated that the unemployment rate ticked up to 3.6% as a result of more people looking for jobs. The expansion of the labor force should be taken as an additional sign of the confidence Americans have in the health of the labor market. |

|

INFLATION |

POSITIVE |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

FISCAL POLICY |

POSITIVE |

The Tax Cuts and Jobs Act of 2017 lowered the effective tax rates for many individuals and corporations. We view the cuts as a tailwind for economic activity over the next several years. |

|

MONETARY POLICY |

POSITIVE |

With the potential threat that COVID-19 poses to the economy, attention is now turning to whether the Federal Reserve will take action following its March policy meeting. Markets are beginning to anticipate a rate cut from the Fed, which would provide support for market in the near-term. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

Our geopolitical risks rating is now VERY NEGATIVE as there is more evidence of the coronavirus spreading outside China. However, we think it is important for investors to disentangle the public health concerns over the near-term from the expectations for markets over the long-term. The outbreak remains a near-term issue at this time. |

|

ECONOMIC RISKS |

NEUTRAL |

Due to low inflation and lukewarm economic activity, central banks around the world remain in a very accommodative stance. We have seen some recent evidence of modest recovery in places like Germany, but overall, we expect global economic growth to remain modest. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

VNFA NEWS

Our team in the news.

Did you see Laurie Siebert on WFMZ 69 News last week? She was interviewed about Women United’s funding for non-profits assisting women, children and families.

Plus, Elizabeth Wilson’s interview with PICPA went live via the organization’s CPA Conversations podcast.

Quote of the Week

“Global health issues remind us – perhaps more than any other issue – that we are all children of the same extended family.” – Kathleen Sebelius

“Your Financial Choices”

This week, Laurie will address more: “Listener Tax Questions.” Listen to the February 19 show devoted to listener tax questions at yourfinancialchoices.com.

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

Laurie will take questions at 610-758-8810 during the live show, and address those submitted online at yourfinancialchoices.com/contact-laurie

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.