“Be as passionate about listening as you are about wanting to be heard.” – Brené Brown

Monthly Archives: August 2020

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your

Financial Choices” show on WDIY: Financial

Planning with the Tax Return

She

can take your questions live on the air at 610-758-8810, or address those

submitted via yourfinancialchoices.com.

Recordings of past

shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA Voted Readers’ Choice for Wealth Management

Your votes made Valley National Financial Advisors a winner in the Wealth Management category of the 2020 Lehigh Valley Business Reader Rankings.

Lehigh Valley Business received nearly 28,000 votes this year from the business community. READ MORE & SEE ALL THE WINNERS

VNFA NEWS

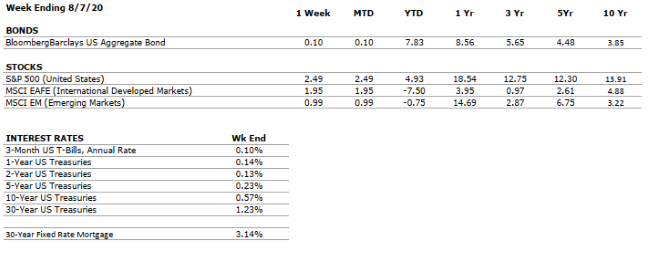

The Markets This Week

by Maurice (Mo) Spolan, Investment Research Analyst

U.S., international and emerging market equities were all up between 1% and 3% last week. Fixed income indices, such as the widely followed Barclay’s Aggregate, have provided returns only slightly above zero over the last month, a result of the historically low rate environment in which investors are participating.

The U.S. added about 1.2 million jobs in July, a considerable deceleration from the 4.8 million added during June. While employment gains are certainly welcomed amidst a global pandemic, the slowdown may indicate the unfortunate possibility that new job growth is plateauing. This is troublesome because the unemployment rate remains very high, at 10.2%.

With Q2 corporate earnings almost complete, S&P 500 constituents have experienced an aggregate decline in earnings of 33%, the greatest year-over-year stumble since 2008. With that said, analysts expected earnings to erode by 40%, so companies have beaten expectations.

As Democrats and Republicans remain distant in their proposed stimulus packages, President Trump signed an executive order over the weekend to provide fiscal support. Whether the order will actually come into effect, however, is uncertain, as several legal analysts believe that it is unconstitutional for the president to supersede congressional spending authority.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP declined at an annualized rate of 32.9% in Q2, the fourth-largest fall in the last 100 years. Although the figure is staggering, it was in-line with economists’ expectations. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

S&P 500 earnings have fallen by around 33% in Q2, the sharpest year-over-year decline since 2008. |

|

EMPLOYMENT |

VERY NEGATIVE |

1.8 million jobs were added in the U.S. during July. While gains, rather than losses, are welcomed, the figure represents a considerable deceleration from the 4.8 million jobs added in June. Unemployment remains very high at 10.2%. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

In light of the expiration of federally granted, weekly unemployment support, and an absence of congressional progress towards the next round of stimulus, President Trump signed an executive order over the weekend provisioning fiscal support. However, the legality of the order, and whether it will actually come into effect, are in question. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, and several measures of the economy improved in May and June. However, economic activity remains well-below that in 2019, and uncertainty remains very high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“You can’t be brave if you’ve only had wonderful things happen to you.” – Mary Tyler Moore

Did You Know…?

REMINDER – The Internal Revenue Service is allowing taxpayers who have taken a

2020 Required Minimum Distribution (RMD,) which includes beneficiaries, to

repay that amount back to their retirement account(s) by August 31. For

taxpayers who took more than the RMD, only the RMD portion would be allowed to

be repaid unless a 60-day rollover would otherwise be available. If you

took an RMD and wish to return some or all of it, please contact your financial

advisor.

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY: Lehigh Valley Real Estate

Laurie will be joined by Carrie Ward, Realtor,CIPS, TRC, MRP, RENE with Howard Hanna The Frederick Group to discuss real estate in the valley – overview and tips.

They can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA Named Again to Financial Times 300 Top Registered Investment Advisers in USA

Valley National Financial Advisors (VNFA) is pleased to announce it has been named to the 2020 edition of the Financial Times 300 Top Registered Investment Advisers. The list recognizes top independent RIA firms from across the U.S. This is VNFAs second year in a row being honored as part of this national list.

This is the seventh annual FT 300 list, produced independently by Ignites Research, a division of Money-Media, Inc., on behalf of the Financial Times. Ignites Research provides business intelligence on investment management.

RIA firms applied for consideration, having met a minimum set of criteria. Applicants were then graded on six factors: assets under management (AUM); AUM growth rate; years in existence; advanced industry credentials of the firm’s advisers; online accessibility; and compliance records. There are no fees or other considerations required of RIAs that apply for the FT 300.

The final FT 300 represents an impressive cohort of elite RIA firms, as the median AUM of this year’s group is $1.9 billion. The FT 300 Top RIAs represent 39 different states and Washington, D.C.

“As our firm celebrates 35 years in business, it is wonderful to have this additional industry recognition,” says Matt Petrozelli, CEO. “2020 has been unprecedented in many ways, but our firm has been able to maintain our client-first focus and we are confident that we will emerge from this pandemic period stronger than ever. The commitment from our team of professionals along with a strong business infrastructure have provided a stability that is hard to come by right now; and, for that, I could not be prouder.”

The FT 300 is one in series of rankings of top advisers by the Financial Times, including the FT 401 (DC retirement plan advisers) and the FT 400 (broker-dealer advisers).

The Financial Times 300 Top Registered Investment Advisers is an independent listing produced annually by Ignites Research, a division of Money-Media, Inc., on behalf of the Financial Times (July 2020). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. The listing reflected each practice’s performance in six primary areas: assets under management, asset growth, compliance record, years in existence, credentials and online accessibility. Over 750 qualified firms applied for the award, 300 of which were selected (40%). This award does not evaluate the quality of services provided to clients and is not indicative of the practice’s future performance. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.