by William Henderson, Vice President / Head of Investments

The markets continued to move into record high territory last week looking past COVID-19 and forward to additional stimulus, greater distribution of vaccines and a long-awaited recovery in employment. As expected, Fed Chair Jerome Powell also stuck with his dovish tone last week reminding us that the Fed has no intention of lifting from the economic accelerator for a long time. For the week ended February12, 2021, the Dow Jones Industrial Average returned +1.0%, the S&P 500 Index +1.2% and the NASDAQ +1.7%. Last week’s returns piled onto an already positive year for the markets. Year-to-date, the Dow Jones Industrial Average has returned +3.0%, the S&P 500 Index +4.9% and the NASDAQ at +9.4%. For the week, the 10-year U.S. Treasury note moved only one basis point higher to 1.16%.

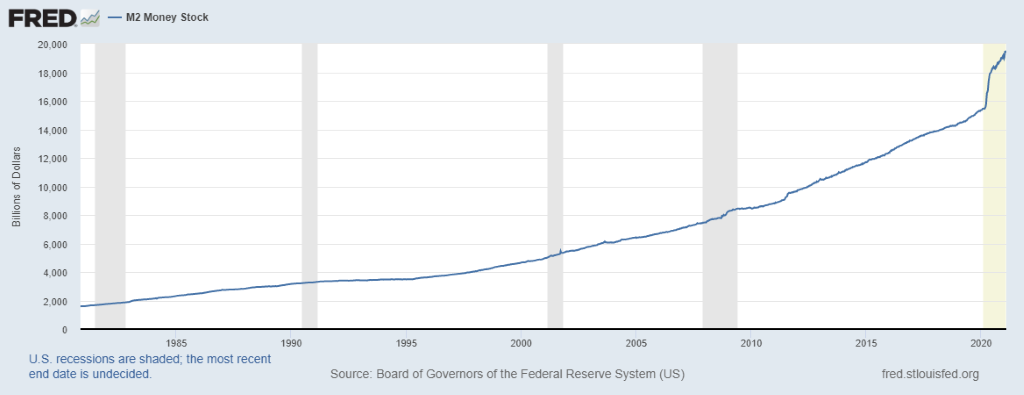

We have talked about M2, the Money Stock of savings deposits, bank deposits and retail money market fund balances, several times in The Weekly Commentary. The chart above from the Federal Reserve Bank of St. Louis shows M2 sitting at record levels and indicates graphically how much cash is sitting on the sidelines waiting to be released into a post-COVID-19 economy. An additional stimulus package of $1.5 to $1.9 trillion will only add to those reserves. As we reach herd immunity and the magic 75% of the population vaccinated, that cash will be put to work. Sectors like leisure, travel, energy, and retail will see a surge in activity. It will be gradual and the journey back to normal will be bumpy and winding, but it is in sight and the markets are seeing the end game not the path.

I feel like this column often returns to the same thing: a dovish Fed, a willing Treasury Secretary, an able Democratic majority party across the government, and vaccine distribution when coupled with the sidelined cash only points to a very healthy economy in the second half of 2021. Several firms are predicting double-digit GDP prints (10%-11%) in 3Q & 4Q 2021. Investors should look past the clamor, and instead focus on the end game described above. It is interesting to note that on years when the S&P 500 Index returns greater than 10%, there are between three and five market corrections that year of 5% or more. Why does that matter? It is a reminder to investors that corrections are normal in healthy markets and part of long-term investing.