Our team will be working normal hours this Friday, April 2. Happy Easter to all who celebrate this weekend.

Monthly Archives: March 2021

Current Market Observations

by Maurice (Mo) Spolan, Investment Research Analyst

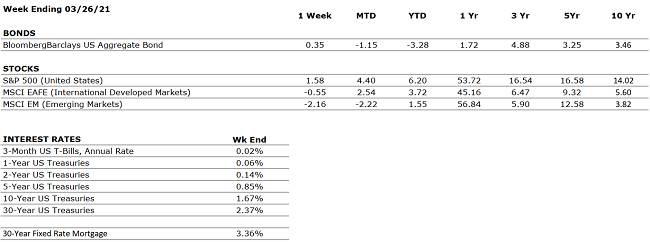

The S&P 500 and Dow Jones Industrial Average were both up modestly last week, 1.6% and 1.4% respectively, while the tech-heavy Nasdaq 100 was flat and International and Emerging Market equities trended lower. Bond prices rose as interest rates declined slightly; interest rates have risen quite a bit in 2021 but remain very low from a historical perspective. The 10-year U.S. Treasury note ended the week at 1.66%.

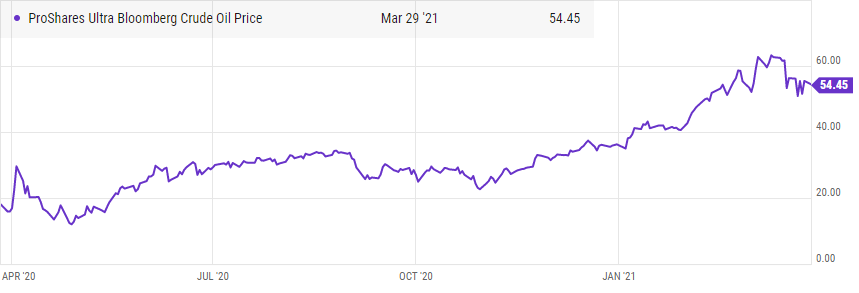

The blockage in the Suez Canal is disrupting as much as 12% of global trade. This supply constraint has also facilitated a rise in the price of oil, which is now above $61. Oil prices have recovered considerably since the pandemic’s outset and may settle at this higher level as demand for travel accelerates upon reopening throughout 2021. The giant container ship bocking the Suez Canal seems to have finally been cleared but the impact to the global supply chain is unclear.

President Biden is increasing his vaccination target, up to 200 million doses administered in his first 100 days in office, from an initial goal of 100 million. Estimates show that 14% of Americans are fully inoculated and 26% of residents have received at least one dose.

The economic outlook remains extremely favorable as both monetary and fiscal stimulus are highly accommodative, and the vaccine roll-out accelerates. As pent-up demand is unleashed, 2021 may end up being one of the most lucrative years in American economic history.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The FOMC forecasts the U.S. economy will grow by 6.5% in 2021, while the unemployment rate will retreat to 4.5% by year’s end. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q4 profits grew 3.8% year-over-year, well in excess of analyst expectations, which figured that earnings would fall by 7%. Earnings in 2021 are set to look strong as they lap Q2-Q3 2020. |

|

EMPLOYMENT |

NEUTRAL |

The unemployment rate declined to 6.2% in February from 6.4% in January. Most of the added jobs last month were concentrated in the Leisure & Travel sector. Total employment remains 9.5 million jobs below the pre-pandemic peak. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden signed a $1.9 trillion fiscal bill last week. The U.S. economy has received a total of approximately $4 trillion in stimulus during the COVID-19 pandemic. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April 2020 nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Patience is the calm acceptance that things can happen in a different order than the one you have in mind.” – David G. Allen

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Updates on Stimulus, filing dates and amendments

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Tax Update

The IRS and the Treasury Department have extended the federal income tax filing due date for individuals for the 2020 tax year from April 15, 2021, to May 17, 2021. Many states, including Pennsylvania, are following suit, and extending their filing deadlines to match (and in some cases extended beyond May – be sure to check with the state tax agencies where you are required to file).

The change is in response to an initial delay in the tax filing season coupled with the recent tax law changes presented by the American Rescue Plan Act. The later deadline allows individuals and tax preparers more time to accurately gather, prepare and review your tax return to determine the best possible outcome.

This relief applies to individual taxpayers, including those who pay self-employment tax.

- You do not have to take any action to qualify for this postponement.

- This relief does not apply to estimated tax payments that are due on April 15, 2021.

- The decision does not automatically change deadlines for state tax payments or payments of any other type of federal tax.

Recent changes, including those impacting unemployment and stimulus payments require software updates that present further possible delays in the preparation process. Additionally, those who qualify for additional tax benefits may still receive recommendation for an additional filing extension to October 15, 2021.

If your tax returns are prepared by our VNFA Tax Department, we ask for your patience as we manage these updates and give careful attention to each of the returns moving through our offices. Email tax@valleynationalgroup.com with any immediate questions. Otherwise, you will hear from us when we have additional updates on your return(s).

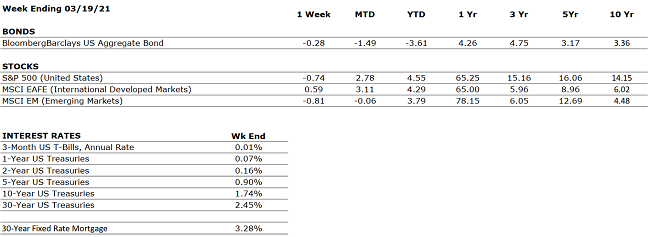

Current Market Observations

by William Henderson, Vice President / Head of Investments The markets took a pause last week with a brief pull back, and all three indices posted negative returns. For the week that ended March 19, 2021, the Dow Jones Industrial Average returned –0.5%, the S&P 500 Index lost –0.8%, and the NASDAQ fell by –0.8%. The minor pull back did not reverse the positive returns across the market on a year-to-date basis. Year-to-date, the Dow Jones Industrial Average has returned +6.6%, the S&P 500 Index +4.2% and the NASDAQ +2.5%. We continue to see the natural divergence occur between growth (technology) and value (industrial) stocks as the economic recovery gets underway. Treasury yields continue to put pressure on the markets as yields are slowly moving higher each week, which is another typical pattern seen as the economy comes out of a recession. Last week the 10-year U.S. Treasury Note moved higher in yield by six basis points to 1.69%. At year-end 2019, prior to the pandemic and during a very strong and growing economy, the 10-year U.S. Treasury Note stood at 1.91%. As the economy recovers from the “Black Swan Event,” of COVID-19, the markets are simply reverting to their traditional patterns of performance.

The Federal Reserve concluded its two-day meeting last week and announced a widely expected continuation of its policy to keep interest rates unchanged at zero to 0.25%. Relative to the December Fed meeting, more committee members expected higher rates by 2023 year-end. Still, the majority anticipate a policy hold through 2023. On the economic front, the Fed upgraded its near-term economic growth and recovery outlook to 6.5% in 2021. The Fed is seeing all the positive headwinds behind an already strengthening and recovering economy and adjusting their estimates higher. As we have written repeatedly, there is $20 trillion of cash in bank deposits, commercial accounts, and money market funds; fiscal and monetary policy are fully behind the economy; and the COVID-19 vaccine is being widely distributed nationwide. A primed consumer is ready to spend!

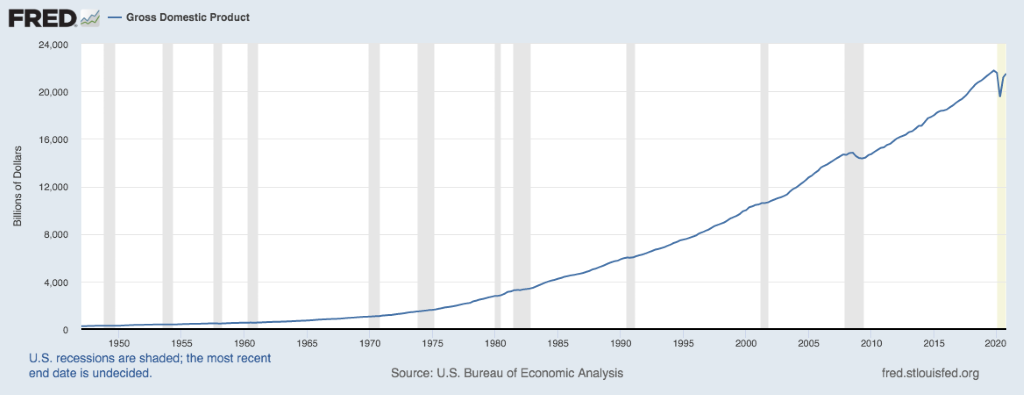

A brief glance at the chart below shows the Gross Domestic Product of the United States since 1950 as reported by the Federal Reserve Bank of St. Louis. The pandemic dip in GDP is clear, but so is the recovery. Plus, the Fed is on the low side of GDP estimates for 2021 when compared to most Wall Street economists who are predicting numbers as high at 9-10%.

Our VNFA Founder and Chairman, Tom Riddle, recently mentioned a market anecdote to me that I thought was interesting: “The stock market is like a Yo-Yo on an escalator, and the media wants you to focus on the Yo-Yo but you should focus on the escalator.” Remember to speak with your financial advisor often so you remain focused on the escalator.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The FOMC forecasts the U.S. economy will grow by 6.5% in 2021, while the unemployment rate will retreat to 4.5% by year’s end. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q4 profits grew 3.8% year-over-year, well in excess of analyst expectations, which figured that earnings would fall by 7%. Earnings in 2021 are set to look strong as they lap Q2-Q3 2020. |

|

EMPLOYMENT |

NEUTRAL |

The unemployment rate declined to 6.2% in February from 6.4% in January. Most of the added jobs last month were concentrated in the Leisure & Travel sector. Total employment remains 9.5 million jobs below the pre-pandemic peak. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden signed a $1.9 trillion fiscal bill last week. The U.S. economy has received a total of approximately $4 trillion in stimulus during the COVID-19 pandemic. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April 2020 nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“The bad news is time flies. The good news is you’re the pilot.” – Michael Altshuler

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Retirement Funding

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.