We are Hiring!

Team VNFA is seeking a Senior Accountant. The Senior Accountant will perform general accounting operations by controlling and verifying our financial transactions. Additional responsibilities will include reconciling account balances and bank statements, maintaining general ledgers and performing month-end close procedures. READ MORE / APPLY ONLINE

Daily Archives: March 16, 2021

Did You Know…?

American Rescue Plan Act of 2021

The stimulus signed into law last week includes many items that could impact people’s tax planning for 2021, but let’s focus on two of the key topics that have an impact on the 2020 tax return.

Unemployment:

- Extends the $300 unemployment weekly supplemental benefit through Sept. 6, 2021

- Makes

the first $10,200 of unemployment benefits tax-free for people with incomes of

less than $150,000 for 2020 only. If

you are married, each spouse receiving unemployment compensation doesn’t have

to pay tax on unemployment compensation of up to $10,200.

- The exclusion should be reported separately from your unemployment compensation – the IRS has updated instructions and the Unemployment Compensation Exclusion Worksheet

- The IRS strongly urges taxpayers to not file amended returns related to the new legislative provisions or take other unnecessary steps at this time

- For those who haven’t filed yet, the IRS will provide a worksheet for paper filers and work with software industry to update current tax software so that taxpayers can determine how to report their unemployment income on their 2020 tax return.

Stimulus Payments:

- Payments are based on 2019, or 2020 tax returns if they have already been filed.

- Individuals earning up to $75,000 in adjusted gross income (AGI) will get direct payments of $1,400

- Partial payments are available only to individuals making up to $80,000 AGI and couples earning $160,000 AGI

- Married couples earning up to $150,000 in adjusted gross income will get $2,800

- Eligible recipients also will receive $1,400 for each of their dependents

- Taxpayers who have an increase in adjusted gross income in 2020 as compared to 2019 may want to hold off filing 2020 returns until the filing deadline. This will maximize the amount of stimulus payments received because their stimulus payment will not be potentially reduced by the higher 2020 adjusted gross income.

Current Market Observations

by William Henderson, Vice President / Head of Investments

The markets posted a strong week with all three major averages gaining last week. For the week that ended March 12, 2021, the Dow Jones Industrial Average returned +4.1%, the S&P 500 Index gained +2.6%, hitting a new record, and the NASDAQ gained +3.1%. With last week’s positive returns included, year-to-date, each index stands well into positive territory. Year-to-date, the Dow Jones Industrial Average has returned +7.1%, the S&P 500 Index +5.0% and the NASDAQ +3.1%. The Dow and S&P 500 continue to diverge from the NASDAQ as value stocks shine a bit more than traditional growth stocks. Higher yields on U.S. Treasury bonds are also impacting growth stocks as they weigh heavily on price/earnings multiples – a gauge of equity valuations. These returns are indicative of a strong recovery as growth stocks, which are best represented by the NASDAQ, initially lead the market out of a recession; and value stocks, represented more closely by the Dow Jones Industrial Average, tend to accelerate once the recovery is well under way. Last week, the 10-year U.S. Treasury Note moved higher in yield by three basis points to 1.63%.

The latest $1.9 trillion stimulus package is in the books and direct deposits will be hitting consumer bank accounts as early as this week. The Federal Open Markets Committee (FOMC) under the leadership of Fed Chairman Jay Powell, holds it two-day meeting this week but there is no indication that Powell will lift the pedal off the monetary stimulus in the form of zero interest rates. Beyond stimulus, we are seeing the pace of COVID-19 vaccine distribution accelerate. As of last Friday, more than 100 million doses had been administered to Americans. President Biden is committed to May 1 as the date for states to make vaccine shots available to all Americans. It is getting harder for investors to bet against a very strong and sustained economic recovery throughout 2021. The economic recovery is evident in new sectors of the economy. Last week’s market winners included retailers such as Macy’s, L Brands, and Kohl’s, big airlines, and some of America’s stalwart manufacturers, including Boeing, Caterpillar, Ford, and GM. Several economists, including Cornerstone Macro, are predicting 9%-10% GDP growth in the second half of 2021.

According to the Federal Reserve Bank of St. Louis, the Financial Stress Index has moved well below pandemic levels. This Index is the weekly average of yields, credit spreads, interest rates and other financial indicators. A higher index level suggests severe market disruptions (see chart). The value was close to zero again, thus indicating a return to normal financial market conditions.

SOURCE: Federal Reserve Bank of St. Louis, St. Louis Fed Financial Stress Index [STLFSI2], retrieved from FRED, Federal Reserve Bank of St. Louis, March 13, 2021.

Everything seems in place for a mid-summer reopening of the economy and herd immunity reached nationwide around the same time. The markets clearly recognize that fact and are looking to continue EPS growth and a solid performance in 2021. Stock market corrections and repricing are common in long bull markets, but they are also indicative of a healthy market.

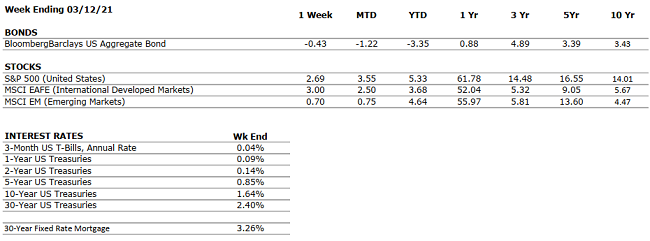

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Retail sales increased by over 5% in January, far higher than the 1% economist expectations. January was also the first month since October in which retail sales were positive month-over- month. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q4 profits grew 3.8% year-over-year, well in excess of analyst expectations, which figured that earnings would fall by 7%. Earnings in 2021 are set to look strong as they lap Q2-Q3 2020. |

|

EMPLOYMENT |

NEUTRAL |

The unemployment rate declined to 6.2% in February from 6.4% in January. Most of the added jobs last month were concentrated in the Leisure & Travel sector. Total employment remains 9.5 million jobs below the pre-pandemic peak. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden signed a $1.9 trillion fiscal bill last week. The U.S. economy has received a total of approximately $4 trillion in stimulus during the COVID-19 pandemic. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April 2020 nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Life’s challenges are not supposed to paralyze you, they’re supposed to help you discover who you are.” – Bernice Johnson Reagon

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: MORE Listener Tax Questions

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.