by William Henderson, Vice President / Head of Investments

It was a rough week for Wall Street as higher bond yields caused investor concern. U. S. Treasury yields moved to their highest level since January 2020. U.S. Treasury Note closed the week at 1.54%, up 17 basis points from last week. For the week that ended February 26, 2021, the Dow Jones Industrial Average fell by -1.8%, the S&P 500 Index fell -2.5% and the tech-heavy NASDAQ fell by -4.9%. However even considering last weeks loses, all three averages remain in positive territory for the year. Year-to-date, the Dow Jones Industrial Average has returned +1.4%, the S&P 500 Index +1.7% and the NASDAQ +2.5%.

Rising bond yields generally point to an economic recovery, however, a rise in rates also increases corporate and consumer borrowing costs, which when taken alone can undermine the recovery, especially if rate rise too quickly. Last week’s move in the 10-year U.S. Treasury Note to 1.54% was a notable one because its yield now matches the yield on the S&P 500 Index. This so called “inflection point” often causes a move from risky stocks to risk-free treasuries, where an investor can get the same yield without the gyrations that accompany investments in the stock market. On the other hand, increasing yields and a steepening yield curve (the measure of yields between overnight rates and the 10-year U.S. Treasury) helps banks, insurance companies, and other financial institutions as they now borrow low (based on short-term rates) and lend high (based on long-term rates). Last week, Fed Chair Jay Powell, committed to keeping short-term rates anchored at 0% for as long as needed to assure the economy fully recovers.

Vaccine distribution, production, and the release of an additional vaccine from Johnson & Johnson, are stifling the COVID-19 headwinds and cases worldwide dropped again last week. The Biden Administration is on track to deliver another whopping $1.9 trillion stimulus package as early as this week, while talking up yet another stimulus package shortly thereafter. Fiscal and monetary stimulus is unparalleled in response to the pandemic and we expect it to continue even as we move to a “normally” functioning economy.

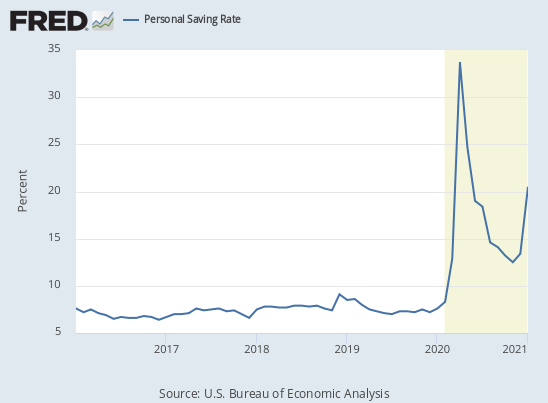

We would be remiss if we did not point out the performance of the consumer. The Personal Saving Rate according to the Federal Reserve Bank of St. Louis, stood at 20%, significantly higher than pre-pandemic levels which were closer to 7%.

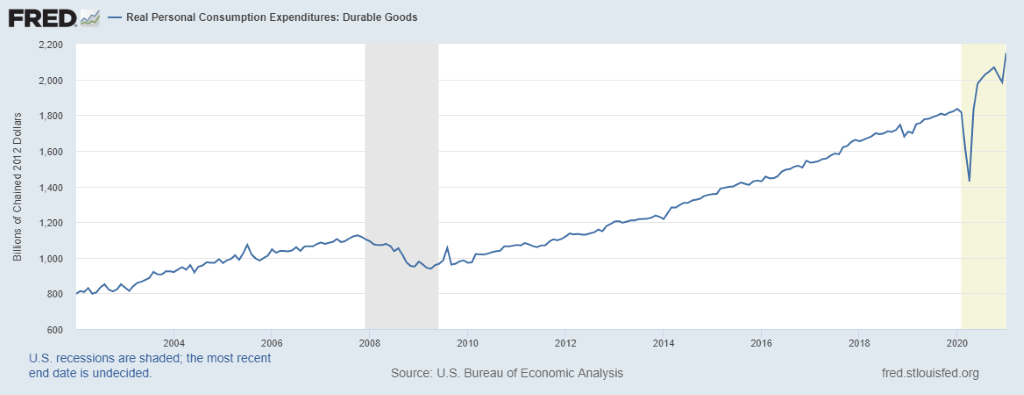

Further, again as reported by the Federal Reserve Bank of St. Louis on February 26, 2021, Real Personal Consumption Expenditures on Durable Goods reached a record $2.2 billion in January 2021. Durable Goods are represented by longer-lasting items, such as cars and washing machines; and personal consumption drives almost 70% of the U.S. economic output.

When the vaccine gets more widely distributed and herd immunity is reached, the consumer will be released to impact the hardest hit sectors of the economy such as travel and leisure.

Some Wall Street economists are predicting second half GDP growth estimates well above 6%. Corrections in the markets like we saw last week, are expected and healthy for a well-functioning stock market. The best antidote for market corrections is a long- term outlook and a well-diversified portfolio.