by William Henderson, Vice President / Head of Investments The markets took a pause last week with a brief pull back, and all three indices posted negative returns. For the week that ended March 19, 2021, the Dow Jones Industrial Average returned –0.5%, the S&P 500 Index lost –0.8%, and the NASDAQ fell by –0.8%. The minor pull back did not reverse the positive returns across the market on a year-to-date basis. Year-to-date, the Dow Jones Industrial Average has returned +6.6%, the S&P 500 Index +4.2% and the NASDAQ +2.5%. We continue to see the natural divergence occur between growth (technology) and value (industrial) stocks as the economic recovery gets underway. Treasury yields continue to put pressure on the markets as yields are slowly moving higher each week, which is another typical pattern seen as the economy comes out of a recession. Last week the 10-year U.S. Treasury Note moved higher in yield by six basis points to 1.69%. At year-end 2019, prior to the pandemic and during a very strong and growing economy, the 10-year U.S. Treasury Note stood at 1.91%. As the economy recovers from the “Black Swan Event,” of COVID-19, the markets are simply reverting to their traditional patterns of performance.

The Federal Reserve concluded its two-day meeting last week and announced a widely expected continuation of its policy to keep interest rates unchanged at zero to 0.25%. Relative to the December Fed meeting, more committee members expected higher rates by 2023 year-end. Still, the majority anticipate a policy hold through 2023. On the economic front, the Fed upgraded its near-term economic growth and recovery outlook to 6.5% in 2021. The Fed is seeing all the positive headwinds behind an already strengthening and recovering economy and adjusting their estimates higher. As we have written repeatedly, there is $20 trillion of cash in bank deposits, commercial accounts, and money market funds; fiscal and monetary policy are fully behind the economy; and the COVID-19 vaccine is being widely distributed nationwide. A primed consumer is ready to spend!

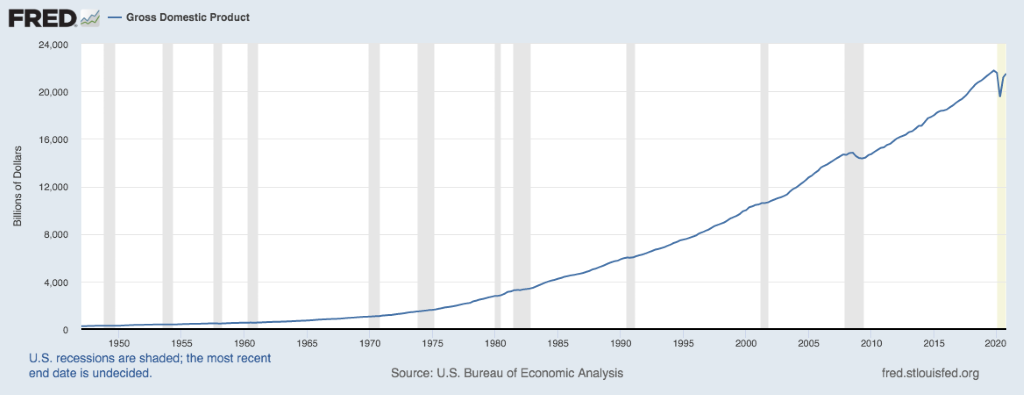

A brief glance at the chart below shows the Gross Domestic Product of the United States since 1950 as reported by the Federal Reserve Bank of St. Louis. The pandemic dip in GDP is clear, but so is the recovery. Plus, the Fed is on the low side of GDP estimates for 2021 when compared to most Wall Street economists who are predicting numbers as high at 9-10%.

Our VNFA Founder and Chairman, Tom Riddle, recently mentioned a market anecdote to me that I thought was interesting: “The stock market is like a Yo-Yo on an escalator, and the media wants you to focus on the Yo-Yo but you should focus on the escalator.” Remember to speak with your financial advisor often so you remain focused on the escalator.