by William

Henderson, Vice President / Head of Investments

Positive

returns across all three broad market indices in a Good

Friday holiday-shortened week gave investors reason to celebrate into the

Easter Weekend. For the week ended April 1, 2021, the Dow Jones

Industrial Average returned +1.6%, the S&P 500 Index gained

+2.8%, and the NASDAQ jumped a healthy +3.9%. Strong weekly

gains in all three broader market indices added to positive returns thus

far for the full year. Year-to-date, the Dow Jones Industrial Average

has returned +8.9, the S&P 500 Index +7.4% and the NASDAQ +4.8%. Stronger

relative gains for the Dow Jones Industrial average simply point to the common

story this year of a shift from growth to value; with growth stocks

best represented by the technology heavy NASDAQ and value stocks better

represented by industrial and financial stalwarts that make up the

Dow. Generally, as an economic cycle matures, value stocks begin to

outperform growth stocks, and this is exactly what we are seeing play

out nicely in 2021. Lastly, the bell weather 10-year U.S.

Treasury Bond rose by a modest four basis points during

the previous week to end at 1.72%.

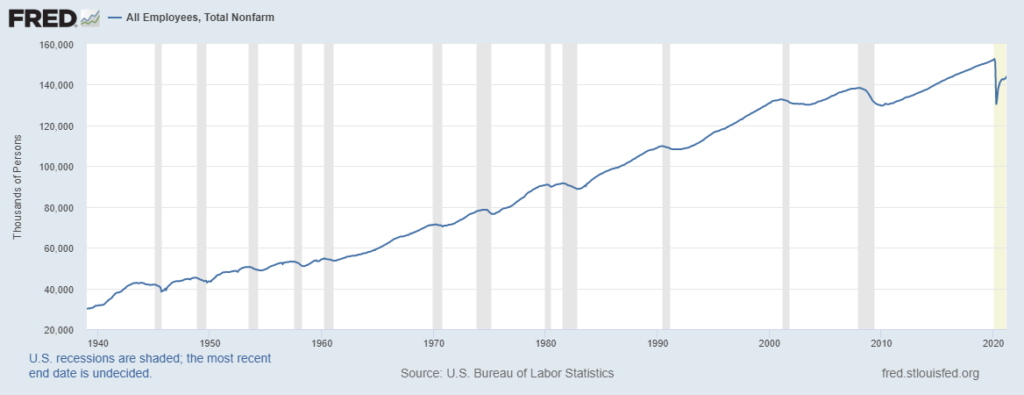

Last week, the Labor Department’s March jobs report showed a nonfarm payroll gain of 916,000 vs. economists expectation of up 625,000. Easing COVID-19 restrictions on travel and leisure and multiple stimulus packages will continue to allow job growth to boom. Total U.S. Payroll Employment stood at 144.1 million, significantly higher since the pandemic low in 2020. (See chart below from the Federal Reserve Bank of St. Louis.)

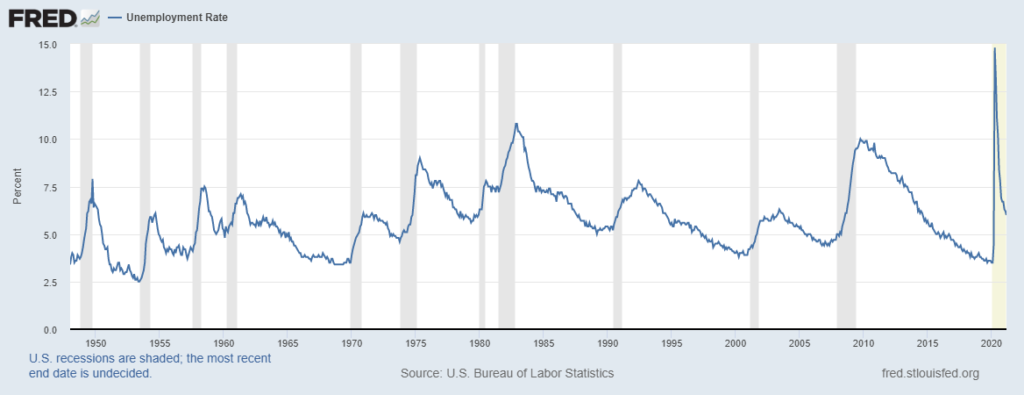

Further, the jobless rate fell to 6% from 6.2%, in line with estimates and further pointing to a strong rebound in employment and the economy. (See chart below from Federal Reserve Bank of St. Louis.)

Strong increases in payrolls and a resultant decrease in unemployment are pushing economists such at Cornerstone Macro, to predict a 9% real GDP outlook for 2021. Further, employment gains could push the unemployment rate to 3.5% by year-end 2021 and potentially as low as 2.8% in 2022.

Responsible Investing and ESG (Environmental, Social & Governance) focused dollars are taking the headlines this year with many large investment managers pressuring U.S. Corporations to place greater emphasis on doing good rather than just doing. Investment managers are stressing that Responsible Investing is possible without sacrificing returns. Improvements in technology are allowing tectonic positive shifts in sustainable and responsible investing. Last week, Vanguard Group Inc. and Blackrock Inc., along with 41 other investment management firms representing $23 trillion of assets joined the “Net Zero Asset Managers” initiative. This initiative is pledging to support efforts that place a greater focus on investors as activists for their clients and to influence companies to use their substantial resources in a more responsible and sustainable way.

In this professional’s opinion, whether viewed as a divisive issue or not, Responsible Investing can be acceptable to everyone. I would like to believe that all investors want clean air to breath, fresh water to drink and healthy forests and parks for recreation. Valley National Financial Advisors can assist clients with building and maintaining a portfolio with a clear focus on Responsible Investing. VNFA is a steward for our client’s assets and, as such, can help them become a steward of all resources.