by William

Henderson, Vice President / Head of Investments

We saw another strong week

of positive returns across all three major market indices, adding

to already solid

year-to-date gains. For

the week that

ended April 9,

2021,

the Dow Jones Industrial Average returned +2.0%,

the S&P 500 Index gained +2.7%,

and the

NASDAQ moved higher

by +3.1%. As

noted, the gains in all

three broader market indices added to decent returns

thus far for

the full year. Year-to-date, the Dow Jones Industrial Average has returned

+10.4%,

the S&P 500 Index +9.9%

and the NASDAQ +7.9%. Following

a full quarter where we saw value stocks, best

represented by the Dow Jones Industrial Average, out-perform

growth stocks, markets

came closer into balance with growth stocks posting a strong

finish. Lastly, after commentary

by Federal Reserve Chairman, Jay Powell about keeping

rates lower for longer, the 10-year U.S.

Treasury Bond fell six

basis points to 1.66%. As

recently as March 31, 2021, the 10-year U.S. Treasury Bond

stood at a one-year high of 1.74%, as

investors believed the strong economic recovery would push

interest rates higher.

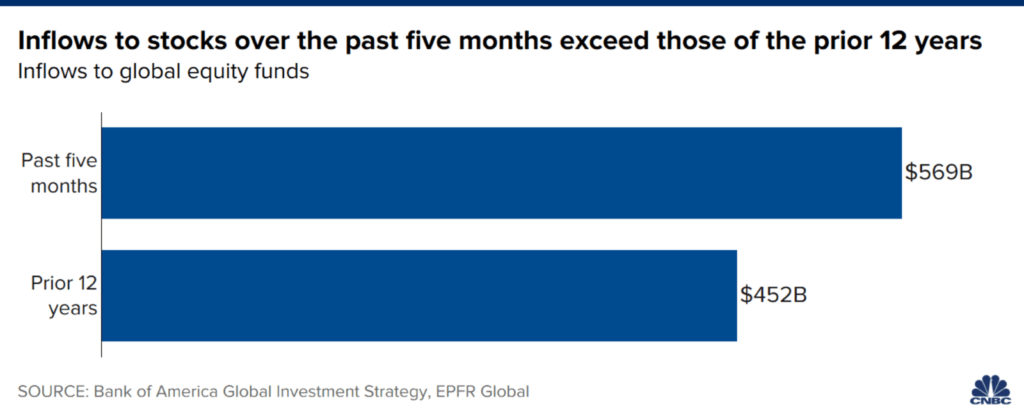

We continue to see investor assets flow into the equity markets. The so called “TINA” trade – There Is No Alternative – certainly seems to be playing out in full force right now. With interest rates so low and returns on fixed income securities anemic, cash is flowing only one place – the equity markets. See the chart below by CNBC using data from Bank of America, where inflows to global equity funds over the past five months exceed those of the prior 12 years.

The markets are taking their cues from strong monetary support by the Fed and record fiscal report by the government in the form on multiple trillion-dollar stimulus packages. Further, JPMorgan Chase CEO, Jamie Dimon, said in his annual shareholder letter that an economic boom could easily run into 2023. The combined impact of stimulus support, vaccine distribution and record amounts of cash on the sidelines held by investors and consumers is fueling an economic rebound that could be as strong as +9% in GDP growth in 2021.

In a nod to adding validity and importance to cryptocurrencies, Coinbase Global, Inc., the fastest growing cryptocurrency exchange announced its intent to go public this week with a massive $100 billion valuation. If the IPO goes as planned, Coinbase will cement itself at the “Big Board” of U.S. cryptocurrencies. Coinbase has 56 million verified users and has been adding as many as 13,000 new retail customers a day. Coinbase isn’t a cryptocurrency itself like Bitcoin, rather it is simply an exchange where cryptocurrencies are traded and thereby producing trading fees. Cryptocurrencies and exchanges are not yet regulated like banks or trading firms and carry a higher degree of risk and complexity. Watch for regulators to continue to pay very close attention to this market and eventually impose a needed level of regulation.

The economy has all the tools for the continued strong rebound from the COVID-19 pandemic recession in 2020. Retail and institutional investors are “all-in” on the market and massive piles of cash fuel the markets and the economy. As vaccine distribution reaches more consumers, the last sectors of the economy, travel & leisure, will explode and could create a labor shortage as those sectors require a lot of employees to operate effectively. Inflation seems like a distant pipe dream of Fed Chairman Powell, and he wants to see it before raising interest rates.

We covered a lot this week. Please reach out to your Financial Advisor to discuss any topics further, or for specific market-related questions.