by William

Henderson, Vice President / Head of Investments

The market continued its

hot streak with yet another week of positive gains across all three major indices. For

the week that

ended April 16,

2021,

the Dow Jones Industrial Average returned +1.2%,

the S&P 500 Index gained +1.4%,

and the

NASDAQ moved higher

by +1.1%. Year-to-date

gains moved higher as well, with the

Dow Jones Industrial Average returning +12.3%,

the S&P 500 Index +11.9%

and the NASDAQ +9.2%. Strong

demand from international investors for U.S. Treasuries pushed bond yields

lower again even as the economy is exhibiting considerable evidence of a

powerful rebound in 2021. The 10-year U.S. Treasury Bond closed the week

at 1.58% down another eight basis points from the previous week.

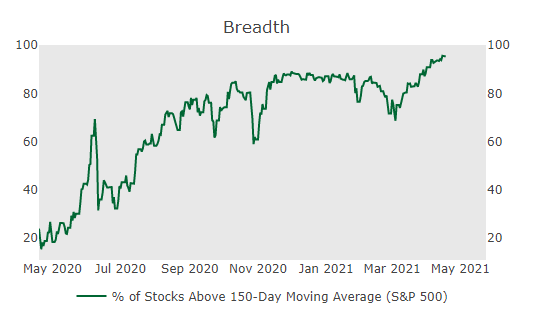

The past week’s gains were widespread with the market showing strength and breadth of performance across several industry sectors including healthcare, retail, and industrial names. Widespread gains across industry sectors is a sign that the market is healthy with strong participation by many companies and industries rather than just a few names. See the chart below from Cornerstone Macro showing the Breadth of the Market in terms of the percent of stocks in the S&P 500 above their 150-day moving average.

Evidence of the economic rebound was present in several places last week. According to Bloomberg, retails sales rose by 9.8% in March compared with February; this was the one of the largest paced gains in 30 years. The jump in sales was driven by consumer spending as stimulus checks continued to hit personal bank accounts. The more favorable news was that easing of COVID-19 lockdown restrictions and progress in vaccinations allowed consumers to resume their old spending habits. Spending was spread among many retail sectors such as clothing stores, motor vehicle sales, and restaurant and bars.

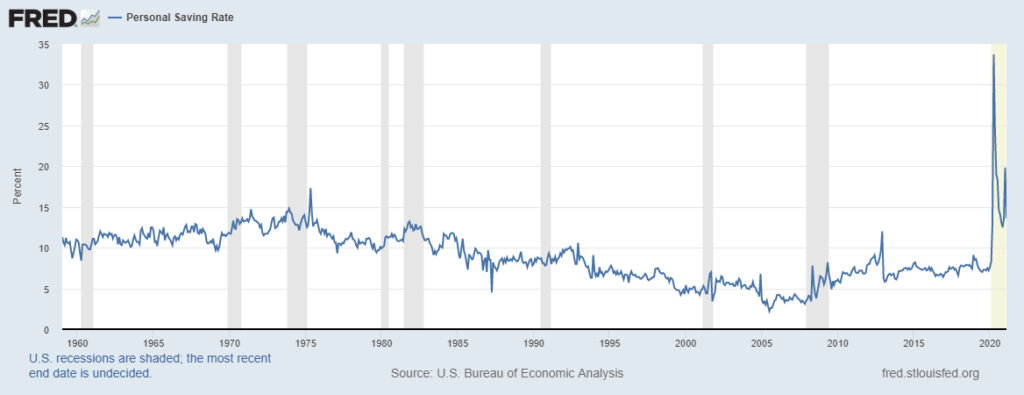

The green shoots in consumer spending could be just the beginning of a spending juggernaut that will unfold as more sectors of the economy open and the vaccination rate increases. The U.S. personal saving rate, as reported by the Federal Reserve Bank of St. Louis, currently 14%, stands nearly twice its pre-pandemic level of 8%. If consumers simply reduce their savings to the former level and resume historic spending patterns a strong economic rebound is on the near horizon.

Lastly, corporate earnings releases for the first quarter of 2021 began last week with several major banks reporting their first-quarter results. According to Bloomberg, profits for all 13 major banks easily exceeded Wall Street analysts’ expectations, driven by lower credit costs, active trading, and investment banking activity. Banking is the backbone of economic activity as lending to companies allows for growth and investment. Federal Reserve Chairman Jay Powell is committed to keeping rates low for as long as necessary to force an economic recovery. Low rates allow banks to borrow low and lend high – a simple equation for success and growth.

Low rates, consumers flush with cash, and widespread COVID-19 vaccine distribution continue to propel the economic recovery. The breadth of the recovery among economic sectors and across equity markets is pointing to the next phase of our economy when we move from recovery to expansion.