by William Henderson, Vice President / Head of Investments

As is typical in any protracted bull market, major stock indices took a pause last week. As a result, we saw some selling of equities with negative returns across all three market averages. For the week that ended April 23, 2021, the Dow Jones Industrial Average fell by -0.5%, the S&P 500 Index lost -0.1% and the NASDAQ fell by -0.3%. Profit taking and selling are typical in any market especially in one that has produced such strong results since the bottom of the pandemic in March 2020. Year-to-date returns on all market indices remain solidly in the green column; with the Dow Jones Industrial Average returning +11.9%, the S&P 500 Index +11.8% and the NASDAQ +9.0%. There were whispers of a Biden-led capital gains tax increase throughout the week and demand for less risky U.S. Treasuries stayed steady. The 10-year U.S. Treasury Bond closed the week at 1.58%, unchanged from the previous week. The market still has the facets needed to sustain favorable returns going forward. Interest rates are low, fiscal stimulus is strong, corporate balance sheets are in great shape and the vaccination rate continues to increase. Quarterly earnings seasons got into full swing last week and most reports provided evidence that the economy is gradually moving to a post-pandemic environment. The last remaining market sector to continue exhibiting weakness: travel and leisure, showed a few glimmers of hope last week. Although major airlines, including Southwest, American and United, posted weak quarterly earnings, they reported seeing significant pick up in travel demand as greater numbers of people are vaccinated and therefore becoming more comfortable traveling.

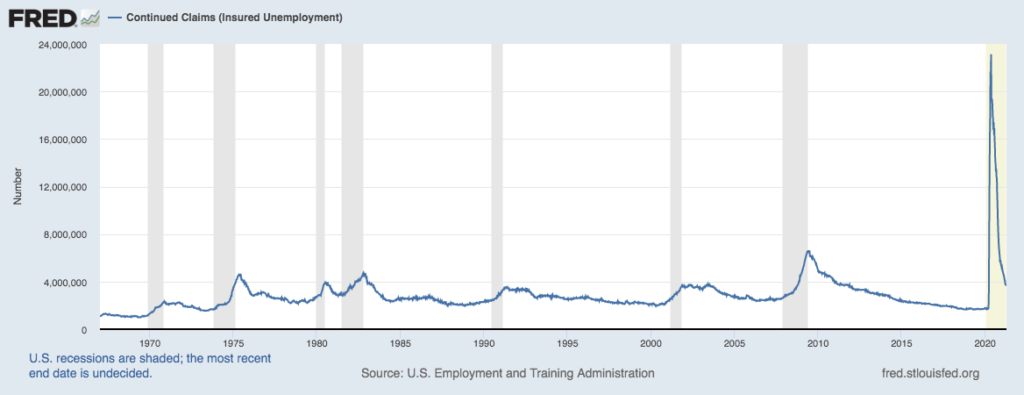

The U.S. Labor market continued to show renewed strength. According to the Department of Labor and Federal Reserve Bank of St. Louis, initial unemployment claims fell to the lowest level since the onset of the pandemic in March 2020.

While labor and manufacturing are showing renewed strength, the recovery in services on the back of vaccination efforts and the gradual lifting of social distancing measures should lead to accelerating growth over the remainder of the year for rest of the economy.

This week we have a rush of tech stock earnings reports including Tesla, Facebook, Amazon, and Google. These reports will give us a view forward to the full year of earnings if recent strength in the sector is able to continue its run.

Consumers have cash on hand and healthy personal balances sheets to fuel the economic recovery well into 2022 especially if the vaccination rate accelerates and travel and leisure returns to a normal level. Market setbacks like rumors of capital gains tax increases are visible risks that always present themselves in the short run. We like to be concerned about the long run and staying invested and staying the course is the right plan.