“Find the space in the world that fits your exact shape. And fill it authentically.” – Tanya Markul

Monthly Archives: April 2021

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Laurie will discuss

Cash flow and what we have learned through COVID?

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

Our team has been hard at work remotely interviewing as many of our contacts as possible to create a library of videos for Big Brothers Big Sisters of the Lehigh Valley to use in their Beyond School Walls Program.

This project, showcasing a variety of different careers, is part of our partnership with BBBSLV for the Volunteer Challenge. Do you work in a career that you would like to share with kids/teens thinking about their futures? Reach out to us to volunteer!

Save the date for May 20, to join #TeamVNFA and many others in the community in a showcase of the projects – and voting for your favorite while supporting the Volunteer Center of the Lehigh Valley! volunteerlv.org/volunteer-challenge

Did You Know…?

Tax Q&A RE: Filing for Extension

When do I need to get my information to (VNFA) to file in time for the new May 17 deadline?

April 15 is our estimate based on current turnaround times. For return information received after that date, our team will be assessing the best course of action, including the option of filing for an extension to file by October 15.

How do you determine when filing an extension is appropriate?

There are several reasons and benefits to filing for an extension. Most often the recommendation comes due to late arrival of information. Sometimes that is because they are not available or there are corrections – Schedule K-1s and Form 1099s are frequent culprits. Tax filing season is a finite amount of time and tax preparers get busy. So, taxpayers who are out of town for a period during tax season or clients who simply got their information together too close to that deadline can often take advantage of an extension to relieve the stress that often accompanies trying to pull everything together by tax time. Finally, and especially notable this year, an extension will allow you to take advantage of retroactive changes to the tax law that might be made after the filing deadline, without the added time and expense of filing an amendment.

Does an extension mean there is something wrong with my return or flag me for auditing?

No and no. Filing an extension is very simply allowing more time to complete an accurate return. In fact, sometimes, filing an extension can help avoid penalties or errors because of the extra time to evaluate everything. As for the myth that extensions somehow flag taxpayers as an audit risk, some tax professionals theorize that filing an extension will decrease your odds of being audited, since IRS auditors must meet quotas and try to do so early in the year. While the IRS does not disclose its process for selecting returns for audit, the earlier a return is filed, the longer it is in the system and thus subject to a review.

READ MORE from our Tax Q&A at valleynationalgroup.com/tax

Current Market Observations

by William

Henderson, Vice President / Head of Investments

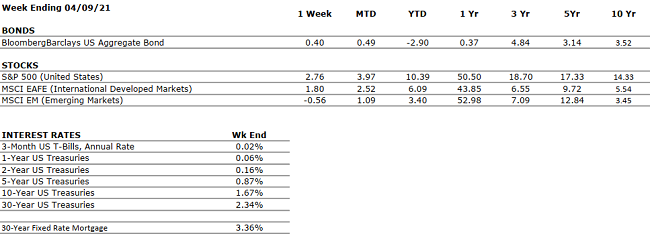

We saw another strong week

of positive returns across all three major market indices, adding

to already solid

year-to-date gains. For

the week that

ended April 9,

2021,

the Dow Jones Industrial Average returned +2.0%,

the S&P 500 Index gained +2.7%,

and the

NASDAQ moved higher

by +3.1%. As

noted, the gains in all

three broader market indices added to decent returns

thus far for

the full year. Year-to-date, the Dow Jones Industrial Average has returned

+10.4%,

the S&P 500 Index +9.9%

and the NASDAQ +7.9%. Following

a full quarter where we saw value stocks, best

represented by the Dow Jones Industrial Average, out-perform

growth stocks, markets

came closer into balance with growth stocks posting a strong

finish. Lastly, after commentary

by Federal Reserve Chairman, Jay Powell about keeping

rates lower for longer, the 10-year U.S.

Treasury Bond fell six

basis points to 1.66%. As

recently as March 31, 2021, the 10-year U.S. Treasury Bond

stood at a one-year high of 1.74%, as

investors believed the strong economic recovery would push

interest rates higher.

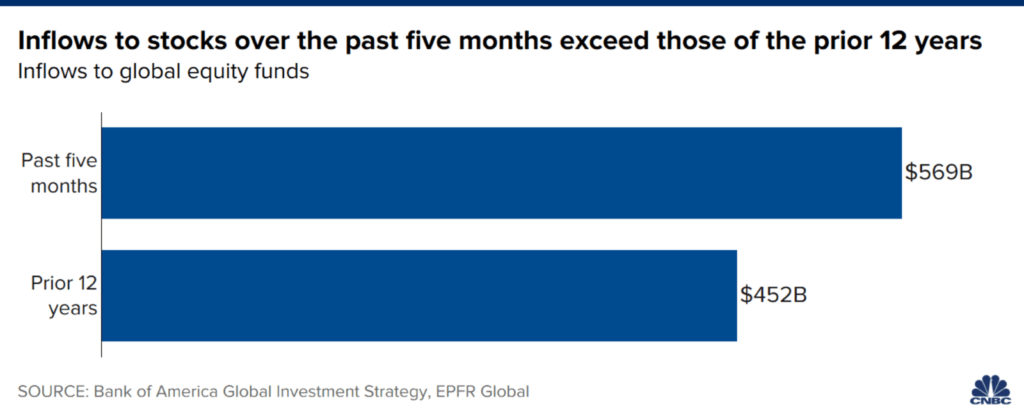

We continue to see investor assets flow into the equity markets. The so called “TINA” trade – There Is No Alternative – certainly seems to be playing out in full force right now. With interest rates so low and returns on fixed income securities anemic, cash is flowing only one place – the equity markets. See the chart below by CNBC using data from Bank of America, where inflows to global equity funds over the past five months exceed those of the prior 12 years.

The markets are taking their cues from strong monetary support by the Fed and record fiscal report by the government in the form on multiple trillion-dollar stimulus packages. Further, JPMorgan Chase CEO, Jamie Dimon, said in his annual shareholder letter that an economic boom could easily run into 2023. The combined impact of stimulus support, vaccine distribution and record amounts of cash on the sidelines held by investors and consumers is fueling an economic rebound that could be as strong as +9% in GDP growth in 2021.

In a nod to adding validity and importance to cryptocurrencies, Coinbase Global, Inc., the fastest growing cryptocurrency exchange announced its intent to go public this week with a massive $100 billion valuation. If the IPO goes as planned, Coinbase will cement itself at the “Big Board” of U.S. cryptocurrencies. Coinbase has 56 million verified users and has been adding as many as 13,000 new retail customers a day. Coinbase isn’t a cryptocurrency itself like Bitcoin, rather it is simply an exchange where cryptocurrencies are traded and thereby producing trading fees. Cryptocurrencies and exchanges are not yet regulated like banks or trading firms and carry a higher degree of risk and complexity. Watch for regulators to continue to pay very close attention to this market and eventually impose a needed level of regulation.

The economy has all the tools for the continued strong rebound from the COVID-19 pandemic recession in 2020. Retail and institutional investors are “all-in” on the market and massive piles of cash fuel the markets and the economy. As vaccine distribution reaches more consumers, the last sectors of the economy, travel & leisure, will explode and could create a labor shortage as those sectors require a lot of employees to operate effectively. Inflation seems like a distant pipe dream of Fed Chairman Powell, and he wants to see it before raising interest rates.

We covered a lot this week. Please reach out to your Financial Advisor to discuss any topics further, or for specific market-related questions.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

Consumer confidence has increased meaningfully over the last month as vaccine distribution has accelerated. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q1 earnings are expected to be up greater than 20%, year-over-year. Earnings season begins in a couple of weeks. |

|

EMPLOYMENT |

NEUTRAL |

The unemployment rate declined to 6% in March, from 6.2% in February. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and highly accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“I often wonder if there were no deadlines, would anything ever get ended?” – Judith Weir

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie will discuss: Where are we with tax season and 2021 planning?

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Tax Update (April 2021)

The new tax deadline for 2020 returns of May 17, 2021 is closing in fast. For all tax clients who have not yet sent us documents, we are requesting that you get your tax information (either in full, or whatever you have available) to us no later than April 15.

If you are unable to do so, we will most likely be recommending filing an extension with the IRS, which will allow us until October 15 to file the final return. If we find that filing an extension is in your best interest, our team will reach out to let you know more about that process.

In anticipation of questions, we have collected a brief Q&A for you on our website. If you have additional inquiries, please contact our Tax Department at 610-868-9000 or tax@valleynationalgroup.com.

Current Market Observations

by William

Henderson, Vice President / Head of Investments

Positive

returns across all three broad market indices in a Good

Friday holiday-shortened week gave investors reason to celebrate into the

Easter Weekend. For the week ended April 1, 2021, the Dow Jones

Industrial Average returned +1.6%, the S&P 500 Index gained

+2.8%, and the NASDAQ jumped a healthy +3.9%. Strong weekly

gains in all three broader market indices added to positive returns thus

far for the full year. Year-to-date, the Dow Jones Industrial Average

has returned +8.9, the S&P 500 Index +7.4% and the NASDAQ +4.8%. Stronger

relative gains for the Dow Jones Industrial average simply point to the common

story this year of a shift from growth to value; with growth stocks

best represented by the technology heavy NASDAQ and value stocks better

represented by industrial and financial stalwarts that make up the

Dow. Generally, as an economic cycle matures, value stocks begin to

outperform growth stocks, and this is exactly what we are seeing play

out nicely in 2021. Lastly, the bell weather 10-year U.S.

Treasury Bond rose by a modest four basis points during

the previous week to end at 1.72%.

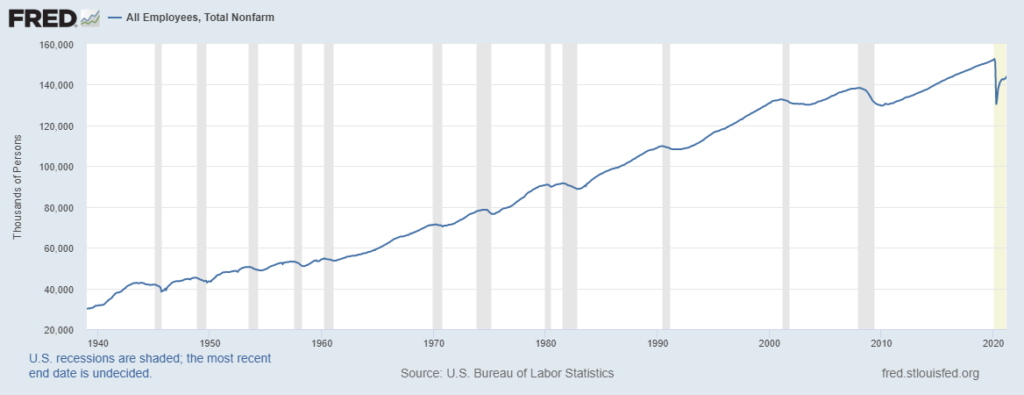

Last week, the Labor Department’s March jobs report showed a nonfarm payroll gain of 916,000 vs. economists expectation of up 625,000. Easing COVID-19 restrictions on travel and leisure and multiple stimulus packages will continue to allow job growth to boom. Total U.S. Payroll Employment stood at 144.1 million, significantly higher since the pandemic low in 2020. (See chart below from the Federal Reserve Bank of St. Louis.)

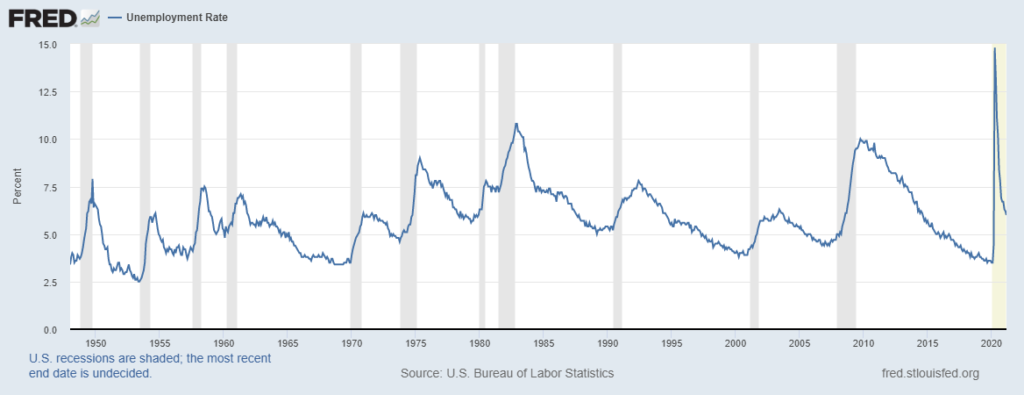

Further, the jobless rate fell to 6% from 6.2%, in line with estimates and further pointing to a strong rebound in employment and the economy. (See chart below from Federal Reserve Bank of St. Louis.)

Strong increases in payrolls and a resultant decrease in unemployment are pushing economists such at Cornerstone Macro, to predict a 9% real GDP outlook for 2021. Further, employment gains could push the unemployment rate to 3.5% by year-end 2021 and potentially as low as 2.8% in 2022.

Responsible Investing and ESG (Environmental, Social & Governance) focused dollars are taking the headlines this year with many large investment managers pressuring U.S. Corporations to place greater emphasis on doing good rather than just doing. Investment managers are stressing that Responsible Investing is possible without sacrificing returns. Improvements in technology are allowing tectonic positive shifts in sustainable and responsible investing. Last week, Vanguard Group Inc. and Blackrock Inc., along with 41 other investment management firms representing $23 trillion of assets joined the “Net Zero Asset Managers” initiative. This initiative is pledging to support efforts that place a greater focus on investors as activists for their clients and to influence companies to use their substantial resources in a more responsible and sustainable way.

In this professional’s opinion, whether viewed as a divisive issue or not, Responsible Investing can be acceptable to everyone. I would like to believe that all investors want clean air to breath, fresh water to drink and healthy forests and parks for recreation. Valley National Financial Advisors can assist clients with building and maintaining a portfolio with a clear focus on Responsible Investing. VNFA is a steward for our client’s assets and, as such, can help them become a steward of all resources.