by William Henderson, Vice President / Head of Investments

The markets notched another week of gains across all three broad market indices last week. For the week that ended May 28, 2021, the Dow Jones Industrial Average added +0.9%, the S&P 500 Index added +1.2% and the NASDAQ posted +2.1%; all solid gains for a relatively quiet week of trading in front of the Memorial Day Holiday. For the second week in a row, growth stocks easily outperformed their value counterparts; however, on a year-to-date basis, value still leads the pack. For the full year of 2021, returns on all market indices remain very healthy. Year-to-date, the Dow Jones Industrial Average has returned +13.8%, the S&P 500 Index +12.6% and the NASDAQ +7.0%. Bonds were relatively unchanged for the week, with the 10-year U.S. Treasury Bond remaining at 1.62% as of May 28, 2021.

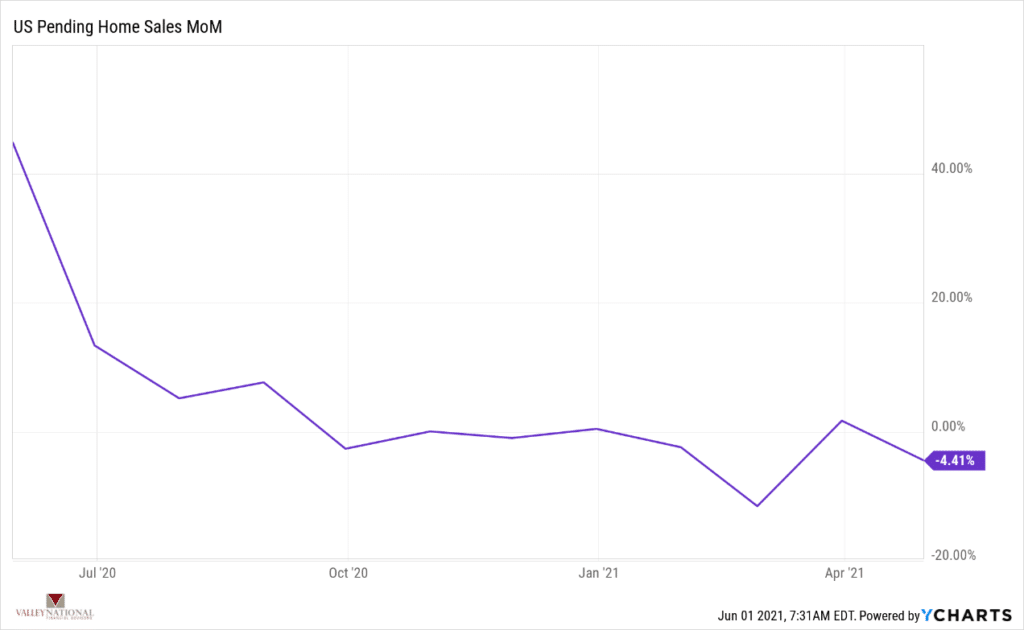

While Fed officials stressed last week that inflationary pressures should prove temporary, consumers continue to worry about real inflationary indications. Supply chain pressures, semi-conductor chip shortages, and housing price increases continue to worry consumers. For example, according to the S&P CoreLogic Case-Shiller Index, average home prices in major metropolitan areas rose 13.2% in the year ended in March 2021, up from a 12.0% annual rate the prior month representing the highest growth rate since December 2005. Conversely, we saw forward indications that housing may be cooling off. Last week, the National Association of Realtors reported that April 2021 pending new homes sales fell 4.4%, month over month (see chart below from YCharts); which was significantly below expectations.

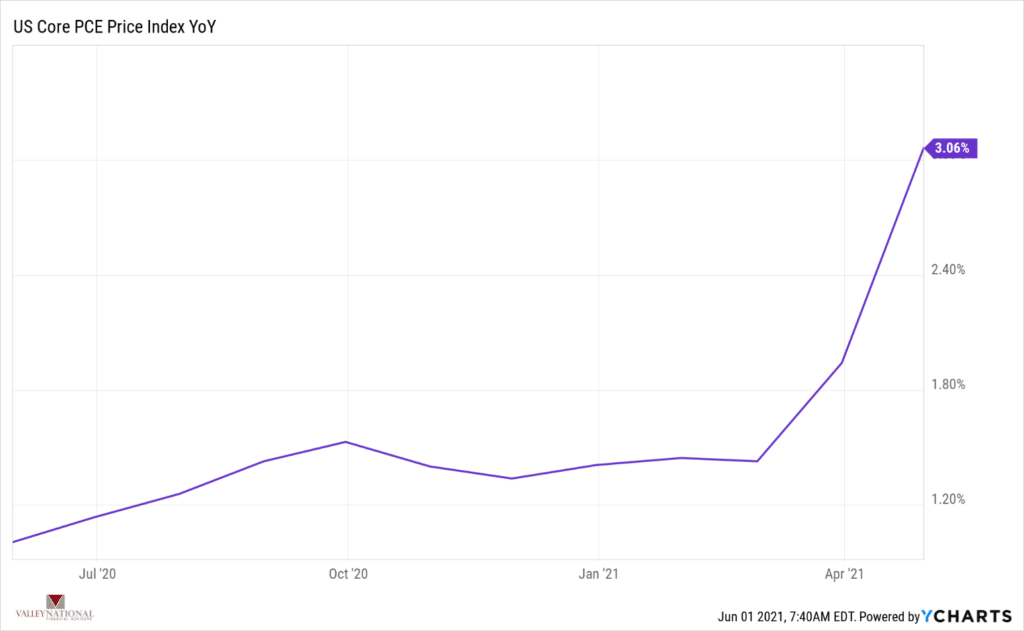

Regardless of what Fed officials are saying, the consumer certainly is seeing the impacts of inflation. For example, the Core PCE Price Index, or Personal Consumption Index, which measures the prices paid by consumers for goods and services, moved higher last week by 3.1%. (See the chart below from YCharts). This measure is a very good indicator of inflation trends as it removes food and energy, two categories where prices tend to swing up and down more dramatically.

Certainly, there are issues that concern consumers and investors such as inflation, supply shortages and variants of the COVID-19, but a return to normal activities and relaxing of travel and gathering restrictions seems to be impacting the markets’ upward trajectory. The consumer, with the help of stimulus funds and an easy Federal Reserve Bank, will continue to propel the economic recovery throughout 2021 and well into 2022.