by William Henderson, Vice President / Head of Investments

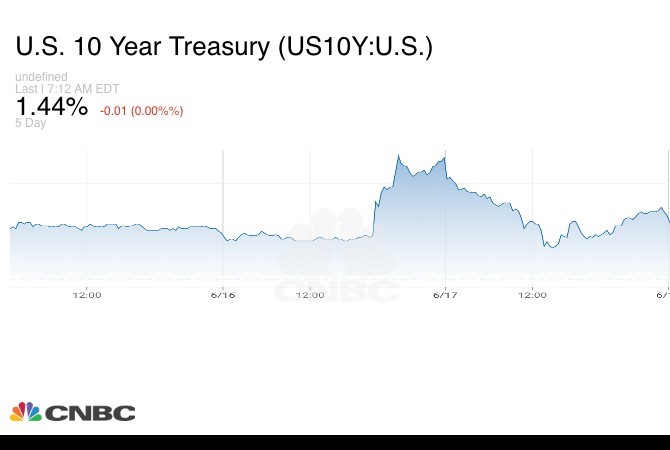

Last week, the markets saw negative returns after posting positive gains for several consecutive weeks. Of the three major indexes, the Dow Jones Industrial Average saw the biggest weekly decline, and the largest decline for that index in more than eight months. Value-style stocks once again underperformed growth stocks as the NASDAQ saw only a modest pullback. For the week that ended June 18, 2021, the Dow Jones Industrial Average lost -3.5%, the S&P 500 Index fell by -1.9%, and the NASDAQ fell by only -0.3%. Modest pullbacks are to be expected in any healthy stock market and last week’s negative returns did not significantly chip away at this year’s strong year-to-date returns. Year-to-date, the Dow Jones Industrial Average has returned +9.8%, the S&P 500 Index +11.7%, and the NASDAQ +9.2%. Bonds had a quick reversal during the week, with the 10-year U.S. Treasury initially spiking to 1.57% after the Federal Open Market Committee (FOMC) announcement about interest rates (more on that below) but calmed down by week’s end to close at 1.44%. (See the 5-day chart below of the U.S. 10-year Treasury Note – CNBC)

The news of the week was certainly the FOMC meeting and the follow-up press conference by Chairman Jay Powell. The Fed raised its inflation forecast, and a dot plot of individual central bank members’ expectations on policy, signaled that an interest hike could happen sooner than expected, in 2023. Investors typically get spooked with the mention of higher interest rates, as cheaper (lower) rates help to spur economic growth. Further, St. Louis Fed President James Bullard told CNBC on Friday that he expected an initial rate increase to happen even sooner in 2022. “We’re expecting a good year, a good reopening. But this is a bigger year than we were expecting, more inflation than we were expecting,” Bullard said on CNBC’s Squawk Box. “I think it’s natural that we’ve tilted a little bit more hawkish here to contain inflationary pressures.” That comment was in direct contradiction of Powell’s press conference comments that higher interest rates were not expected until 2023-24.

Clearly, the markets are seeing

the trends. First, global stimulus in the form of dollars to consumers is fading, which

will lead to a contraction in in M2 (supply of

money and savings). Second,

the temporary demand/supply imbalances are ebbing allowing commodity

prices to stabilize (lumber,

critical for new building, led the way lower – see chart

below from the Federal Reserve Bank of St. Louis).

Third, the global economic rebound is continuing and now includes the Eurozone. These trends overall are positive for the market and continued economic growth, but they also point to inevitably higher interest rates in the not-to-distant future. The Fed will watch for inflation, which thus far has appeared (as mentioned last week, with the 5% jump in the Consumer Price Index). The question remains about whether the inflation will be transitory or more permanent. For us, the picture remains clear: last year featured collapsing global growth and massive stimulus. Looking at 2021-23 we see healthy growth and a cooperating Federal Reserve that is timid about raising interest rates too quickly.