by William Henderson, Vice President / Head of Investments

Last week the markets showed conditions remain favorable for equities as easy financial conditions and a healthy economic recovery are firmly in place for the foreseeable future. All three major indices posted strong weekly returns adding to their very healthy year-to-date gains. The Dow Jones Industrial Average rose by +3.4% last week, the S&P 500 Index rose +2.7% and the NASDAQ increased by +2.4%. The “value-over-growth” trade seems to have waned as the major indices have moved into relative parity on a year-to-date basis. Year-to-date, the Dow Jones Industrial Average has returned +13.6%, the S&P 500 Index +14.8% and the NASDAQ +11.8%. Bonds continue to be well bid with yields remaining stubbornly low. The 10-year U.S. Treasury dropped six basis points last week to end at 1.51%.

Three additional factors boosted the markets. First, all 23 major U.S. banks including J. P. Morgan Chase, Bank of America, and PNC Bank passed the Federal Reserve’s annual stress tests, which are designed to test the resilience of large banks under severe global recessionary conditions. Second, after several weeks of negotiation, President Biden and a bipartisan group of senators announced an agreement on an infrastructure deal that could carve out up to $1 trillion from the $2.25 trillion American Jobs Plan that was released in March 2021. The agreement focuses on traditional infrastructure such as roads and bridges as well as water infrastructure and broadband internet access. The deal is a positive development because it comes with no new taxes and instead is funded by hodgepodge of revenue sources including repurposing unused pandemic relief funds, tougher Internal Revenue Service tax collection, and selling oil from the Strategic Petroleum Reserve. And third, inflation fears are modestly abating as supply chain pressures have eased and prices for basic commodities, including metals and lumber, fell from their recent spikes.

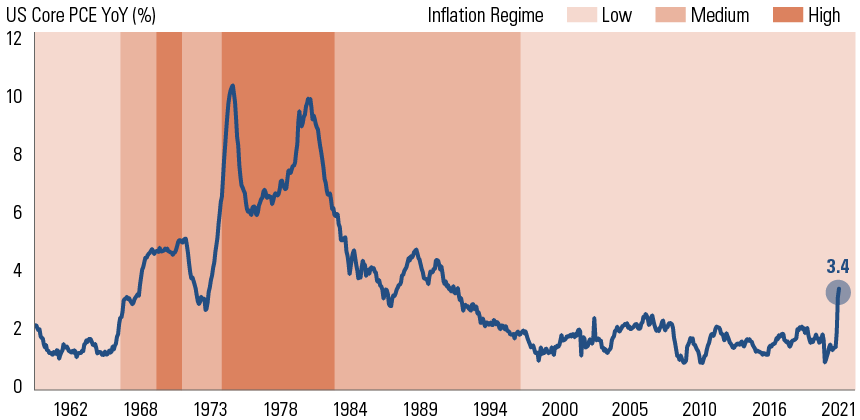

It is important to keep inflation concerns in the proper perspective. The chart below shows the long-term U.S. Core PCE (Personal Consumption Expenditure) year-over-year percent change. The recent jump in U.S. Core PCE of +3.4%, is not that significant when you look at inflation over a much longer term. The Fed’s goal of +2.0% average annual inflation remains in place, which means rates remain low for longer.

U.S. Core Personal Consumption Expenditure (PCE)

(Source: Bloomberg & Goldman Sachs June 2021)

As we move to close the second

quarter, corporate earnings announcements most

likely will surprise to the upside and revenue growth will remain robust. However,

companies may have to

deal with cost increases due to supply chain disruptions and

higher wages going forward. The economic tailwinds for the second half of

2021 will be consumer driven rather than stimulus driven.

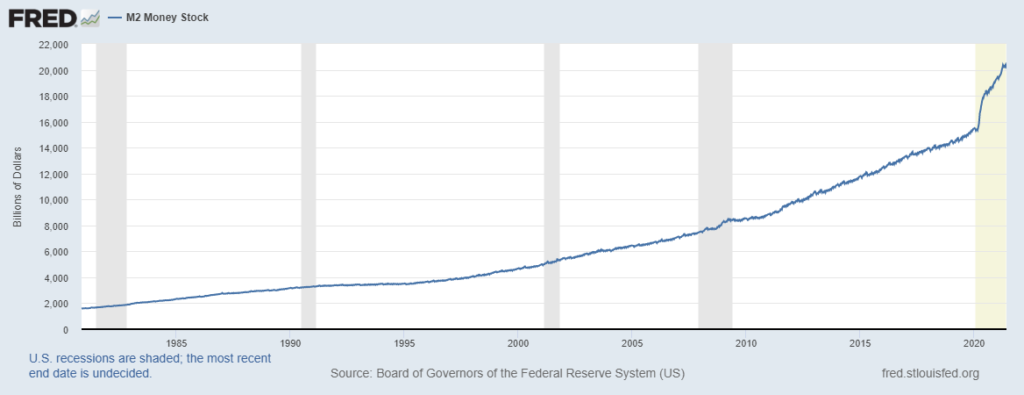

Consumers are in excellent financial shape with personal savings accounts at record levels. According to the Federal Reserve Bank of St. Louis, M2, the money supply measure that includes cash, checking deposits and money market funds, reached $20.3 trillion on June 22, 2021 (See chart above). There is massive pent up demand for travel and leisure; and with summer upon us, watch for the consumer to fuel the economy and the Fed to keep the pump primed.