by William Henderson, Vice President / Head of Investments

In front of a Labor Day holiday weekend, stock markets closed the week with mixed returns and a quiet Friday trading session. Last week, the Dow Jones Industrial Average lost -0.2%, the S&P 500 Index gained +0.6% and the NASDAQ gained +1.6%. Regardless of the modest mixed results, 2021 year-to-date returns remain solidly in the black column with double-digit returns across all major indexes. Year-to-date, the Dow Jones Industrial Average has returned +17.1%, the S&P 500 Index +22.0% and the NASDAQ +19.8%. A weaker than expected jobs report on Friday suggested the Fed may remain on hold for rate hikes; patiently waiting for the unemployment rate to reach the targeted 4.5%. Regardless of the weaker economic news, U.S. Treasury Bonds sold off by the end of the week as thin trading on Wall Street continued to believe the Fed will taper its bond purchases by year end. The yield on the 10-year U.S. Treasury rose five basis points to 1.36% from 1.31% the previous week. The current 1.36% on the 10-Year U.S. Treasury is 38 basis points lower than the 1.74% yield level hit in March of this year.

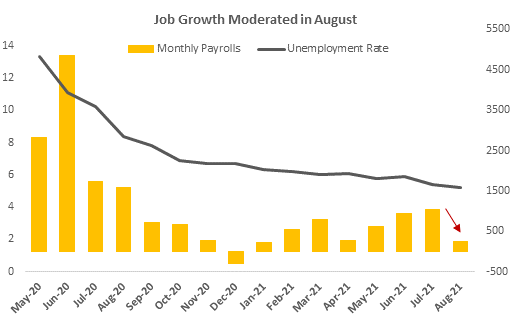

As mentioned above, the August employment report released on Friday showed a recovery hitting a small bump in the road. Monthly job gains totaled 235,000, significantly below economist’s expectations and a drop of 800,000 from July report. Renewed concerns around the Delta-variant of COVID-19 pointedly slowed job growth in the leisure and hospitality sector, emphasizing the results of resurfacing pandemic restrictions. (See the chart below from Bloomberg showing monthly payrolls and the unemployment rate.)

While the jobs report was weaker than expected, it is unlikely that this is the new direction of the economic recovery. A lot of noise could have been in that number including, summer job cessations due to students returning to school. Last weekend also marked the end of the Pandemic Unemployment Assistance, which in theory, should force many people back to a labor force starving for employees in many sectors and regions of the U.S. August’s weak labor number certainly gives the Fed some cover for delaying any bond purchase tapering and any thoughts of raising rates. The general direction of labor and the Fed’s position should keep the economic recovery on track.

Cornerstone Macro released a quick study on stock market sector rotation trading, i.e., growth to value or vice versa trades. “Despite all the machinations and zigging and zagging and rotation talk, the long-term winners remain in place,” the study noted. “From the March 2009 Financial Crisis low to present, only two Sectors have outperformed the market, Technology and Consumer Discretionary. One has paced the market – Health Care – while all the others have lagged.” From 2009 – 2021, Information Technology has returned +1106%, Consumer Discretionary +766% and Healthcare +415%, all other sectors underperformed the S&P 500 Index at +402%. The point of their study was simply to show that long-term investing and a long-term commitment is a winning “trade.” Further, an emphasis on investing in sectors which favor growth (technology) and demographic trends like aging western economies (health care) has historically proven to be additive to that trade.

We remain steadfast in our opinion that a dedication to long-term investing and solid financial planning rather than gimmicks like “market timing” or “sector rotation trading” is the only winning trade for investors.