by William Henderson, Vice President / Head of Investments

Markets ticked downward last week, and the S&P 500 notched its first five-day losing streak since mid-February. Last week, the Dow Jones Industrial Average lost -2.4%, the S&P 500 Index fell by -1.7% and the NASDAQ, following suit, fell by -1.4%. Modest losses for the week impacted year-to-date returns but returns remain strong for all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +14.6%, the S&P 500 Index +19.9% and the NASDAQ +17.8%. We are seeing global growth concerns as the COVID-19 variant is delaying a stronger reopening of travel and leisure activities by consumers. U.S. Treasury Bonds. continue to offer safety and risk protection for investors and we consistently see a flight to safety when stock markets sell off. That said, last week the 10-year U.S. Treasury Bond fell three basis points to 1.33% from the previous week’s 1.36%. The current 1.33% on the 10-year U.S. Treasury is 41 basis points lower than the 1.74% yield level hit in March of this year when the markets were predicting a strong and steady opening of the economy and hints that the Fed was going to raise rates sooner rather than later. Those concerns have been muted as modest job reports and virus concerns continue to impact the economy. It is important to keep the big picture in perspective. The U.S. economy is growing at a pace that historically would be solid by any measure. Most economists are expecting third-quarter GDP growth nearing 4% and fourth-quarter GDP growth hitting 6% or stronger. These numbers are solid despite headwinds like rising gasoline prices, supply chain disruptions due to port closures, and the latest COVID-19 “wave” rolling through the country.

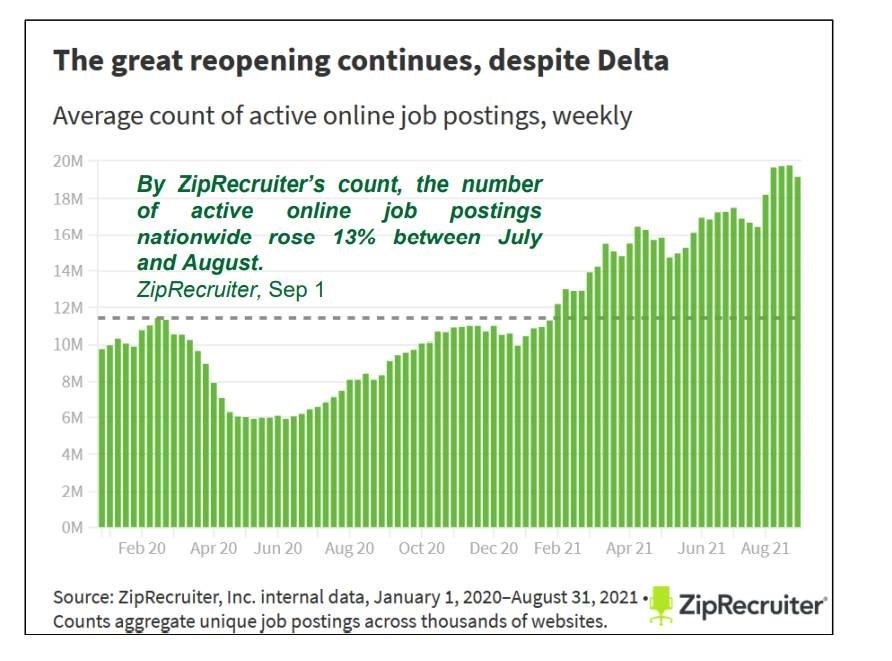

The chart below from ZipRecruiter shows the number of active online job postings. Postings remain strong and will stay that way as the unemployment continues to fall closer to the Fed’s target of 4.5% from the current 5.2% (Bureau of Labor Statistics).

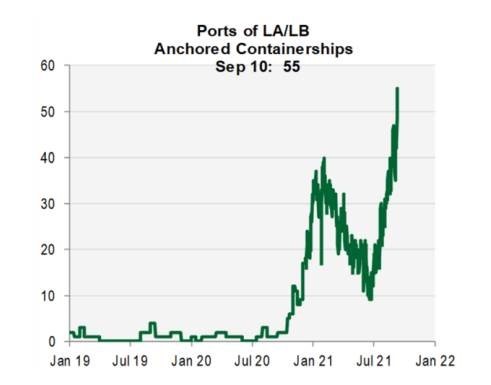

As noted above, there are headwinds impacting continued economic growth. First, supply chain disruptions are impacting corporate activity and logistical problems at U.S. ports are a major problem. See the chart below from Cornerstone Macro showing the number of anchored (meaning waiting to unload) containerships in the Ports of LA/LB.

Snagged ships and clogged ports mean less freight moving and less economic activity.

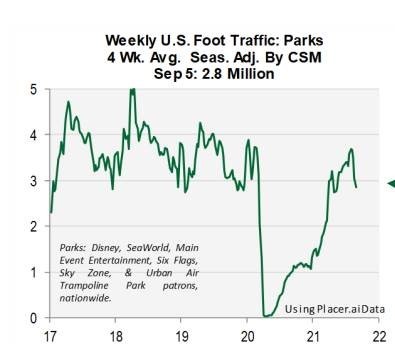

Second, the COVID-19 variants are modestly impacting consumer activity. An interesting and telling chart below from Cornerstone Macro shows weekly foot traffic at U.S. Parks (Disney, Six Flags, etc.) Foot traffic is certainly down from recent peaks but that can also be attributed to the summer season ending and back to school starting.

Certainly, concerns exist, and we are seeing markets reacting to these concerns as we did last week. But the economy remains healthy and strong. Critically important are corporate earnings and profits which rose 9.2% in the second quarter according to the Bureau of Economic Analysis (BEA). When corporations are growing and earnings are growing, they hire more employees. Consumer activity makes up the bulk of the U.S. economy. Pfizer is close to getting FDA approval for its COVID-19 vaccine for children aged 5-11. Throw in a cooperative Federal Reserve and we have the trifecta for continued economic recovery: healthy corporate activity leading to more jobs, wider distribution of the COVID-19 vaccine and low interest rates well into 2022. Stay focused on the bigger picture, avoid the noise, and remain committed to your long-term financial objectives.