by William Henderson, Vice President / Head of Investments

As predicted by the so called “market prognosticators,” September, as is typical, is shaping up to be a negative month for market returns. According to Forbes Magazine, the S&P 500 has averaged a -0.6% decline in September each year since 1945. Given how strong market returns have been thus far in 2021, a modest correction certainly seems normal and healthy for a Bull Market. Last week, the Dow Jones Industrial Average lost -0.1%, the S&P 500 Index fell by -0.5%% and the NASDAQ lost -0.5%. As noted, the small pullback last week has done little to impact the strong year-to-date gains we have had across all three major stock market indexes. Year-to-date, the Dow Jones Industrial Average has returned +16.6%, the S&P 500 Index +19.3% and the NASDAQ +17.3%. September’s typical weakness is often attributed to institutional portfolio managers locking in their strong gains in funds before year-end thereby cementing a positive performance year. Anything could be the real reason, but we have said repeatedly that in any given Bull Market, you are going to have selloffs, pullbacks, or corrections – it is what healthy markets do and how they should behave.

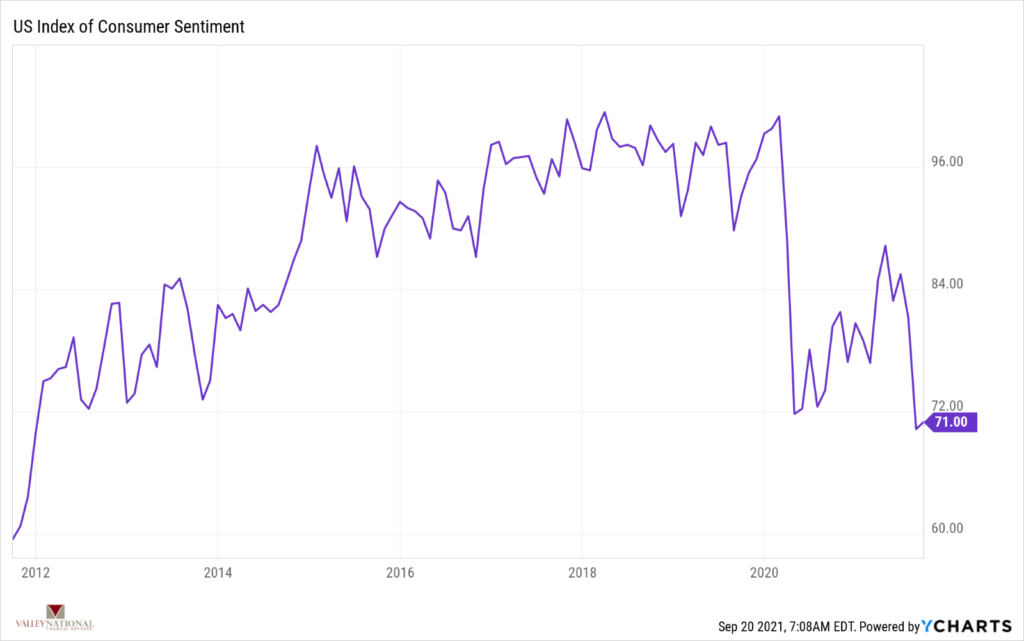

We saw some conflicting economic data last week. While consumer sentiment has recently fallen (see chart below from YCharts), retail sales for the month of August rebounded sharply to +0.7% in August 2021 from a drop of -1.8% in July 2021.

Consumer sentiment typically predicts consumer behaviors – retail shopping – for example, so one could assume a drop in sentiment would lead to decreases in retail sales. Continued strong retail sales could soften economists’ expectations for a third-quarter slowdown in economic activity. Beyond continued concerns around COVID-19 variants and regional flare ups, crude oil, which is a raw material used in everything from gasoline to textiles to cosmetics, and plastics, has slowly crept higher in price lately. U.S. prices for Brent Crude Oil rose above $70/barrel, once again throwing inflationary concerns into in the fray. (See chart below from YCharts).

We have a consumer with lessening confidence but shopping more, and a Federal Reserve looking for inflation but a consumer weary of higher prices for goods and services. Meanwhile, despite higher prices for crude and regional labor shortages, Wal-Mart announced they are hiring an additional 20,000 workers and Amazon announced they are hiring 125,000 workers, both before the holiday season. Again – conflicting data and news items.

This week, the U.S. Federal Reserve will hold its two-day meeting to discuss monetary policy including opinions on interest rates and whether to continue their bond purchasing stimulus program. It has been assumed by economists that as the economy rebounds, the Fed should begin to reduce it bond purchases – so called “tapering.” Hence all the noise about a “taper tantrum,” or selloff in fixed income markets when the Fed is no longer the buyer at large. First, while the Fed is a significant buyer of bonds, other major buyers include large financial institutions, such as pension funds, endowments, mutual funds, insurance companies, banks, and individuals. Those additional buyers will remain even after the Fed reduces its purchases. That said, all the recent choppy and conflicting economic data certainly gives the Fed all the ammunition it needs to keep interest rates low and to continue their bond purchasing stimulus program. In fact, we expect the Fed to remain on hold and modestly note that eventual tapering in bond purchasing will begin before the end of 2021.

COVID-19 variants, issues with China, supply chain disruptions and concerning crude oil prices worry us but there is always offsetting good news. Let us keep focused on the Fed and the healthy U.S. Consumers and U.S. Corporations, both of which are flush and sitting on extraordinarily strong balance sheets. These are strong forces impacting the economy and the markets.