by William Henderson, Vice President / Head of Investments

Although the markets started the week headed down with record drops on Monday – due to a major Chinese debt holder, real estate developer Evergrande, flirting with bankruptcy, and concerns about the week’s FOMC (Federal Open Market Committee) meeting bringing Fed tapering of bond purchases – by week’s end things were in check and the markets ended flat to slightly up. Last week, the Dow Jones Industrial Average gained +0.6%, the S&P 500 Index increased +0.5%% and the NASDAQ closed unchanged. Year-to-date, the Dow Jones Industrial Average has returned +15.3%, the S&P 500 Index +19.9% and the NASDAQ +17.3%. As mentioned, China managed to stave off a major bankruptcy and the fixed income markets digested the widely anticipated tapering of the Fed’s bond-buying stimulus program. At his press conference on Wednesday, Fed Chairman Jerome Powell indicated that the Fed may cut back its bond purchases as early as this November. Further, Powell hinted that the Fed could begin a series of interest rate hikes sometime in 2022.

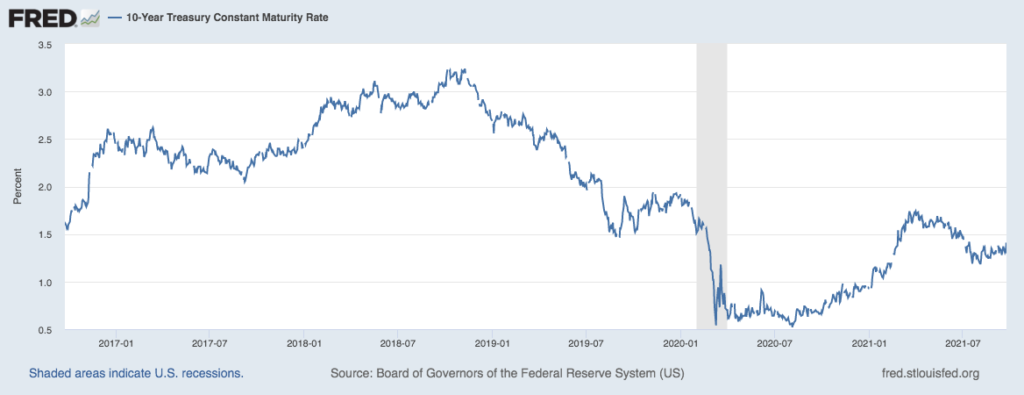

While the tapering news was expected, the fixed income markets still reacted negatively to the news. By the end of the week, the 10-year U.S. Treasury Bond reached 1.41%, eight basis points higher than the previous week, and the 10-year note’s highest level in three months (see chart below from the Federal Reserve Bank of St. Louis).

Bond yields are still off their levels seen in March of this year when the yield on the 10-year hit 1.74%. Investors should understand that in a portfolio that holds Treasury Bonds or other fixed-income securities, such as corporate investment grade bonds, those securities are held as a risk management tool and add stability to the portfolio when risky assets such as stocks sell off. While the increase in bond yields can be attributed to Powell’s comments about tapering bond purchases, investors garnered some comfort from the fact that monetary policy in the form of lower interest rates will continue for some time into 2022.

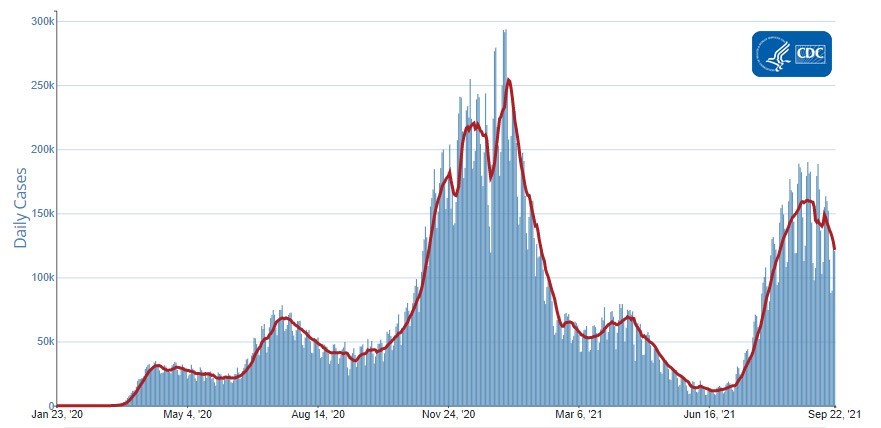

In economic news, we have seen a nice drop in weekly COVID-19 cases (see chart below from the CDC).

COVID-19 case movements are a

critical input in consumer confidence and consumer spending. Recall

the July/August upswing in COVID-19 cases and the resulting poor reading

in the August/September consumer confidence level. Two critical

sectors, retail sales and auto sales saw

softness in

early September. With cases dropping, headwinds

become tailwinds as consumer confidence and resultant consumer

spending increase, especially heading into the holiday selling season. Further,

as COVID-related extended employment benefits end, watch for a pickup in job

growth, continued

increases in wage gains, and consumers with excess savings looking for ways to

spend. Some persistent headwinds remain,

included increasing energy prices as we near fall/winter, limited inventory of

autos and

microchips and nagging supply chain disruptions.

We are always impressed by the

market’s

ability to keep things in balance, much better so than

an impressionable and impatient investor. Global

concerns always exist whether political turmoil or bankruptcy-type risks among

foreign banks and corporations. The stability and

strength of the U.S. Federal Reserve helps to offset

global concerns by stabilizing the largest

economy in the world. Higher bond yields worry some investors,

and they whisper “Taper Tantrum” but higher

yields also indicate the

economy is well on its way to a healthy recovery. Lastly,

there’s

always sector jockeying within the stock market with growth outpacing value and

then vice versa or tech selling off but energy rallying.

The Fed is keeping monetary stimulus policy

in place well into 2022, the consumer is healthy and still eager to spend, and

corporate and bank balance sheets remain the

strongest we have seen in years. Headwinds

– tailwinds – balance.