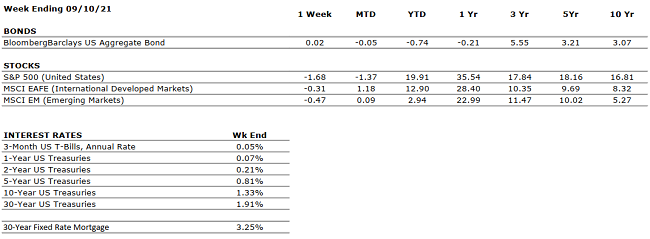

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

July retail sales declined 1.1% vs. June 2021 but are 15.8% higher than July 2020. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q2 sales and earnings grew an astonishing 25% and 89%, respectively, when compared to the heavily depressed figures in Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 5.2%. In August, new job creation was disappointing, but jobless claims were as low as they have been since March 2020. |

|

INFLATION |

NEUTRAL |

Inflation remained at 5.4% year-over-year in July, the same reading as in June. Fed Chairman Jay Powell believes that the high inflation is transitory and will decelerate as global supply chain bottlenecks resolve. |

|

FISCAL POLICY |

POSITIVE |

The Senate passed a $1 trillion infrastructure package. The bill is expected to be voted on by The House by the end of this year. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve has indicated that it does not plan to increase interest rates until 2023. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

Although the Taliban’s control in Afghanistan is concerning, it is unlikely to have a meaningful global economic impact. |

|

ECONOMIC RISKS |

NEUTRAL |

2021 is shaping up as one of the strongest economic years on record. The primary risk at present is that of persistent inflation which begets higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.