by William Henderson, Vice President / Head of Investments

Equities notched yet another win last week with each of the major market indexes adding gains to already strong year-to-date returns. The Dow Jones Industrial Average rose +1.1%, the S&P 500 Index increased by +1.6% and the NASDAQ moved higher by +1.3%. Year-to-date, the Dow Jones Industrial Average has returned +18.3, the S&P 500 Index +22.4% and the NASDAQ +17.7%. Bond yields continued their slow rise recognizing that Fed tapering of bond purchases and higher short-term rates could happen sooner rather than later as the economic recovery from the pandemic continues in force. The 10-year U.S Treasury closed the week at 1.65%, up four basis points from the previous week and only slightly below the 1.74% level reached in March of this year.

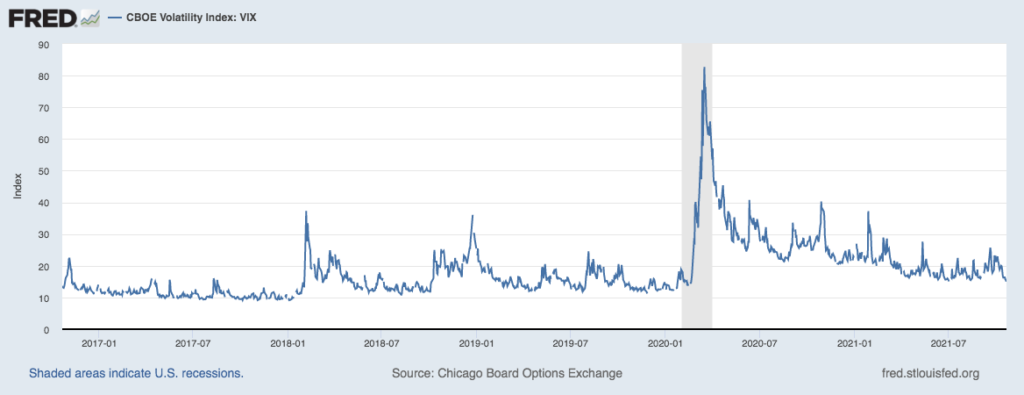

Comments from Federal Reserve Chair Jerome Powell late last Friday afternoon seemed to temper the bond market a bit. He stated that the U.S. Central Bank was on track to begin reducing asset purchases soon; however, he added that it is not yet time to raise interest rates because employment levels are still too low. Lastly, he added that inflation is likely to ease next year as pandemic-related pressures fade and supply chain disruptions settle. Powell’s comments cooled the bond market and helped to heat up the stock market and temper risk levels. The Chicago Board of Exchange Volatility Index (VIX) fell to its lowest level in more than four months. The VIX measures investors’ expectations of short-term market volatility. See the chart below of the VIX from the Federal Reserve Bank of St. Louis.

This week we will see two important measures of the strength of the economic recovery: Continued 3rd quarter corporate earnings releases and the U.S. government’s initial estimate of third quarter GDP growth. Earnings announcements thus far have bested Wall Street Analysts’ expectations so watch for this pattern to continue, which would bode well for the stock market. Conversely a miss by a major technology firm would put negative pressure on equity prices. The third quarter GDP growth report will give us a clearer picture of the negative impacts of the delta variant and oft talked about supply chain disruptions. Recall the second quarter GDP rose at a healthy 6.7% annual rate.

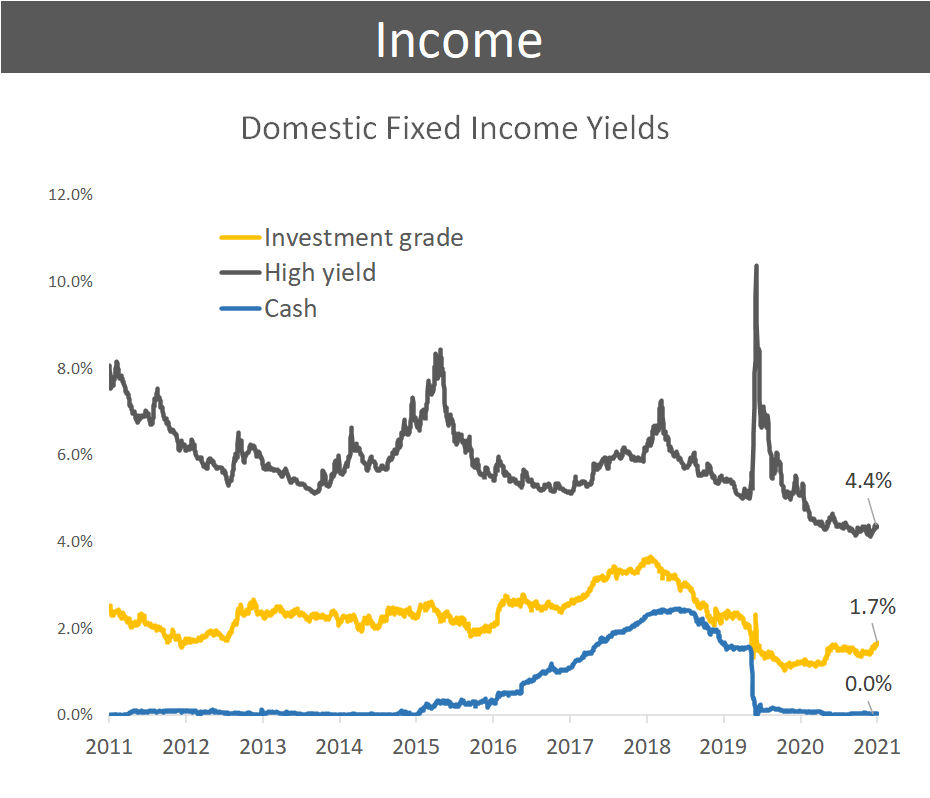

It is important to recognize that as bond yields rise, their relative attractiveness as an investment also rises. The 10-year U.S. Treasury at 1.65% yield offers substantially higher returns than parking money in cash which is effectively paying 0.00%. Further, while not offering stellar yields, fixed income investments also provide ballast to a balanced portfolio in times of market turmoil. See the chart below from Factset showing Domestic Fixed Income Yields.

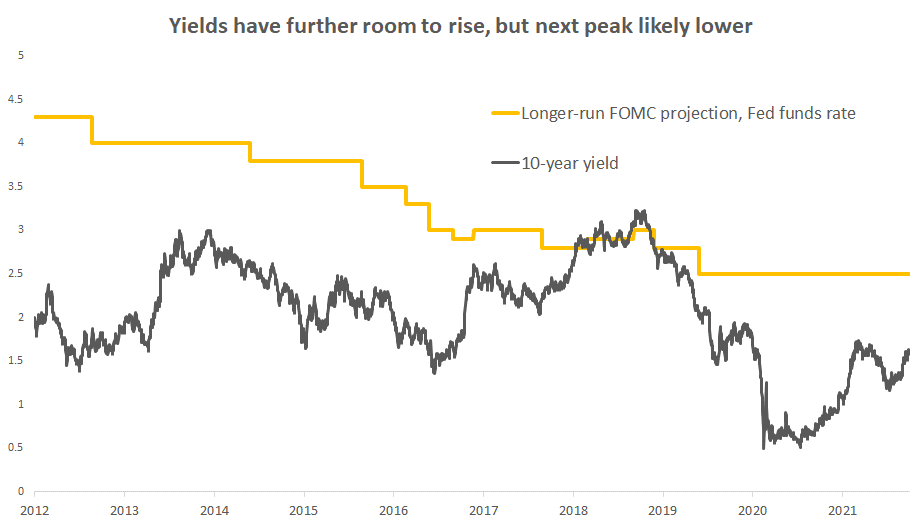

Certainly, rising bond yields are generally bad news for bond prices because prices move inversely to yields. The current projections for yields as predicted by the FOMC (Federal Open Market Committee) shows short-term rates peaking around 3.00% in this current cycle and the 10-year U.S. Treasury peaking nearer to 2.50%. See the chart below from Bloomberg showing Fed policymakers predictions for short-term rates and the 10-year Treasury yield.

Recall also that while low by historical standards, U.S. bond yields are higher than most developed countries and there is still $11 trillion of negative-yielding debt globally. Global demand for U.S. Treasuries will likely remain strong for some time which will keep a virtual cover on a significant rise in domestic rates. We have pointed out for many weeks that the markets are indeed more efficient than investors ever believe. This is witnessed by the fact that it continues to climb the ever-present “Wall of Worries,” which includes: COVID-19 variants, inflation, Fed Tapering, supply chain disruptions and concerns about China. As we move into the fourth quarter, the consumer, flush with cash and sitting on a clean balance sheet will take over as the engine of economic growth. Analysts are already predicting a stunning increase of 15% or more in holiday spending this season and remember, domestic consumption makes up about 70% of the U.S. economy.