by William Henderson, Vice President / Head of Investments

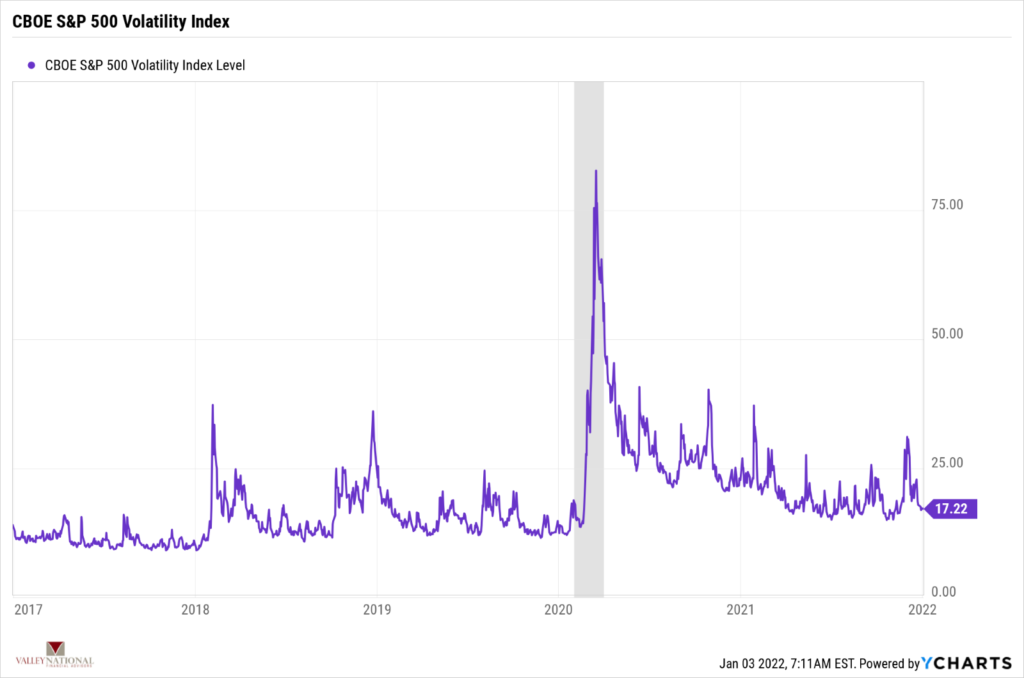

Stocks ended the year on a mixed note with the broader markets posting modest gains while the technology-laden NASDAQ notched a barely noticeable loss. The Dow Jones Industrial Average rose +1.1%, the S&P 500 Index gained +0.9%, and the NASDAQ dropped –0.1%. Massive piles of cash in consumer coffers, corporate earnings hitting new records, and waning but still in place federal monetary and fiscal stimulus propelled markets to new records in 2021 and the patient investor was richly rewarded with double-digit full year 2021 returns in all three major market indexes. Year-to-date 2021, the Dow Jones Industrial Average has returned +21.0%, the S&P 500 Index +28.7% and the NASDAQ +22.2%. What made the returns in equities more palatable was that these returns were garnered with very little volatility. A brief look at the VIX (Chicago Board of Options Exchange S&P 500 Volatility Index), which measure stock market volatility shows that by historic measures the VIX in 2021 was calm. See the chart below from YCharts and Valley National Financial Advisors. There were very few spikes in the VIX above 25, and for most of the year, the index was modestly falling.

During this record rise in stock prices, fixed-income markets, while selling off early in 2021, regained some composure mid-year and stayed relatively steady into year-end. he 10-year U.S. Treasury opened 2021 at a yield of 0.91%, hit a high of 1.74% in March and then closed the year at 1.51%. While not a year for strong bond returns, for the few occasions in 2021 when risk assets sold off, it was important that smart investors held anchor positions in risk management assets like bonds.

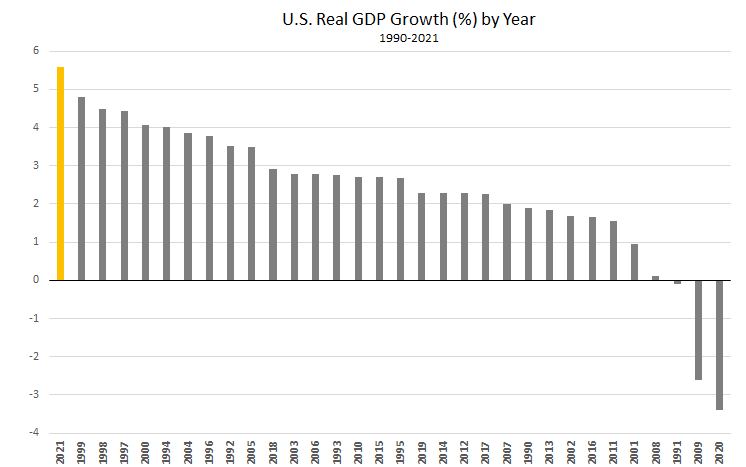

As mentioned, corporate earnings were strong, reflecting economic growth that was the strongest since 1984. (See the chart below from Factset.)

The Fed successfully orchestrated a recovery from the pandemic-induced recession of 2020, which gave consumers the confidence to spend on everything from leisure activities to new homes and renovations to existing homes. While inflation became a concern along with supply chains disruptions, labor markets were hot all year and unemployment slowly fell to 4.2% as hiring continued across all sectors of the economy.

As we look to 2022, there are headwinds and tailwinds to consider. While monetary stimulus will slowly get removed as the Fed reduces its bond buying and then moves to higher interest rates, fiscal stimulus could continue in the form of big policy spending like the Biden-proposed $1.8 trillion Build Back Better Bill. The consumer starts the year in excellent financial shape bolstered by strong increases in savings accounts and limited spending in 2021. Corporate balance sheets are also in excellent shape allowing firms to boost wages and hiring but supply chain disruptions and drastic increases in raw material costs pose dilemmas for corporate CEOs. Wall Street economists are modestly optimistic on 2022 with growth estimates for U.S. GDP averaging +3.0% which certainly provides a solid base that supports the continuation of the bull market. Stay focused on the tailwinds while being aware of the headwinds and keep a long-term perspective on your investments and your financial plan.