by William Henderson, Vice President / Head of Investments

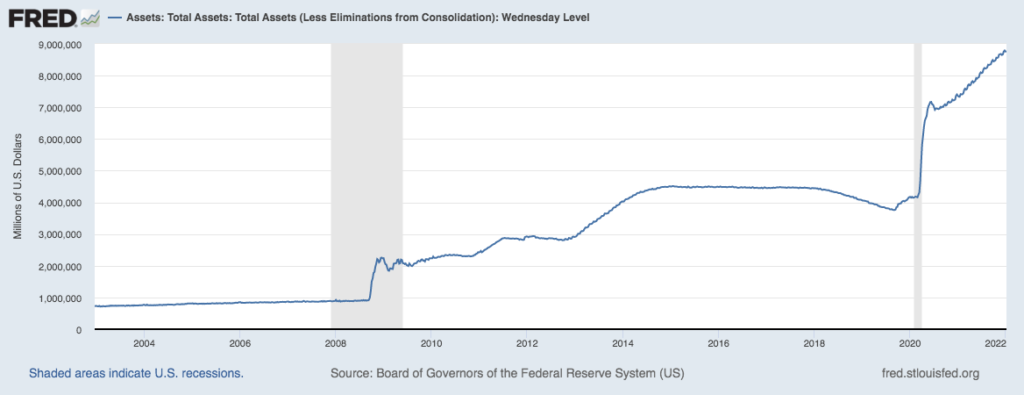

Equity markets began the year with a dose of volatility that was largely absent in 2021; with all three indexes selling off and U.S. Treasury yields rising leaving investors with few places to shelter from the storm. The Dow Jones Industrial Average lost a respectable –0.3%, the S&P 500 Index lost –1.8%, and the NASDAQ got walloped dropping –4.5%. All the news that was fit to print was bad for the markets and the headlines were dominated by the Fed and the release of the minutes from the December 2021 FOMC meeting. The minutes revealed a Fed not only willing to taper bond purchases and raise rates in 2022 but one also willing to begin some serious balance sheet management. This sent the yield on the benchmark 10-Year U.S Treasury higher by 40 basis points to 1.75%. The Fed’s attention to its balance sheet should not be considered shocking in our view as you look at how large balances have grown even since the Great Financial Crisis of 2008 and before the pandemic. (See the chart below from the Federal Reserve Bank of St. Louis.)

Certainly, a Fed relying more heavily on balance-sheet reduction, which in turn removes liquidity from the market as the largest buyer of bonds slows its process, although this action alone may not be all bad for markets. With this action, the Fed could focus more on its balance sheet and less on rate hikes as a way of removing monetary stimulus. Lower short-term interest rates allow for a steeper yield curve (the measure of rates between short-term levels and long-term levels); which generally is good for financial firms and banks and therefore the overall economy.

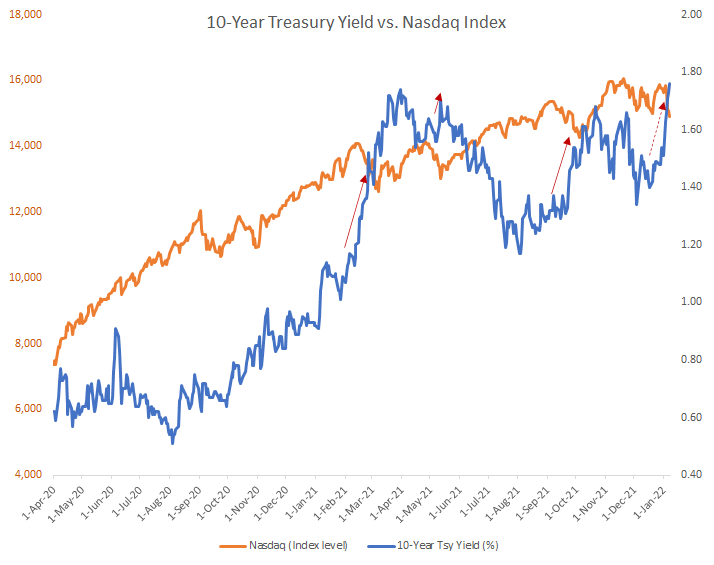

Last week’s market moves were impactful, but this same movie played early last year, and Wall Street strategists prognosticated the great growth-to-value rotation in equity markets. Yet, by the end of the year, markets moved closer to parity and all three major indexes posted strong gains for the full year. Three times since the pandemic interest rates rose sharply in a brief time followed by a sell-off in growth stocks and the NASDAQ. (See the chart below from FactSet)

Generally, the technology heavy NASDAQ sees higher rates as a headwind to upward performance. This is true because technology firms typically borrow more than established firms and therefore higher rates affect future performance, due to increased borrowing expenses. Besides the obvious relationship between rates and growth, this chart also shows that these selloffs tend to be brief and often create a window to buy technology and growth sectors at more reasonable prices.

2022 looks to be a year with more volatility and uncertainty than 2021. You will hear the phrase “All Eyes on the Fed” about 1,000 times this year as Wall Street tries to decipher the FOMC dot plots and tea leaves of Fed minutes and comments made by Chairman Jay Powell at his press conferences. It is understood that monetary policy whether in the form of higher rates, less bond purchases or balance sheet management must be adjusted to reflect recent strong inflation data and an unemployment level reaching 3.9%. Fiscal policy seems in flux as well, as President Biden’s Build Back Better plan flounders in Washington with each passing week. This leaves us with the consumer and the corporation to propel the economy alone. That’s not a bad picture when you consider both are very healthy with strong balance sheets, healthy cash positions and relatively low interest rates.

This week we will get a good amount of economic data with inflation (CPI) coming out Wednesday, unemployment level on Thursday and retail sales and consumer confidence on Friday. “All Eyes on the Fed”? We say all eyes on the consumer.