by William Henderson, Chief Investment Officer

Uncertainty and fear stoked market volatility last week, even a much expected 50-basis point rate hike did little to quell concerns that the Fed was behind the inflation problem in the United States.

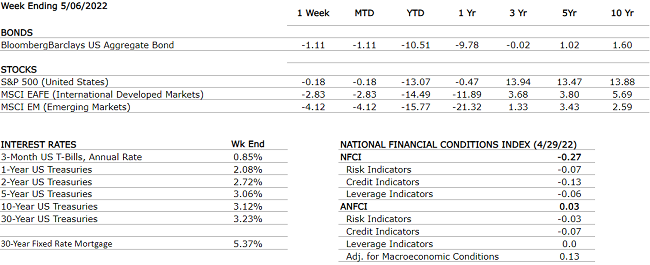

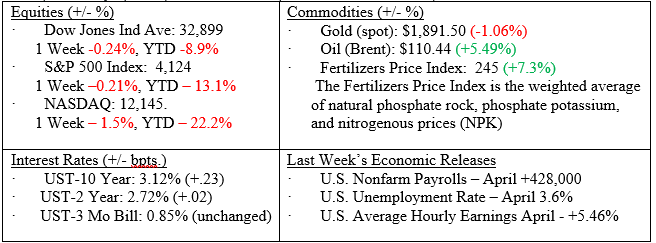

Markets (as of May 6, 2022; 1 week Returns, Year-to-date Returns)

The markets continued to exhibit extreme volatility and last week we saw the biggest one-day gain in the Dow Jones Industrial average (+932 points on May 4) and the biggest one-day loss (-1034 on May 5). Market volatility is telling us that the struggle between higher prices (inflation) and economic growth exhibited by consumer health and the strong labor market continues. We are still confident that the Fed will be able to execute the perfect “soft landing” by gradually raising interest rates to combat inflation but not simultaneously slowing the economy so much that we fall into a recession. This may not be very comforting given the painful returns thus far in 2022 for both equities and bonds, but the premise lies firmly upon the strength of the labor markets and the relative financial health of the consumer.

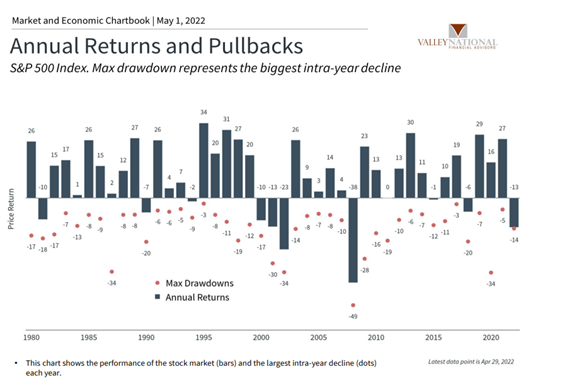

It is tough to find positives to discuss when the markets are punishing investors, but we have been here before; and, as we had said over and over, pullbacks and selloffs in the market are common and to be expected. (See the chart below from Valley National Financial Advisors and Clearnomics on pullbacks). Even in years when the markets had large positive gains, intra-year there were large negative returns. The point is that timing the market is dangerous and rarely successful.

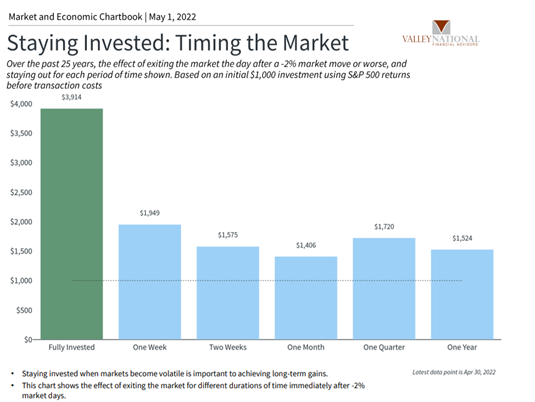

See the chart below, from Valley National Financial Advisors and Clearnomics showing the poor result of “market timing” vs staying invested for the long term and sticking with your investment plan.

What we are focused on is the labor markets and the health of the consumer. Last week saw strong labor numbers released with 428,000 new jobs created in the month of April, unemployment staying at 3.6% and job openings listed at 11.5 million. With only 5.9 million people currently unemployed, there are two job openings for every unemployed person. While these numbers point to a booming economy, hiring new workers is not cheap and employers only hire when current staff can no longer keep up with demand. Importantly, labor demand, just like demand for goods and services, is causing inflation across the board; and continued issues with labor shortages and supply chain problems will continue to put upward pressure on prices. Remember – high prices cure high prices. Thankfully, the Fed is focused on inflation and higher interest rates will be the result of their focus. If 2.50-2.75% is the Fed’s terminal rate for Fed Funds, we may have most of that priced into the market already – the yield on the two-year Treasury note is 2.72%.

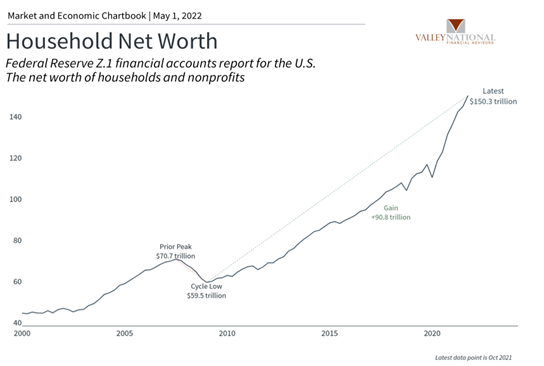

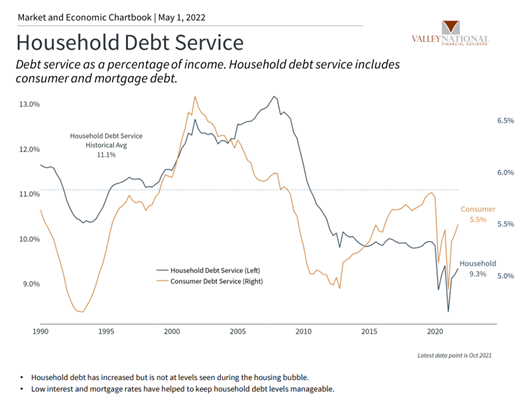

Along with near record low unemployment, consumers have record amounts of cash on the sidelines as exhibited by Household Net Worth and are sitting with extremely low Household Debt Service (see charts below from Valley National Financial Advisors and Clearnomics).

As strong as this data is, it is still not very comforting when the fixed income and equity markets are both off double digits year-to-date. As investors, we have time and history on our side and understand that market corrections occur and are healthy but never fun while happening. Bond yields at 2.72% for the two-year Treasury and 3.12% for the 10-year Treasury are attractive levels for pension funds, and foreign investors and equities are now trading at levels that again make them attractive to buyers. Caution as much patience is required at times like this, and time is always our friend and the great healer of poor market returns. Stay focused on your long-term plan and reach out to your financial advisor for guidance.