by Jonathan Susser, Investment Technology Associate

Overview

- Global pressures continue to weigh on the markets, leading to a poor week for US equities and fixed income. Inflation remains a concern as agricultural commodities and oil appreciate in price, hurting consumers’ wallets at the grocery store and gas pump. The Russo-Ukrainian war continues to be a major point of global focus as Western aid is distributed to Ukraine.

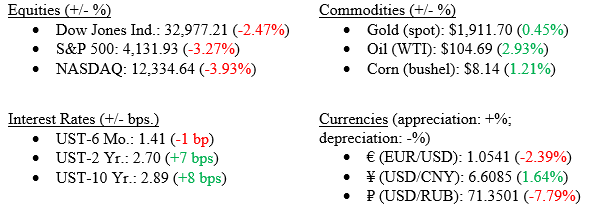

Markets (as of April 29th; change since April 25th)

US Economy

- The 1Q22 earnings season continues—of the 266 companies in the S&P 500 to report so far, about 66% have beaten revenue estimates and 81% have exceeded profit expectations. For the S&P 500 overall, year-over-year sales growth is projected to be roughly 11.1% and earnings to rise approximately 0.6%, according to Bloomberg.

- In March, personal income rose 0.5% over February, lower than the revised 0.7% estimate. Personal spending nearly doubled estimates of 0.6% growth at 1.1%. Savings declined month-over-month to 6.2% versus the revised 6.8% figure seen in February. Chart 1 below showcases income versus spending rates on a year-to-year basis.

Chart 1: Personal Income versus Spending Rates Year-over-Year

- The PCE Deflator rose 0.9% month-over-month, meeting projections. This compares to February’s revised 0.5% increase. On a year-over-year basis, the PCE Deflator rose 6.6%, slightly below the 6.7% expected and higher than February’s 6.3% increase. The PCE Core Price Index rose 0.3% from February, and 5.2% higher than last year, slightly lower than 5.3% expectations, as seen in Chart 2.

Chart 2: PCE Core Inflation Year-over-Year

Policy and Politics

- President Biden requested $33 billion in both economic and military aid for Ukraine, causing the Kremlin to reframe the conflict as a war against the West and threaten retaliation. The Russian Defense Ministry claims that 1,351 soldiers have been lost to Ukraine, while UK intelligence claims that number to be north of 15,000.

- China’s “Zero-COVID” lockdowns continue as roughly 180 million people across 27 cities remain stuck in their homes with no end in sight. In Beijing and Shanghai alone, this accounts for roughly 7.25% of China’s overall GDP.

What to Watch

- The Federal Reserve is expected to raise rates by 50bps at the FOMC meeting on May 4th.

- US Nonfarm Payrolls data will be released on Friday, May 6th, with estimates at 380k.

- US Unemployment Rate data will be released on Friday, May 6th, with forecasts around 3.5%.