by William Henderson, Chief Investment Officer

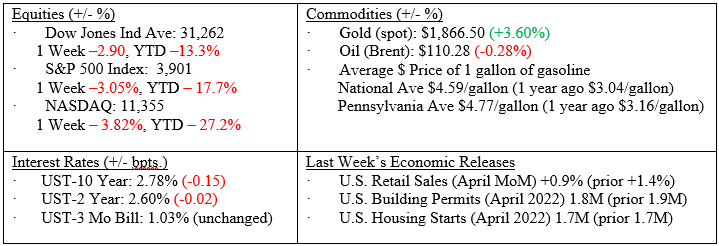

Markets continued to reel from a slew of negative news headlines including poor earnings releases from retail stalwarts Wal-Mart and Target, new cases of COVID-19 in Shanghai, and persistent inflation especially in gasoline with the national average for a gallon of gasoline hitting $4.59/gallon vs $3.04/gallon one year ago. Thankfully, U.S. equities posted a monster 614-point rally late on Friday which allowed the markets to avoid being labeled a true “Bear Market” (meaning down 20% on the S&P 500 – see returns below).

Markets (as of May 20, 2022; 1 week Returns, Year-to-date Returns)

It is hard being a market optimist these days and we can certainly understand how investors feel given year-to-date returns on stocks and bonds are so poor. Further, you would think the world is in even worse shape than the markets are telling us if you listen to the news. A new pandemic called Monkeypox is making headlines along with baby formula shortages in the United States seem like stories ripped from a movie about the end of the world. A market prognosticator once said, “if someone wants to bet you on the end of the world, take that bet.” We are on the other side of that bet as well. Current headlines are bad and downright scary, but the underlying fundamentals of our economy remain sound. However, the issues surrounding us are real and impact consumers in ways that eventually impact the economy. Remember, our economy is 60-65% consumer driven and when the consumer slows down or stops spending the economy will be impacted in a big way.

Several Wall Street economists are calling for a recession within the next 12 months. Certainly, with the S&P 500 Index down -18% year-to-date, the markets have already priced in a 75% chance of a recession. The issue at hand is that the Fed is doing its part to combat inflation, not prevent a recession. Fed Chairman Jay Powell refuses to temper his hawkish tone and instead is committed to raising all year toward a more neutral rate of 2.25% to 2.50% (currently 0.75% to 1.00%). At that level, or even a bit higher, it is expected that inflation will begin to significantly decline.

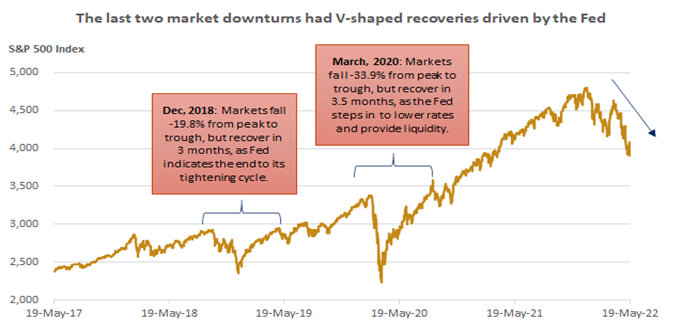

As mentioned, the Fed is focused on fighting inflation rather than the markets and that is a dramatic change from previous market downturns. See the chart below from Edward Jones showing the two previous downturns (2018 & 2020) and the Fed’s reaction to those market selloffs. At the point of December 2018 correction sparked by growth concerns, the Fed clearly and succinctly stated lower interest rates were ahead which helped spur a rapid market rebound. Similarly, at the March 2020 pandemic-related sell-off, the Fed came into the markets with every tool in their toolbox and markets again rebounded quickly.

Here we are in 2022, and the Fed is on a different mission than helping the markets rebound quickly. Instead, Mr. Powell and his Fed are all about fighting inflation. That clear divergence in mission is pushing a slower market recovery than a quick snapback as witnessed in the two previous significant downturns.

We talked above about bond and stock markets both suffering poor returns thus far in 2022. However, for the second week in a row, U.S. government bonds rallied sending the yield on the 10-Year U.S. Treasury to 2.78% down from 3.13% a couple of weeks earlier. While a long way from the 1.51% yield we saw at the beginning of the year, the move higher in Treasury Bond prices has softened the hit fixed income investors have taken thus far in 2022. It also shows there is a modest flight to quality in the markets with buyers moving once again to U.S. Treasury Bonds when markets sell-off so aggressively.

Watch for a few important economic indicators this week including the release of the minutes from the May Federal Reserve meeting on Wednesday and the Personal Consumption Expenditures (PCE) Price Index – the Fed’s preferred gauge for tracking inflation – on Friday. We remain committed to a long-term investment philosophy and understand that sell-offs and market corrections are common in well-functioning financial markets.