This weekend marked 37 years of business for VNFA. On August 28, 1985, Tom Riddle founded the company with a mission to help clients make the right financial choices in pursuit of their lifelong goals and dreams. Today, all of us working with our founder, continue to focus on that mission, putting clients first in all we do. Over the years, the world has changed and so too VNFA has evolved and continues to emerge stronger. We come to work every day with a purpose deliver a great experience for our clients who find value in the combination of financial planning and wealth management. We all look forward to a prosperous future, and we thank you all for your continued confidence in our team, our service, and our mission.

Monthly Archives: August 2022

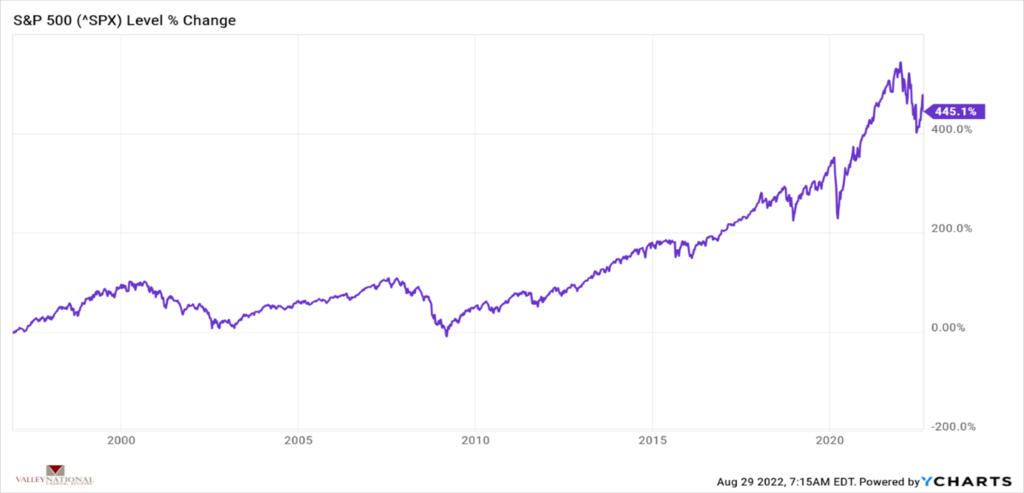

Current Market Observations

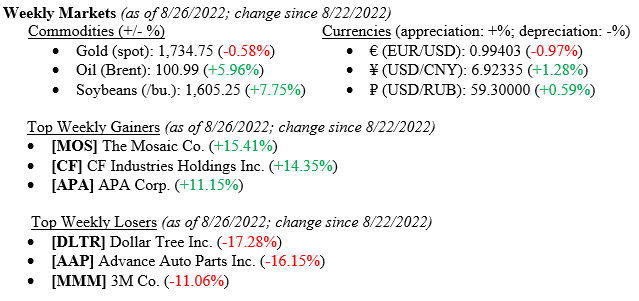

Financial markets spent the week anxiously anticipating Fed Chairman Jay Powell’s closing speech on Friday at the annual Jackson Hole Symposium. The market’s reaction (the Dow fell more than 1,000 points) reminded us of a previous Fed Chair’s comments regarding “irrational exuberance” in the markets and a similar reaction (more on that later). Chairman Powell noted that the Fed is going to remain vigilant on fighting inflation by continuing to raise short-term interest rates, even at the risk of significantly slowing the economy. For the week ended August 26, 2022, the Dow Jones Industrial Average fell -4.22%, the S&P 500 Index dropped -4.04% and rolling with the “four-handles,” the NASDAQ finished down -4.44%. Interest rates remained unchanged with the 10-Year U.S. Treasury Note rising only one basis point last week to close at 3.04%.

Global Economy & Financial Markets

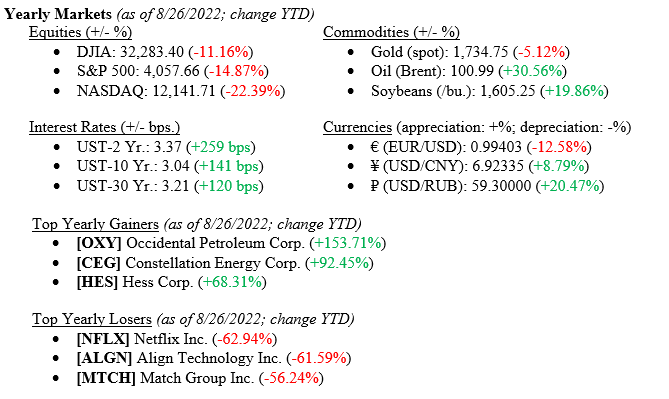

As mentioned, Fed Chairman Powell emphasized at his speech last week that inflation remained their number one concern and further emphasized that employment and economic growth remain secondary to the inflation concern. That said, last week, we saw the Fed’s preferred inflation gauge, U.S. PCE (Personal Consumption Expenditures) Price Index fall to 6.28% for July 2022 v 6.80% in June 2022. (See Chart 1 from Valley National Financial Advisors and Y Charts).

While inflation remains hot and well above the Fed’s 2.5% target rate, it shows that the aggressive monetary policy (raising short-term interest rates) is working, and inflation is slowly ebbing.

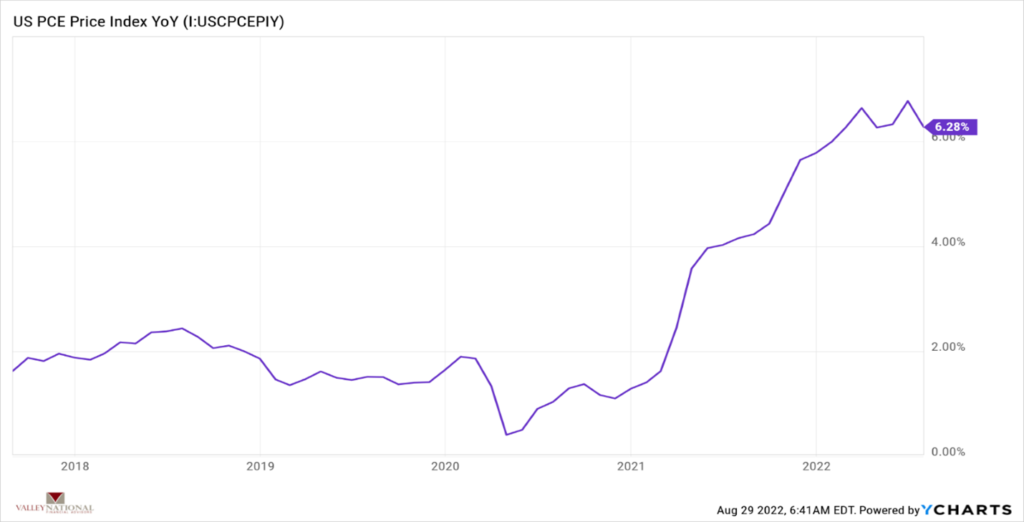

On December 5, 1996, then Fed Chairman Alan Greenspan, referring to stock market prices violently rallying around the time of the “dot-com” bubble, stated that the markets may be exhibiting “irrational exuberance.” Markets around the world quickly sold off by -3-4% across all sectors. That market reaction of 1996 was repeated last week when Fed Chairman Powell stated quite succinctly that the Fed was going to keep raising interest rates to combat inflation. Interestingly to us, this should not have been unknown news, as inflation is still running hot. Even sticky inflation (less food & energy) is running above 5%. What is important to remember from 1996 and from last week is where the markets have come since Greenspan’s comments. (See Chart 2 below from Valley National Financial Advisors and Y Charts).

Certainly, it is sometimes difficult to think long-term when markets violently sell off -4.00% as they did last week, but the numbers do not lie. Whether it is Powell talking about higher interest rates or Greenspan scolding markets for “irrational exuberance,” markets move higher over time. In fact, since 12/5/1996, the S&P 500 Index is up a staggering 445%, and during that time we have also seen massive selloffs (think Great Recession, Pandemic), which occur normally and sometimes frequently in well-functioning markets.

What to Watch

- Case-Shiller Composite 20 Home Price Index Year-over-Year for June 2022, released 9:00am 8/30/22

- U.S Initial Claims for Unemployment Insurance for week of August 27, released 8:30am 9/1/22

- U.S. Unemployment Rate for August 2022, released 8:30am 9/2/22

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.6% annual rate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q2 2022 was 6.7% (up from previous estimates of 4.3%) which marked a new post-pandemic low; but still solidly in the “growth” stage. Most companies have reported earnings for Q2 2022 and early indications of third-quarter earnings are expected to be released starting next week. |

|

EMPLOYMENT |

POSITIVE |

U.S. Nonfarm Payrolls for July 2022 increased by a stunning 528,000 new jobs compared to economist’s estimates of 250,000. The latest unemployment rate for July came in at 3.5%, nearing a record low. Employment activity and job growth continues to impress everyone while also confounding everyone as GDP is slowing at the same time. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the US increased by 8.5% for July 2022. The gasoline index fell 7.7% and the energy index fell 4.6% which offset the increases in food and shelter indexes. The PPI decreased 0.5% in July and registered a year-over-year gain of 9.8%. PCE (Personal Consumption Expenditures) fell to 6.28% in July vs 6.80% for June. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, EV cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. Last week, President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEUTRAL |

The current target for Fed Funds is a range of 2.25% to 2.5%. With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. This plan has been reiterated at the Jackson Hole symposium. The next Fed meeting is September 20-21 and markets are pricing in another 0.50-0.75% increase in short term rates. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of late June for the first time since 1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. On a good note – Israel and Turkey have restored diplomatic ties and will be exchanging ambassadors again after four years. This should result in a significant improvement in regional stability. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

VNFA In the News

Our Senior Associate Simone Sanvito and Senior Vice President Rod Young, CPA/PFS, CFP® are featured guests on the Adapting Social Breaking Barriers podcast.

Watch and listen to their interview about Challenging Yourself – https://m.youtube.com/watch?v=3SD-PkU5FPk (Also available on Spotify and Apple Music)

Quote of the Week

“Deep summer is when laziness finds respectability.’” – Sam Keen

“Your Financial Choices”

Tune in Wednesday, 6 PM for a pre-recorded episode of “Your Financial Choices” on WDIY 88.1FM. Laurie will address questions submitted online during the next live broadcast.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA In the Community

Team VNFA is honoring and remembering our loved ones touched by cancer by decorating our curtain for the Wings of Hope event.

Cancer Support Community of the Greater Lehigh Valley will host the butterfly release at noon on Sunday, Sept. 11 at Cedar Crest College.

Admission is free and donations can be made online at cancersupportglv.org

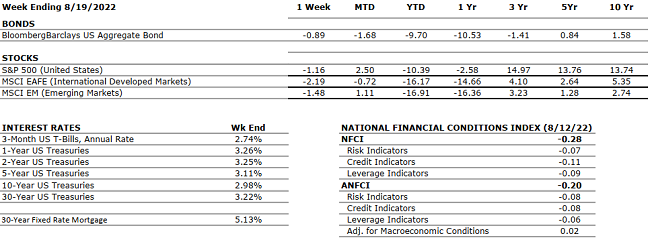

Current Market Observations

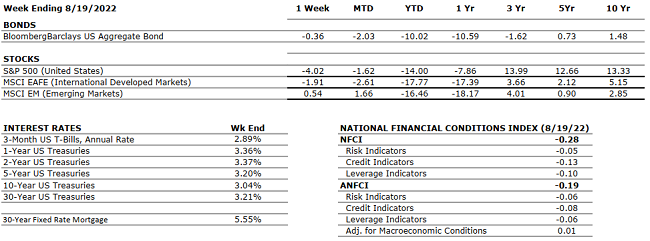

Equity markets were on their way to a fifth consecutive week of gains until last Friday when new concerns about additional rate hikes and a weakening housing market weighed on stocks to push the week into the red by the end of trading. For the week ended August 19, 2022, the Dow Jones Industrial Average fell a nominal -0.16%, S&P 500 Index dropped -1.21% and the NASDAQ finished the week down -2.62%. The poor market news weighed heavily on the bond market as well as the 10-Year Treasury Note closed last week at 2.98% higher by +0.14% since last week, but still lower than the June 2022 recent high of 3.48%.

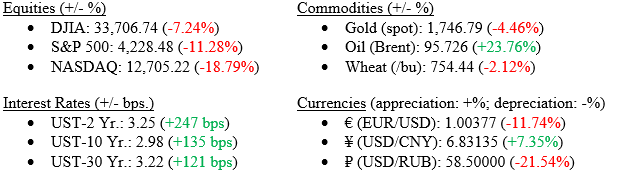

Markets (as of 8/19/2022; change YTD)

Global Economy

As mentioned above, investors and economists will now spend all week parsing and analyzing comments by various Fed speakers this week at the Fed’s annual three-day meeting in Jackson Hole, WY. The meeting will give the Fed the chance to reset or at least clear up thoughts about the pace and duration of future rate hikes. Markets are pointing to a “hawkish” (tighter monetary policy) Fed tone relayed by speakers. A “dovish” (less aggressive moves in interest rates) pivot by the Fed would be considered a positive move for the markets.

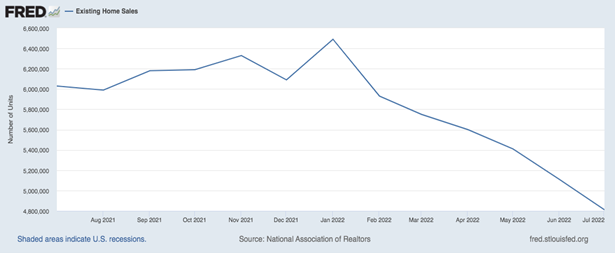

One point to consider when thinking about a key economic indicator of the U.S. Economy is the housing market, which continues to slow. Higher mortgage rates are impacting the housing market. Existing Home Sales have fallen for the last six months. (See Chart 1 below from the Federal Reserve Bank of St. Louis of Existing Home Sales). According to the most recent 2019 “Survey of Consumer Finances,” the primary residence continued to be the largest asset on the balance sheets of households. While most housing experts agree that we still face a housing shortage, higher mortgage rates and slowing sales are concerning.

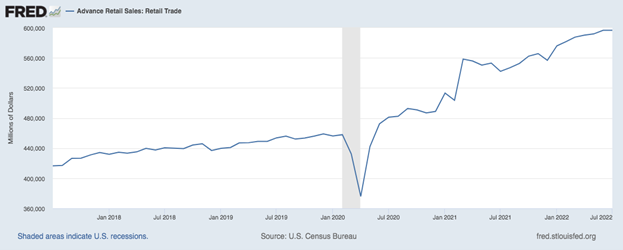

While higher interest rates and a modestly cooling housing market weigh on the markets and the economy, it is important to remember that the consumer makes up the vast majority of economic activity and consumer spending and activity continues to be strong. The July 2022, retail sales numbers, while flat, were mostly impacted by lower gasoline prices. (See Chart 2 below from the Federal Reserve Bank of St. Louis showing Retail Sales).

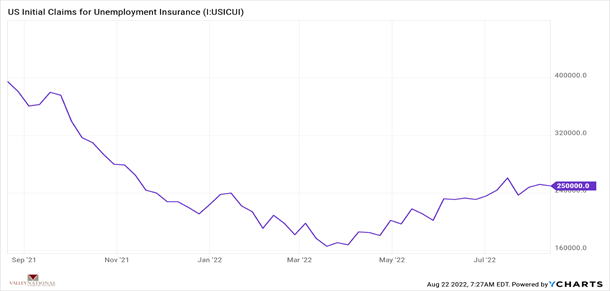

Lastly, a look at employment and the labor market is important. Weekly claims for unemployment last week came in at 250,000 new claims. In the big picture, a weekly jobless claims number of “only” 250,000 new claims is still well below long-term historical averages but also above lows seen as recently as March of 2022. (See Chart 3 below from Valley National Financial Advisors and YCharts). While there seems to be some modest slowing or cooling off in the labor market, unemployment remains at a 50-year low (3.5%) and job openings remain high, and consumer finances and balances sheets remain healthy by any historical measure.

What to Watch

- Fed Chairman and other market expert’s comments during the annual Jackson Hole, WY symposium taking place this week.

- U.S. Durable Goods New Orders for July 2022, released on August 24, 2022

- U.S. Real GDP Quarter over Quarter (revised for 2nd quarter 2022), released on August 25, 2022

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.5% annual rate according to the second estimate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. Real GDP for Q2 2022 decreased at an annual rate of 0.9% marking the second consecutive quarter of declining GDP. |

|

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q2 2022 is now 6.7% (up from 4.3%) which would mark a new post-pandemic low; but still solidly in the “growth” stage. 87% of S&P500 companies have now reported earnings — 75% beat earnings estimates and 70% reported actual revenue above expectations. For Q3, 42 companies issued negative EPS guidance while 30 companies issued positive guidance. |

|

EMPLOYMENT |

POSITIVE |

U.S. Nonfarm Payrolls for July 2022 increased by a stunning 528,000 new jobs compared to economist’s estimates of 250,000. The latest unemployment rate for July came in at 3.5%, nearing a record low. Employment activity and job growth continues to impress everyone while also confounding everyone as GDP is slowing at the same time. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the US increased by 8.5% for July 2022. The gasoline index fell 7.7% and the energy index fell 4.6% which offset the increases in food and shelter indexes. The PPI decreased 0.5% in July and registered a year-over-year gain of 9.8% |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill. The bloated bill is stacked with incentives for green energy, EV cars, and conversely oil & gas companies for exploration. Further, no changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. |

|

MONETARY POLICY |

NEUTRAL |

The current target for Fed Funds is a range of 2.25% to 2.5%. With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. The next Fed meeting is September 20-21 and markets are pricing in another 0.50-0.75% increase in short-term rates. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of late June for the first time since1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. On a good note – Israel and Turkey have restored diplomatic ties and will be exchanging ambassadors again after four years. This should result in a significant improvement in regional stability. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“When the world says, ‘Give Up,’ Hope whispers, ‘Try it one more time.’” – Dr. Seuss