Financial markets finally got what we have all been waiting for: a hint that the Fed’s aggressive monetary tightening policy is putting a cap on the economy’s hot running inflation problem. Last week, we saw U.S. CPI (Consumer Price Index) and U.S.PPI (Producer Price Index) fall for the month of July. The markets rallied strongly on the data, as they have been since the U.S. 10-Year Treasury Note hit 3.48% less than two months ago. The 10-Year Treasury Note closed last week at 2.84%, down 0.64 basis points since June 2022. The Dow Jones Industrial Average moved higher last week by +2.92%, the S&P 500 Index added +3.26% and the tech-heavy NASDAQ finished the week up a solid +3.08%. Last week’s move higher across all major sectors reminds us why what matters to long-term investors is “time in the markets” not “timing the markets.”

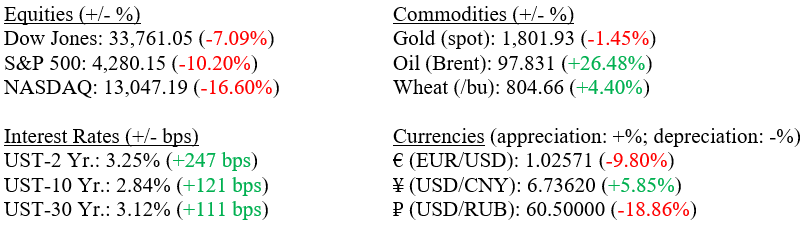

Markets (as of Market Close, 8/12/2022; change YTD)

Global Economy

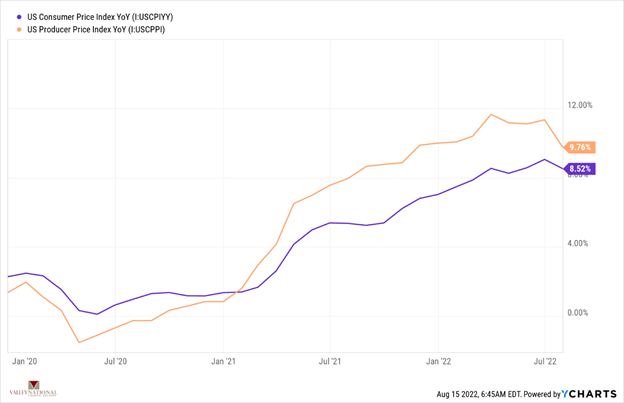

As mentioned above, last week’s economic releases finally showed that inflationary pressures are starting to abate. Both U.S. CPI and PPI showed a decline year-over-year, (see Chart 1 from Valley National Financial Advisors and YCharts). What was particularly encouraging from the data was that many critical components of inflation showed declines, including gasoline, select apparel and used cars.

We still have work to do on the inflation front as shelter (home prices and rent) and labor costs continue to show strength and little signs of softening in prices. This tells us that the Fed will not signal a pivot (from tightening monetary policy to softening) just yet but will remain data dependent. However, markets are always more efficient than we give them credit for, and we continue to see solid performance in the markets. As mentioned above, since the U.S. Treasury Note hit its 2022 high on June 15, all major markets, including the bond market have rallied solidly. (See Chart 2 from Valley National Financial Advisors and YCharts, showing how each index has performed since June 15, 2022.) Of particular note is the NASDAQ composite which is up +20.5% during the period mentioned.

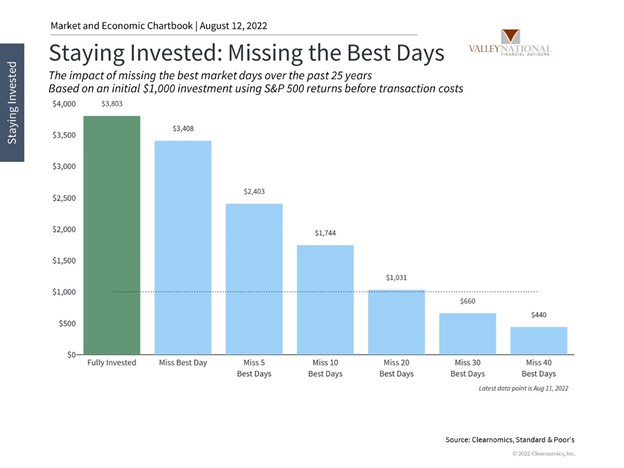

We are not market timers at Valley National Financial Advisors. Instead, we believe that consistent, thoughtful long-term investing is the key to wealth creation. Missing big market weeks like last week can wipe out gains and set investors back years. Chart 3 below from Valley National Financial Advisors and Clearnomics shows the impact of missing the best days of the market rather than simply staying invested.

Policy and Politics

While the U.S. and other developed countries are tightening monetary policy to combat inflation, China is perversely doing just the opposite. China’s Central Bank cut two of its key interest rates by 10 basis points Monday based on weak lending data released last week. Oddly, at the same time, the government is still pursuing strict COVID-zero lockdown in several provinces, which holds back any real hope for consumer-led acceleration in the world’s second-largest economy.

What to Watch

- Continued weakness in Oil. Watch WTI (West Texas Intermediate) prices this week, currently at $87.18/barrel, down from its March 8, 2022, high of $123.70/barrel.

- A lens into to the current health of the U.S. Consumer with 2ndQ ‘22 EPS (Earnings Per Share) releases out this week from Lowes, Home Depot, Target, and Wal-Mart.

- U.S. Claims for Unemployment and 30-Year Mortgage Rate, both released on August 18, 2022.