Equity markets were on their way to a fifth consecutive week of gains until last Friday when new concerns about additional rate hikes and a weakening housing market weighed on stocks to push the week into the red by the end of trading. For the week ended August 19, 2022, the Dow Jones Industrial Average fell a nominal -0.16%, S&P 500 Index dropped -1.21% and the NASDAQ finished the week down -2.62%. The poor market news weighed heavily on the bond market as well as the 10-Year Treasury Note closed last week at 2.98% higher by +0.14% since last week, but still lower than the June 2022 recent high of 3.48%.

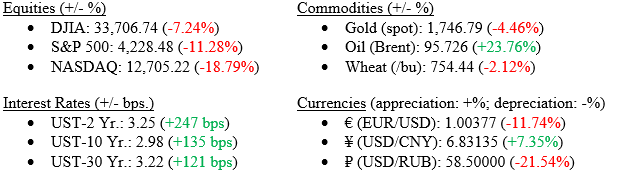

Markets (as of 8/19/2022; change YTD)

Global Economy

As mentioned above, investors and economists will now spend all week parsing and analyzing comments by various Fed speakers this week at the Fed’s annual three-day meeting in Jackson Hole, WY. The meeting will give the Fed the chance to reset or at least clear up thoughts about the pace and duration of future rate hikes. Markets are pointing to a “hawkish” (tighter monetary policy) Fed tone relayed by speakers. A “dovish” (less aggressive moves in interest rates) pivot by the Fed would be considered a positive move for the markets.

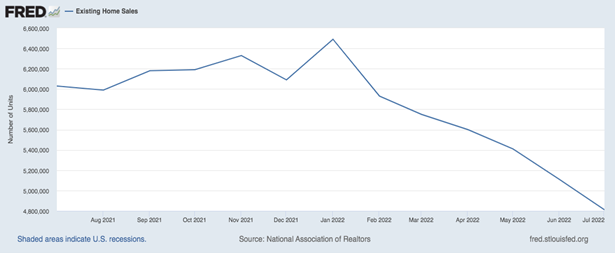

One point to consider when thinking about a key economic indicator of the U.S. Economy is the housing market, which continues to slow. Higher mortgage rates are impacting the housing market. Existing Home Sales have fallen for the last six months. (See Chart 1 below from the Federal Reserve Bank of St. Louis of Existing Home Sales). According to the most recent 2019 “Survey of Consumer Finances,” the primary residence continued to be the largest asset on the balance sheets of households. While most housing experts agree that we still face a housing shortage, higher mortgage rates and slowing sales are concerning.

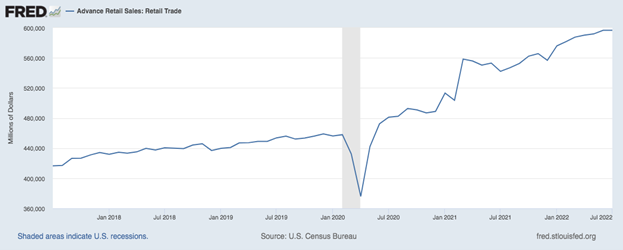

While higher interest rates and a modestly cooling housing market weigh on the markets and the economy, it is important to remember that the consumer makes up the vast majority of economic activity and consumer spending and activity continues to be strong. The July 2022, retail sales numbers, while flat, were mostly impacted by lower gasoline prices. (See Chart 2 below from the Federal Reserve Bank of St. Louis showing Retail Sales).

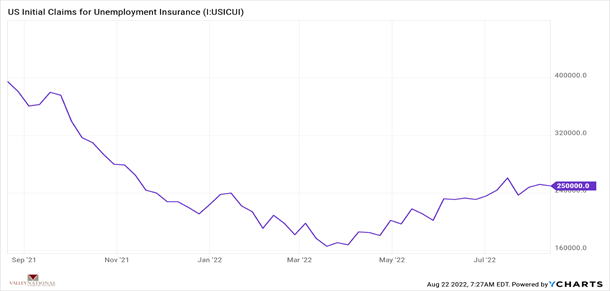

Lastly, a look at employment and the labor market is important. Weekly claims for unemployment last week came in at 250,000 new claims. In the big picture, a weekly jobless claims number of “only” 250,000 new claims is still well below long-term historical averages but also above lows seen as recently as March of 2022. (See Chart 3 below from Valley National Financial Advisors and YCharts). While there seems to be some modest slowing or cooling off in the labor market, unemployment remains at a 50-year low (3.5%) and job openings remain high, and consumer finances and balances sheets remain healthy by any historical measure.

What to Watch

- Fed Chairman and other market expert’s comments during the annual Jackson Hole, WY symposium taking place this week.

- U.S. Durable Goods New Orders for July 2022, released on August 24, 2022

- U.S. Real GDP Quarter over Quarter (revised for 2nd quarter 2022), released on August 25, 2022