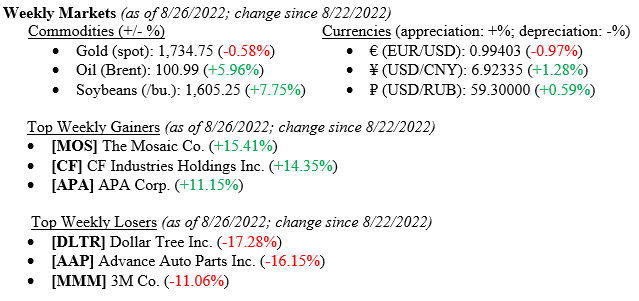

Financial markets spent the week anxiously anticipating Fed Chairman Jay Powell’s closing speech on Friday at the annual Jackson Hole Symposium. The market’s reaction (the Dow fell more than 1,000 points) reminded us of a previous Fed Chair’s comments regarding “irrational exuberance” in the markets and a similar reaction (more on that later). Chairman Powell noted that the Fed is going to remain vigilant on fighting inflation by continuing to raise short-term interest rates, even at the risk of significantly slowing the economy. For the week ended August 26, 2022, the Dow Jones Industrial Average fell -4.22%, the S&P 500 Index dropped -4.04% and rolling with the “four-handles,” the NASDAQ finished down -4.44%. Interest rates remained unchanged with the 10-Year U.S. Treasury Note rising only one basis point last week to close at 3.04%.

Global Economy & Financial Markets

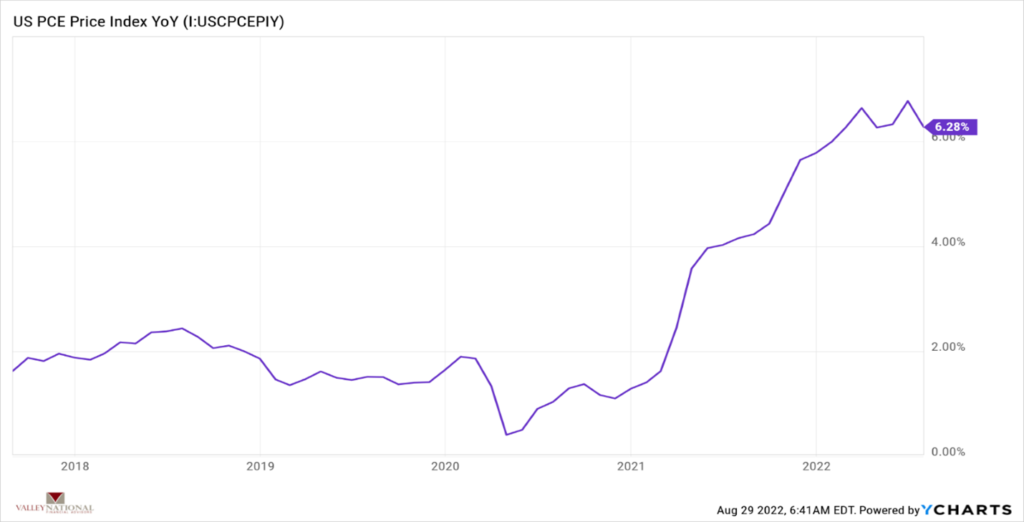

As mentioned, Fed Chairman Powell emphasized at his speech last week that inflation remained their number one concern and further emphasized that employment and economic growth remain secondary to the inflation concern. That said, last week, we saw the Fed’s preferred inflation gauge, U.S. PCE (Personal Consumption Expenditures) Price Index fall to 6.28% for July 2022 v 6.80% in June 2022. (See Chart 1 from Valley National Financial Advisors and Y Charts).

While inflation remains hot and well above the Fed’s 2.5% target rate, it shows that the aggressive monetary policy (raising short-term interest rates) is working, and inflation is slowly ebbing.

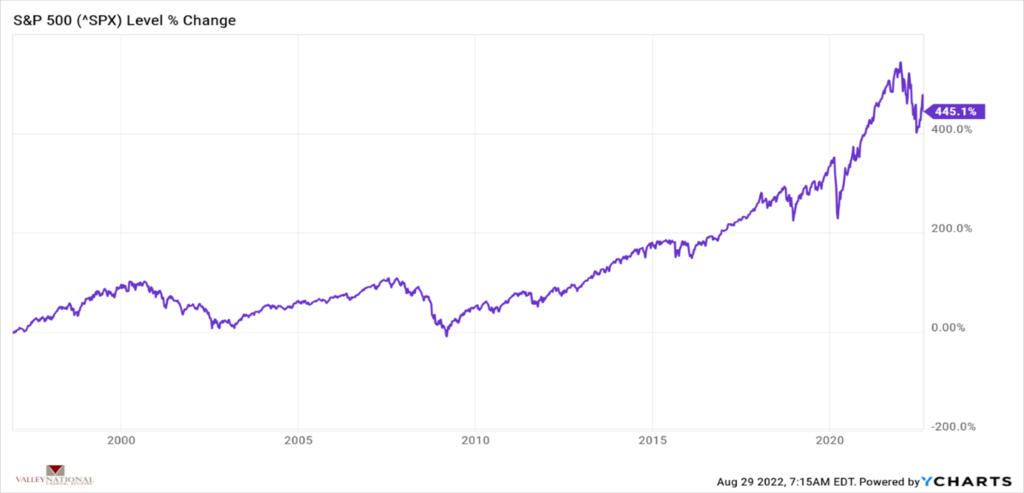

On December 5, 1996, then Fed Chairman Alan Greenspan, referring to stock market prices violently rallying around the time of the “dot-com” bubble, stated that the markets may be exhibiting “irrational exuberance.” Markets around the world quickly sold off by -3-4% across all sectors. That market reaction of 1996 was repeated last week when Fed Chairman Powell stated quite succinctly that the Fed was going to keep raising interest rates to combat inflation. Interestingly to us, this should not have been unknown news, as inflation is still running hot. Even sticky inflation (less food & energy) is running above 5%. What is important to remember from 1996 and from last week is where the markets have come since Greenspan’s comments. (See Chart 2 below from Valley National Financial Advisors and Y Charts).

Certainly, it is sometimes difficult to think long-term when markets violently sell off -4.00% as they did last week, but the numbers do not lie. Whether it is Powell talking about higher interest rates or Greenspan scolding markets for “irrational exuberance,” markets move higher over time. In fact, since 12/5/1996, the S&P 500 Index is up a staggering 445%, and during that time we have also seen massive selloffs (think Great Recession, Pandemic), which occur normally and sometimes frequently in well-functioning markets.

What to Watch

- Case-Shiller Composite 20 Home Price Index Year-over-Year for June 2022, released 9:00am 8/30/22

- U.S Initial Claims for Unemployment Insurance for week of August 27, released 8:30am 9/1/22

- U.S. Unemployment Rate for August 2022, released 8:30am 9/2/22