On January 2nd, VNFA offices will be closed for the holiday. All of us at Team VNFA wish our clients and community a very Happy New Year!

Monthly Archives: December 2022

Did You Know…?

Some people are not drinking champagne, setting off fireworks, or kissing their spouse at the stroke of midnight on New Year’s Eve.

Instead, some have a unique tradition of eating twelve green grapes in the last twelve seconds of the countdown. This tradition is done to ward off bad luck in the new year. Twelve lucky grapes are supposed to be a way to bring 12 wishes to completion in the next year.

Will you be getting green grapes this New Year’s Eve? Read more on New Year’s Twelve grapes.

Current Market Observations

The “Heat Map”

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL | Real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%), marking the second consecutive quarter of declining GDP. The second estimate for Q3 2022 shows Real GDP to have increased by an annual rate of 2.9%, up from the previous advance estimate that reported a 2.6% gain. |

|

CORPORATE EARNINGS |

NEUTRAL | The earnings growth rate for Q3 2022 was 2.4%, which was adjusted upwards from 2.2% last week. All the S&P500 companies reported actual results; 70% beat EPS expectations, while 71% beat revenue expectations. For Q4 2022, earnings are expected to decline by -2.8%. This would be the first negative growth since Q3 2020 (-5.7%). |

|

EMPLOYMENT |

NEUTRAL | U.S. Nonfarm Payrolls for November 2022 increased by 263,000 and the unemployment rate remained unchanged at 3.7%. Wages have risen more than expected at a rate of 5.1% Year over Year. Service sectors contributed the most to the increase in jobs while industries that are sensitive to rising rates, such as construction and manufacturing, have started to level off. |

|

INFLATION |

NEGATIVE | The annual inflation rate in the U.S. increased by 7.1% for November 2022 compared to the expected 7.3% — showing some continued signs of deceleration. Core CPI was also reported below expectations at 6.0% versus the estimated 6.1%. Although energy prices have come down, energy, food, and shelter are still the main contributors to inflation. |

|

FISCAL POLICY |

NEUTRAL | Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE | Two weeks ago the Fed approved a 50-bps rate hike after four consecutive 75 bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot-plot, the expected terminal rate is now 5.1%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE | Russia held controversial referendums for the annexation of four Ukrainian regions, and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE | COVID-19 lockdowns in China are easing, which should help the global supply chain recover. On the other hand, the Russian-Ukraine war does not show signs of abating. Gas supplies from Russia to Europe have decreased by 88% over the past year, and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a significant diesel shortage, with national reserves at their lowest levels since 1951 and a ban on Russian products that will intensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Celebrate endings – for they precede new beginnings.”– Jonathan Huie.

“Your Financial Choices”

Tune in Wednesday, 6 PM for a pre-recorded “Your Financial Choices” show on WDIY 88.1FM. Laurie will address questions submitted online during the next live broadcast.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Did You Know…?

Christmas has many interesting facts:

- Christmas wasn’t always on December 25.

- “Jingle Bells” was originally a Thanksgiving song.

- The Dutch gave us the idea to leave cookies and milk.

- Coca-Cola played a part in Santa’s image.

- Hanging stockings started by accident.

- Celebrating Christmas used to be illegal.

- Candy canes originated in Germany.

- Santa has his own Canadian postal code.

Want to read more interesting facts about Christmas, visit 35 Interesting Christmas Facts.

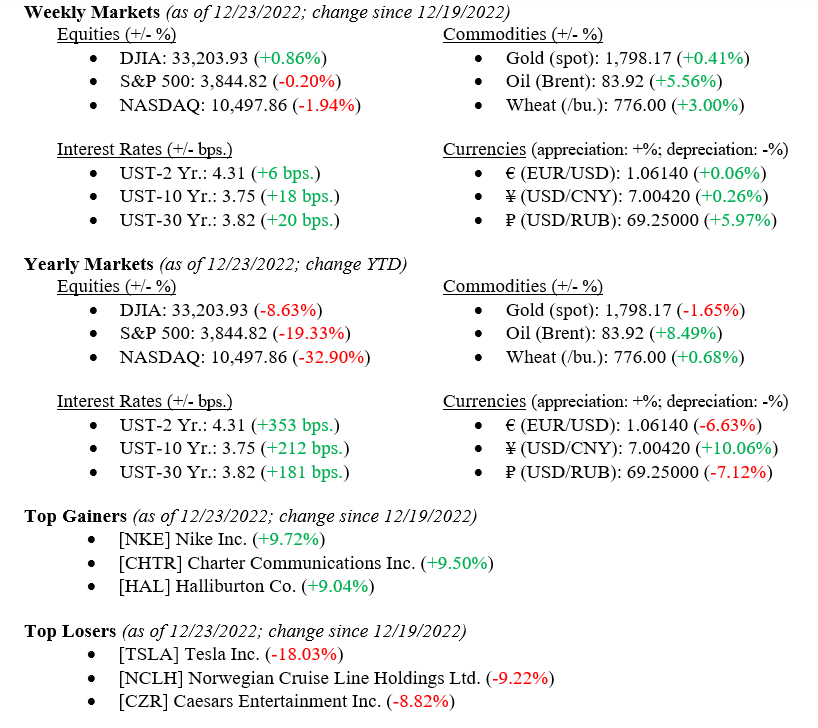

Current Market Observations

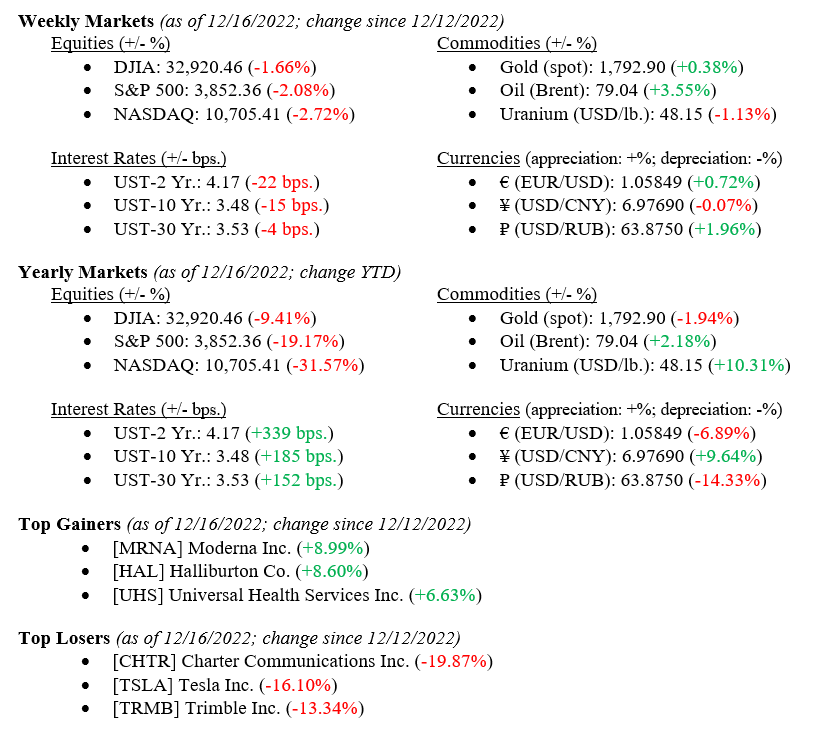

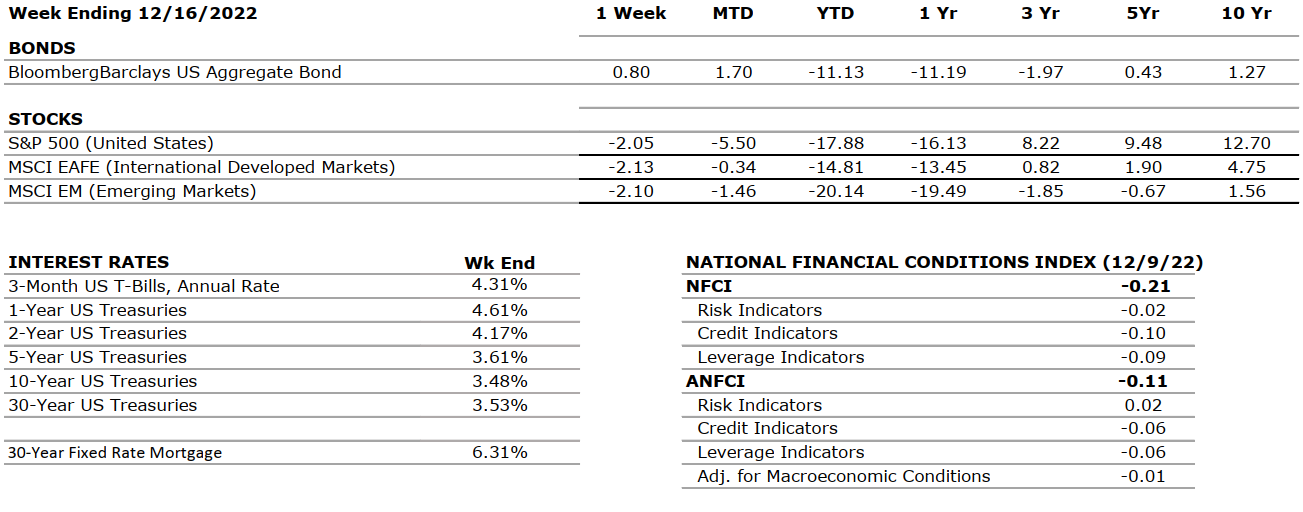

The brief “Santa Claus Rally” investors had hoped for was dashed by Fed Chairman “Ebeneezer” Powell last week at his press conference after the FOMC (Federal Open Markets Committee) meeting when he doubled down on the Fed’s hawkish stance on interest rates insisting that persistent inflation remains, and higher interest rates are still necessary. Even though several inflation indicators reported last week were lower than expected – e.g., U.S. Consumer Price Index (CPI), U.S. Core CPI and the U.S. Inflation Rate – and the Fed raised rates an expected +0.50%, equity markets sold off all week. The Dow Jones Industrial Average ended at -1.66%, the S&P 500 Index sold off -2.08% and the NASDAQ ended a full -2.72% lower. Lastly, a lower-than-expected retail sales figure was reported on Friday that sent additional jitters into markets, adding further uncertainty around an already wobbly economy.

Global Economy

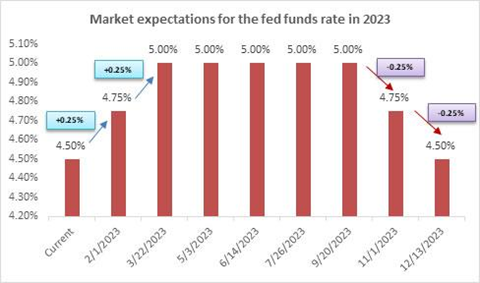

As mentioned above, the Fed raised interest rates by +0.50%, which Wall Street economists and others widely expected. However, Chair Powell’s statements after the meeting indicated that further rate hikes in 2023 are expected and that it was much too soon to discuss long-sought-after rate cuts. Regardless of Powell’s hawkish remarks, future markets continue to price in the possibility of rate cuts late in 2023. Chart 1 below from Bloomberg shows Market Expectations for the Fed Funds Rate in 2023.

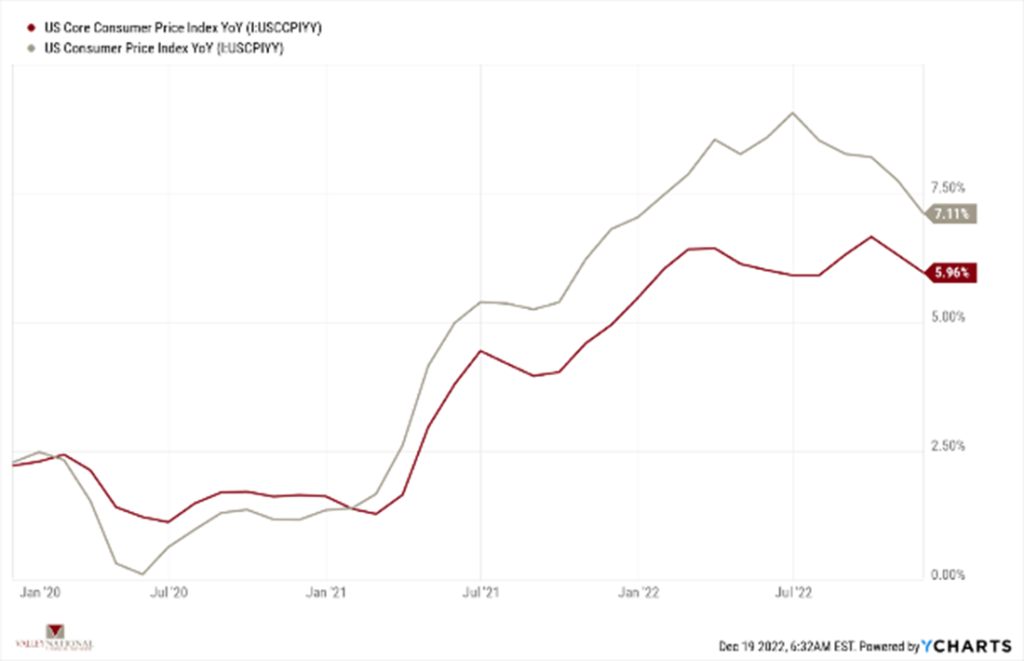

Future markets are pricing in rate cuts, which seems unlikely at this point, and we believe that inflation will continue to moderate all year but also remain elevated and above the Fed’s 2.5% target all year. Last week’s inflation data, while modest, did report lower rates for November, which assists our statement above that inflation will continue to moderate, just at a slower pace than the Fed desires. Chart 2 below from Valley National Financial Advisors and Y Charts showing U.S. CPI and U.S. Core CPI for November. Yes, inflation is moderating, but an inflation rate of +7.11% is still too high for the Fed and too high for U.S. consumers, so more work needs to be done, and that work is done via higher interest rates.

A final issue that worried markets was last Thursday’s retail sales report. The worse-than-expected number (-0.58% for November vs. October’s +1.31%) added concerns that higher rates worry consumers enough to impact spending. Importantly, recall that consumer spending makes up 65%-70% of the U.S. GDP (Gross Domestic Product), and a slowing in consumer spending added to worries about a pending recession in 2023.

Global Policy and Politics

Following the Fed’s move last week, the Bank of England and the European Central Bank (ECB) also raised their policy rates by +0.50%. Similarly, both foreign Central Banks echoed the U.S. Fed that further interest rate hikes are necessary as their inflation levels remain soundly above target ranges. We believe a strong possibility exists for a Eurozone recession due to higher interest rates and extraordinarily high energy prices resulting from the Ukraine/Russia war.

What to Watch

- U.S. Housing Starts for November 2022, released 12/20/22 (prior +1.425M)

- U.S. Claims for Unemployment Insurance for week of 12/17/22, released 12/22/22 (prior +211K)

- U.S. Real GDP for Q3 2022, released 12/22/22 (prior +2.90%)

- U.S. Core PCE (Personal Consumption Expenditures) Price Index Year-over-Year for November 2022, released 12/23/22 (prior +4.98%)

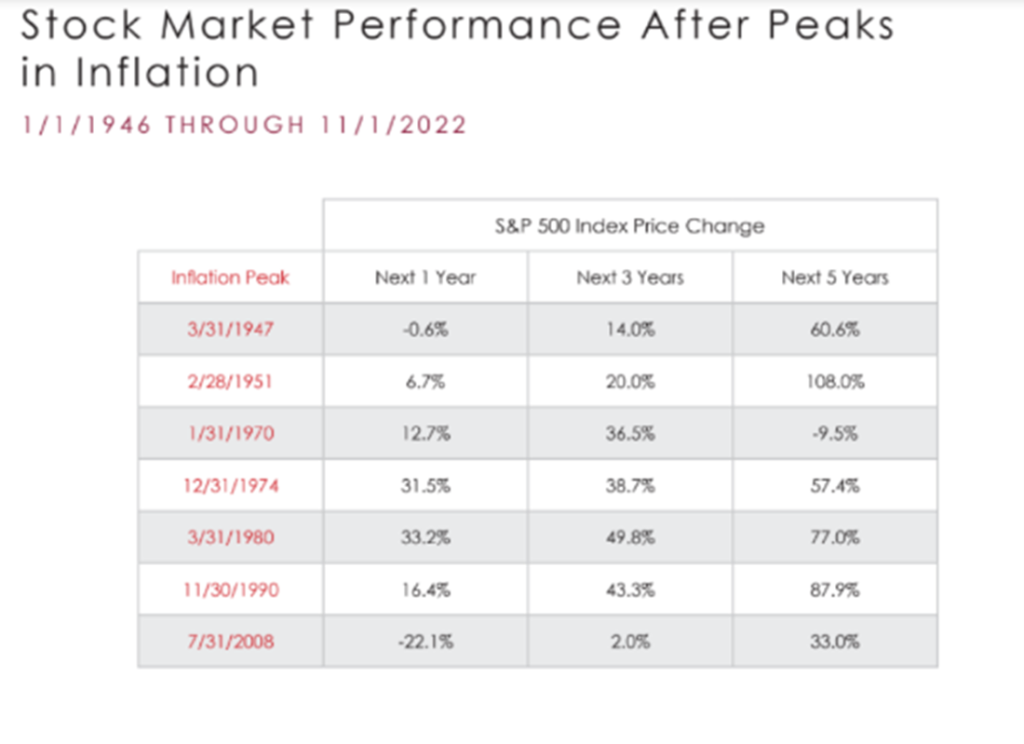

With most of 2022 behind us, we are now looking to 2023 and setting expectations for the year. Most economists are calling for a recession in 2023. There is a possibility for a modest recession especially given the recent softening in consumer spending, higher mortgage rates impacting housing, and weaker earnings releases by U.S. companies. That said, U.S. labor remains strong, and U.S. banks are healthy, both of which are critical to future economic growth. Any recession in 2023 will be short-lived and modest. The Fed will continue to hack away at inflation and eventually hit a “pivot point” on interest rates. We expect inflation to have already peaked, and lower levels are upon us. Historically, the markets perform well after peak inflation. Chart 3 below from Bloomberg shows the last seven inflationary periods and the S&P 500 Index performance over the next one. three, and 5 years.

- Watch for inflation indicators, labor strength, consumer activity and finally EPS (Earnings Per Share) results as we move into 2023.

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. The second estimate for Q3 2022 shows Real GDP to have increased by an annual rate of 2.9%, up from the previous advance estimate that reported a 2.6% gain. |

|

CORPORATE EARNINGS |

NEUTRAL | The earnings growth rate for Q3 2022 was 2.4%, which was adjusted upwards from 2.2% last week. All the S&P500 companies reported actual results, 70% of them beat EPS expectations while 71% beat revenue expectations. For Q4 2022, earnings are expected to decline by -2.8%. This would be the first negative growth since Q3 2020 (-5.7%). |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for November 2022 increased by 263,000 and the unemployment rate remained unchanged at 3.7%. Wages have risen more than expected at a rate of 5.1% YoY. Service sectors contributed the most to the increase in jobs while industries that are sensitive torising rates, such as construction and manufacturing, have started to level off. |

|

INFLATION |

NEGATIVE | The annual inflation rate in the U.S. increased by 7.1% for November 2022 compared to the expected 7.3% — showing some continued signs of deceleration. Core CPI was also reported below expectations at 6.0% versus the estimated 6.1%. Although energy prices have come down, energy, along with food and shelter, are still the main contributors to inflation. |

|

FISCAL POLICY |

NEUTRAL | Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE | Last week the Fed approved a 50-bps rate hike after four consecutive 75 bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot-plot, the expected terminal rate is now 5.1%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE | Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE | COVID-19 lockdowns in China are easing which should help the global supply chain recover. On the other hand, the Russian-Ukraine war does not show signs of abating. Gas supplies from Russia to Europe have decreased by 88% over the past year and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a major diesel shortage with national reserves at their lowest levels since 1951 and a ban on Russian products that will intensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Winter, a lingering season, is a time to gather golden moments, embark upon a sentimental journey, and enjoy every idle hour.” ― John Boswell