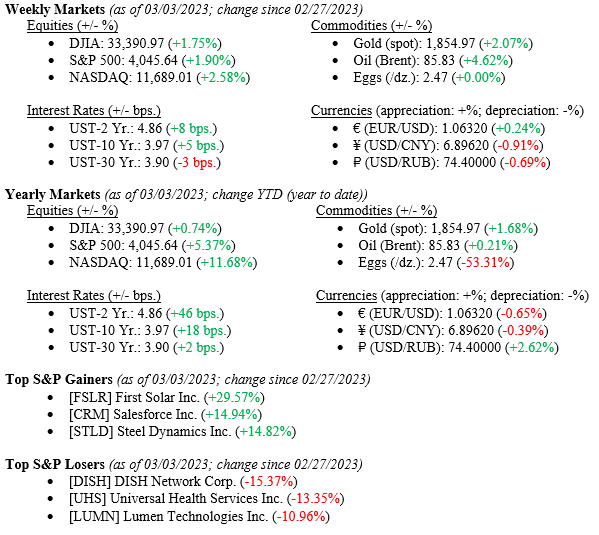

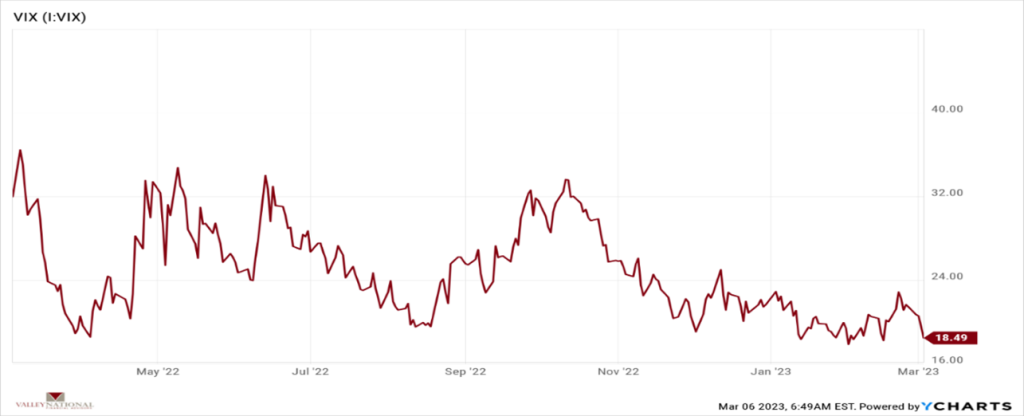

Despite U.S. Treasury Bond yields moving higher, equities notched a solid gain last week as all major indexes ended the week higher, with the Dow Jones Industrial Average rallying +1.75%, the S&P 500 Index moving up +1.90%, and the NASDAQ increasing by 2.58%. The 10-year U.S. Treasury Bond, after briefly touching 4.00% mid-week, closed the week at 3.97%. Oddly, even with higher bond yields, the VIX (Volatility Index, the CBOE Measurement of Expected Volatility) moved lower (18.49) and is down from its October high (33.63) (Chart 3). Further, Fed Fund Futures point to higher short-term rates and a higher terminal rate for Fed Funds rate around 5.25% (Chart 1). Lastly, corporate EPS (Earnings Per Share) releases for the 4th Q 2022 are over, and most were moderately higher even after many analysts projected lower EPS. After the 1st Q 2023 closes, markets will get fresh evidence of economic activity.

US Economy

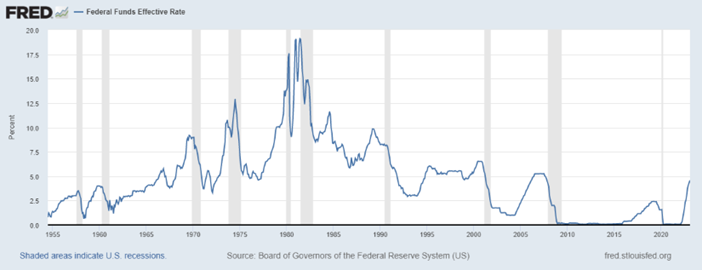

Most inflation indicators are moving lower, and markets continue to point to higher short-term interest rates and a higher terminal rate for the Fed Funds Rate. Chart 1 below by the Federal Reserve of St. Louis shows the current Fed Funds Effective Rate of 4.75%. The average of Fed Fund Futures is now predicting a terminal rate of 5.25 – 5.50% by December 2023. Considering how far and fast we have moved in interest rates—from ZERO last year to 4.75% one year later—why are markets reacting so negatively to, at most, +0.75% higher from here?

It has been and continues to be our opinion at VNFA that the U.S. Economy remains healthy and will be able to easily digest up to three additional +0.25% rate hikes over the next three FOCM meetings, ending the year near 5.25 – 5.50%. Notwithstanding the 1980s inflationary period, multiple GDP (Gross Domestic Product) expansions occurred when interest rates were high, but the economy continued to grow.

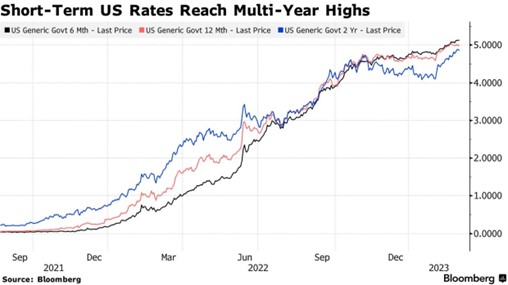

As mentioned above, bond yields continue to increase, especially in the short end of the yield curve (3 months to 2 years). Chart 2 below from Bloomberg shows generic bond yields, which continue to hit multi-year highs offering investors risk-free rates of return significantly higher than in previous years. The opportunity cost for staying out of equities and keeping safe on the sidelines by investing in short bonds (2-year yields ~5.00%) is much lower than in previous years when short rates were zero. However, we at VNFA want our investors to consider whether equity returns over the next two years will be higher than 5.00%. Given the information in front of us: bank health, labor markets, corporate earnings, and consumer spending, we believe investors still need equities in their portfolios to take advantage of future compounding returns.

Markets continue to be volatile, which is expected and common during the Fed tightening interest rates because of the implied uncertainty. However, the VIX (Volatility Index, the CBOE Measurement of Expected Volatility) moves lower. Chart 3 below from the Valley National Financial Advisors and Y Charts shows the VIX Index. The VIX decreases when there is less demand for put options (options bought by investors predicting lower equity prices). The VIX moves inversely to equity prices.

Global Economic Politics

- The Russia/Ukraine war continues to muddle on without much hope for a cessation. Thankfully, a modest winter has helped EU countries avoid an economic disaster that could have happened given natural gas shortages due to the war. Sanctions on Russia have been de minimis as other countries such as China, and India has increased trade, replacing former western trading partners.

- While finally coming out of zero-Covid lockdown, China has set the lowest GDP growth target in decades. Much can be said about China’s economic ambitions. Still, their new growth target of “only” 5% is telling, in that China may finally acknowledge the many issues, demographic among the most important, facing the country in the future.

What to Watch

- U.S. Job Openings: Total Nonfarm, for January ‘23, released 3/6/23, prior 11.01M.

- U.S. Initial Claims for Unemployment Insurance week of 3/4/23, released 3/9/2023, prior 190K.

- U.S. Nonfarm Payrolls MoM (Month Over Month) for February ‘23, released 3/10/23, prior 517K.

- U.S. Unemployment Rate for February 2023, released 3/10/23, prior 3.4%.

Equity markets and bond yields both ended higher last week. The Fed is on a course to reduce inflation to 2.00% while keeping full employment and a growing economy. This scenario would be considered an exceptionally soft landing and a tough one for Chairman Powell to “stick.” Every piece of the puzzle is known – higher rates, employment, economic growth. Short-term bond yields at 5.00% are incredibly enticing to investors still wounded from last year’s market wipe-out. However, wealth is gathered over exceptionally extended periods and is generational. Missing a few big days in the markets can make an enormous difference in portfolio returns, and market timing usually is a fool’s game. Stick to your investment plan and always look at the big picture rather than the minutia of daily market swings.