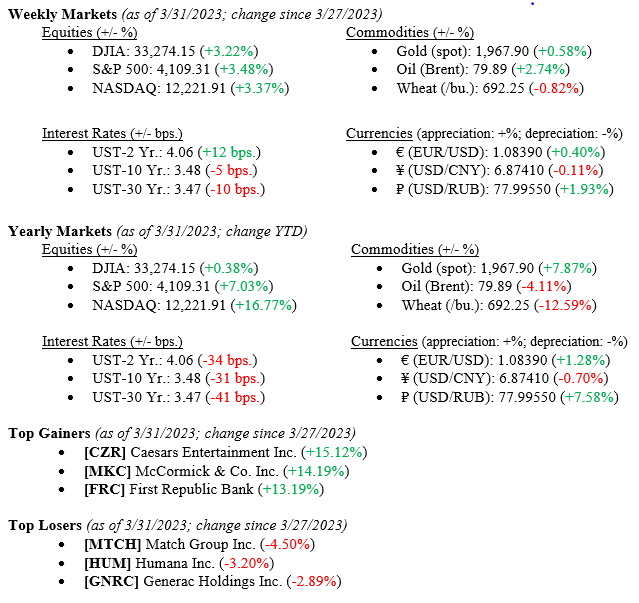

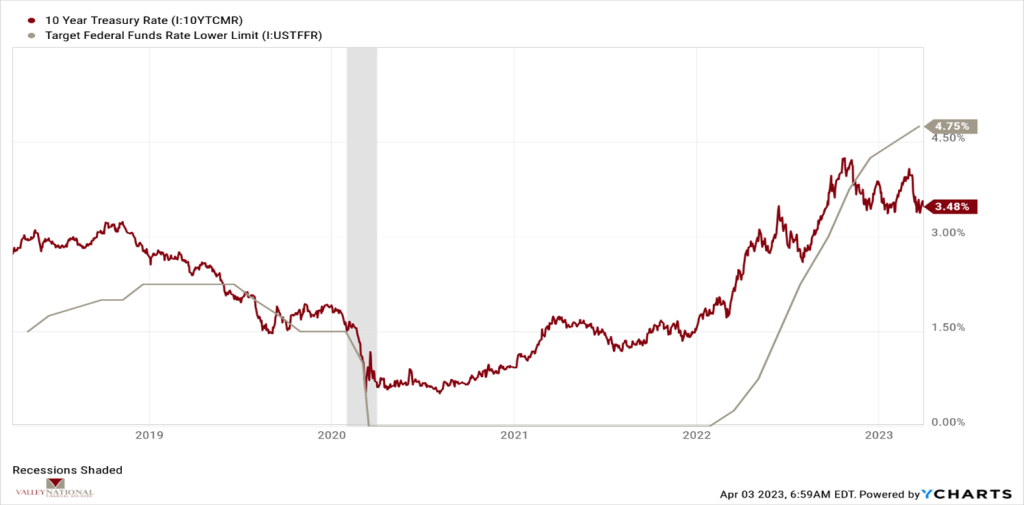

Equity markets wrapped up a volatile quarter with a volatile week as each major market index posted strong gains to end the week. The S&P 500 Index led the markets higher last week, notching a +3.48% gain, followed by the NASDAQ with a +3.37% gain, and finally, the Dow Jones Industrial Average returning +3.22% for the week ending March 31, 2023. These gains, coupled with gains thus far in 2023, pushed all three indexes into positive territory for the year’s first quarter (see year-to-date returns below). The weakness in markets spurned by the short-lived regional bank crisis was offset by investor beliefs that the Fed is finally winding down its aggressive interest rate hiking cycle, and the Fed will announce a long-awaited pause or pivot in interest movements at the May 2023 FOMC (Federal Open Markets Committee) Meeting. Interest rate expectations moved the 10-year US Treasury bond lower by 10 basis points, ending the week at 3.47%. Recall, as recently as October 2022, the 10-year US Treasury was trading at 4.24%, fully 77 basis points higher than today, see Chart 1 below.

US Economy

As mentioned above, US Treasury bonds have moved sharply lower in yield since the recent peak in rates in October 2022. Chart 1 below by Valley National Financial Advisors and Y Charts showing the current 10-year US Treasury bond yield and the current Fed Funds Target Rate). The chart shows the dramatic rise in the Fed Funds Rate (the interest rate at which depository institutions trade balances to each other overnight) as the FOMC has moved interest rates higher to combat inflation. While initially moving higher, long-term rates have tapered off and dropped, indicating that the markets are pricing to this current interest rate cycle. The equity markets are efficiently reading this Fed pivot and reacting accordingly – in the current case, by rallying in 2023.

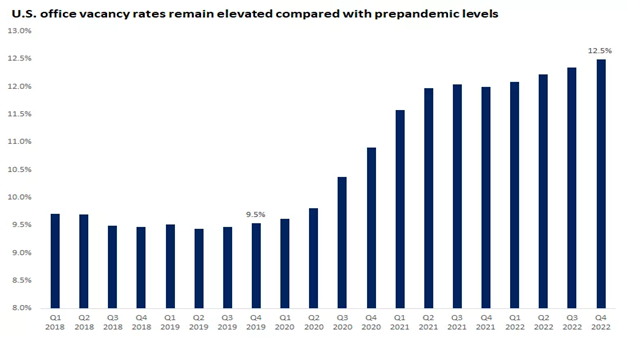

While the markets appear to have moved beyond the recent regional banking crisis, we do not want to ignore other issues showing weakness in 2023 which could again put pressure on banks. Many companies in the U.S. and globally have begun to require a full-time return to work rather than work from home. Office vacancy rates remain elevated compared with pre-pandemic levels; see Chart 2 below from the National Association of Realtors. Like commercial loans, most commercial real estate loans are held by regional banks, and until office vacancy rates recede, pressure will remain on this banking sector. Furthermore, local economies rely on regional bank activities for growth and expansion.

Policy and Politics

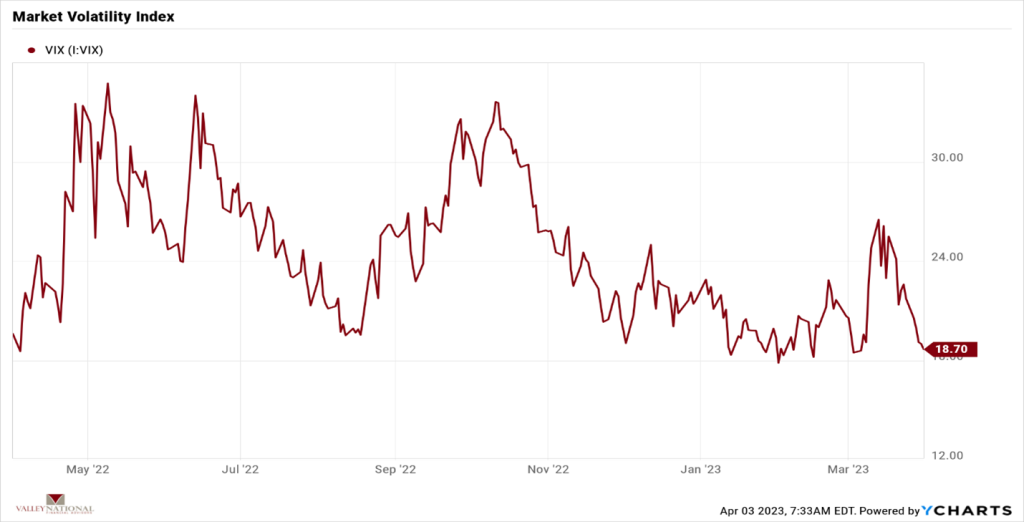

Clearly, all is not well in Washington, and a media firestorm is about to unfold with former US President Trump being indicted. Some may argue that a distracted Washington is good for the markets and the economy as lawmakers are too busy making noise to impart new restrictive or harmful laws; lawmakers can stay out of the way and let the economy do its own thing. A returning calm in the markets can be seen from the VIX (The Volatility Index), which measures the implied expected volatility of the US Stock Market. See Chart 3 below from Valley National Financial Advisors and Y Charts showing the VIX. After a recent spike in the VIX due to the failures of Silicon Valley Bank and Signature Bank, the VIX has fallen back to recent pre-bank crisis levels.

What to Watch

- Monday, April 3rd

- U.S. Retail Gas Price at 4:30PM (Prior: $3.533/gal.)

- Tuesday, April 4th

- U.S. Job Openings: Total Nonfarm at 10:00AM (Prior: 10.82M)

- Wednesday, April 5th

- ADP Employment Change at 8:15AM (Prior: 242,000)

- ADP Median Pay YoY (Year Over Year) at 8:15AM (Prior: 7.20%)

- Thursday, April 6th

- U.S. Initial Claims for Unemployment Insurance at 8:30AM (Prior: 198,000)

- 30-Year Mortgage Rate at 12:00PM (Prior: 6.32%)

- Friday, April 7th

- U.S. Labor Participation Rate at 8:30AM (Prior: 62.50%)

- U.S. Nonfarm Payrolls MoM at 8:30AM (Prior: 311.00K)

- U.S. Unemployment Rate at 8:30AM (Prior: 3.60%)

World famous British Economist John Maynard Keynes said in 1930, “Markets can remain irrational longer than you can remain solvent.” This was a sly way of saying that timing the markets is a fool’s errand. We at VNFA, and others, say that it is “time in the markets rather than timing the markets” that creates true generational wealth. There is always a lot to digest when watching the financial markets. Bulls and Bears exist on both sides of a trade. We remain cautiously optimistic about market returns for 2023 and believe the Fed can moderate inflation without tanking the economy. Opportunities exist for investors, but volatility, while quiet today, could return in short order. Speak with your financial professionals at Valley National Financial Advisors for assistance.