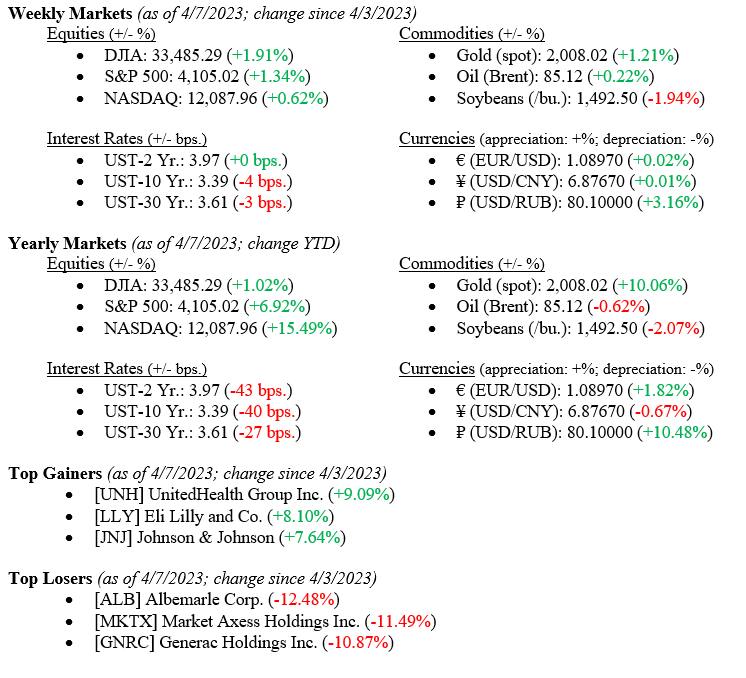

Although last week’s jobs report showed a slowing in hiring during March 2023, equity markets posted another positive week across all three major market indexes, with the Dow Jones Industrial Average leading the way at +1.91% for the week ended April 7, 2023. Meanwhile, the S&P 500 Index notched a decent +1.34% for the week, while the NASDAQ returned +0.62%. Bond prices increased during the week but only modestly, with the 10-year U.S. Treasury bond falling four basis points to close the week at 3.39%. As recently as October 2022, the yield on the 10-year U.S. Treasury was 4.25%, marking a shocking move in rates due to still-unfounded recessionary fears and a clear flight to quality after the mini-banking crisis we saw in March as Silicon Valley Bank & Signature Bank failed.

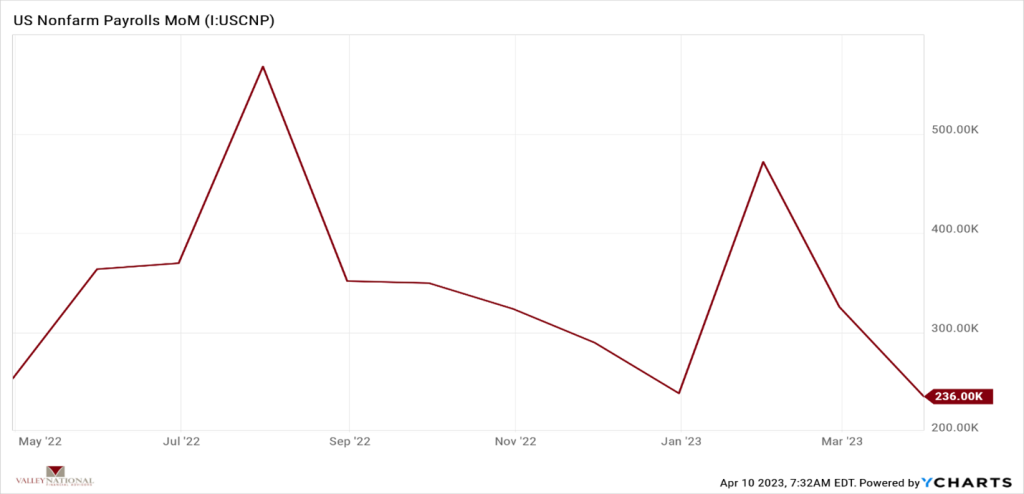

Last Friday’s employment report from the Bureau of Labor Statistics showed the U.S. added 236,000 nonfarm payrolls in March, below the median economists’ forecast of 239,000 and down from February’s revised figure of +311,000, see Chart 1 below. Oddly, the unemployment rate moved a bit lower to 3.5% from 3.6%, and the labor force participation rate increased from 62.5% to 62.6%. At VNFA, these moves are modest and still point to a strong labor market by any historical measure. We continue to believe the U.S. labor market remains a strong point continuing to underpin the economy.

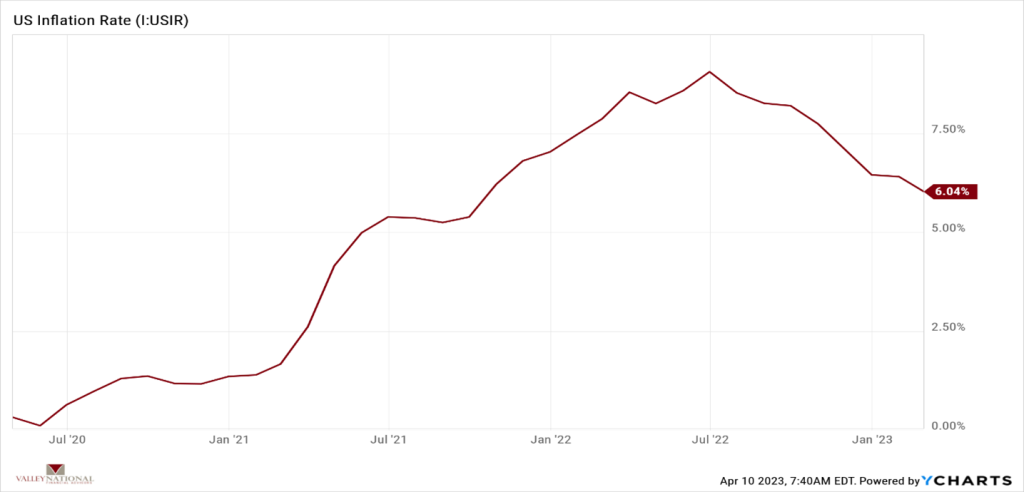

Investors understand the current objective of Fed Chairman Jay Powell is combatting inflation which peaked last summer at 9.06% and has since tapered to 6.04%, see Chart 2 below. Chair Powell has raised interest rates at a near-historic pace, and last year’s markets showed the result of that with poor returns across all sectors. As inflation comes under control and further rate hikes fade into the sunset, we expect markets to moderate but remain volatile.

What to Watch

- Monday, April 10th

- U.S. Wholesale Inventories MoM at 10:00AM (Prior: -0.42%)

- U.S. Retail Gas Price at 4:30PM (Prior: $3.606/gal.)

- Wednesday, April 12th

- U.S. Consumer Price Index MoM/YoY at 8:30AM (Prior: 0.37% / 6.04%)

- U.S. Core Consumer Price Index MoM/YoY at 8:30AM (Prior: 0.45% / 5.53%)

- Thursday, April 13th

- U.S. Producer Price Index MoM/YoY at 8:30AM (Prior: -0.15% / 4.58%)

- U.S. Core Producer Price Index MoM/YoY at 8:30AM (Prior: -0.00% / 4.40%)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.28%)

- Friday, April 14th

- U.S. Export Prices MoM/YoY at 10:00AM (Prior: 0.20% / -0.85%)

- U.S. Import Prices MoM/YoY at 10:00AM (Prior: -0.14% / -1.05%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 62.00)

Equity markets finished the week slightly higher, while treasury yields fell slightly. Last week, the BLS (Bureau of Labor Statistics) labor report was right on target, missing median expectations by only a few thousand jobs and indicating a strong labor market as participation increased and the unemployment rate decreased. However, the strong jobs market is still running a bit contrary to the Fed’s rate-hike path. It was expected that the historic pace of rate increases would negatively affect workers and put many out of jobs, which has yet to be seen. Despite the continued strength in this area, inflation has trended downwards from a peak of 9.06% and is currently down to 6.04%, indicating that the Fed is putting up a good fight. We believe the path to 4% is ahead of us, while returning to the 2% average target may take years longer than initially expected.