by Connor Darrell CFA, Assistant

Vice President – Head of Investments

U.S.

equities generated their worst week in over a decade as fears that the novel

coronavirus might pose a real threat to economic activity began to spread. In

our view, the market action we observed last week was not based upon fundamentals,

because market participants simply don’t have that type of concrete information

available to them. The selling was, however, unsurprising as the panic that

rippled through the financial system last week was likely amplified by the fact

that equity markets had performed so strongly over the previous year. Throughout

2019, stocks generated strong returns despite minimal growth in corporate

earnings. That happened because the global economy was showing signs of

improvement and the prospects for future earnings growth were increasing. The

coronavirus represents a significant unknown that is eating away at the

positive sentiment that built up throughout last year, and investors should

expect continued volatility in markets as the situation continues to evolve.

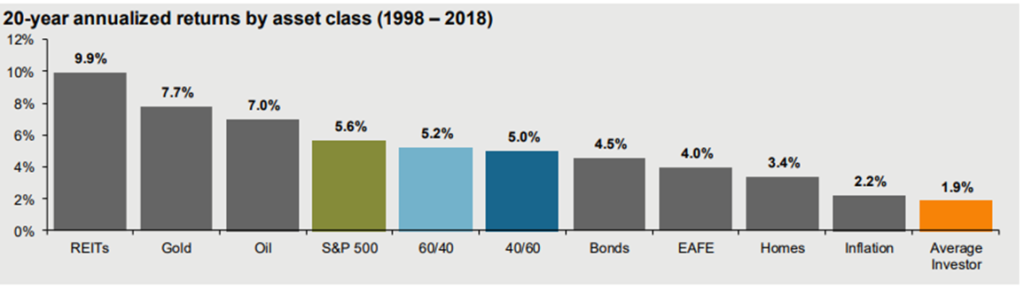

But with all of that said, while the coronavirus itself is new and the public health concerns very real, the fact of the matter is that what we are seeing in markets is not out of the ordinary. Since World War II, there have been a total of 26 stock market corrections (this one makes 27) with an average market decline of 14.3%. Some have been larger, and some have been smaller. What makes this correction particularly difficult is that there are so many details we still don’t know about the coronavirus. At what point will cases reach a peak? How severe might the economic impacts be, and how widespread? The markets have reacted strongly to these uncertainties because investors’ appetite for risk tends to dissipate as more unknown variables enter the equation. In times like these, we like to remind investors that drastic portfolio changes are unlikely to add value over the long-term. In fact, there is overwhelming evidence that most investors make themselves worse off by reacting too strongly to negative news. The below chart from JPMorgan shows the historical performance of the average investor compared to a variety of different asset classes. The average investor has a propensity to act emotionally during periods of market stress and make efforts to time the markets, which has clearly led to significant underperformance. In fact, the average investors’ mistakes have caused portfolio returns to even lag inflation!

The evidence above suggests that investors should consider the amount of fixed income in their portfolios before making drastic decisions to exit equities en masse. For those who have multiple years’ worth of withdrawals that can be funded from bond positions, there is little that should be done to address the pullback.