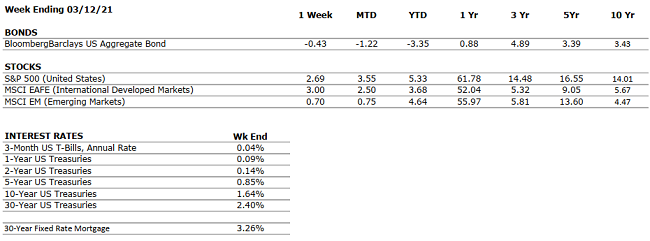

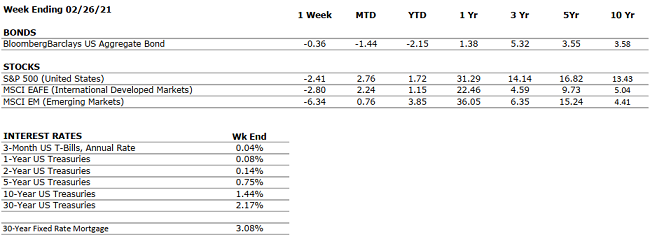

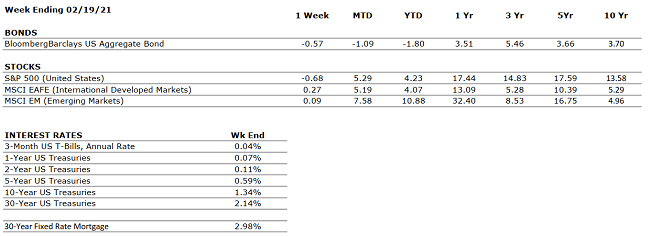

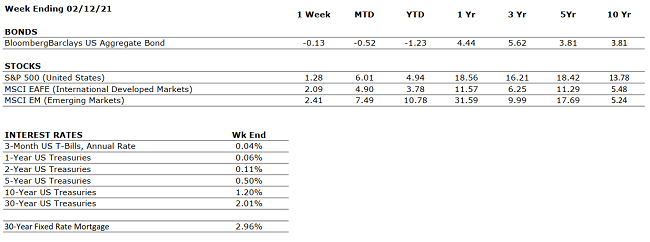

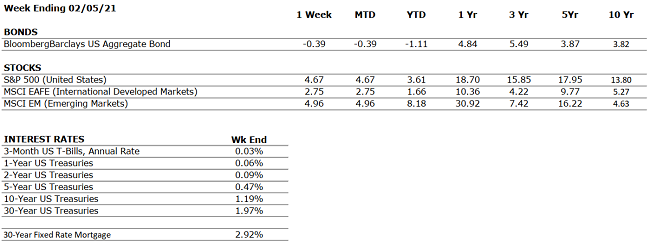

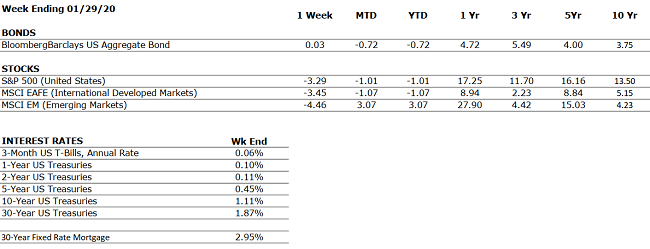

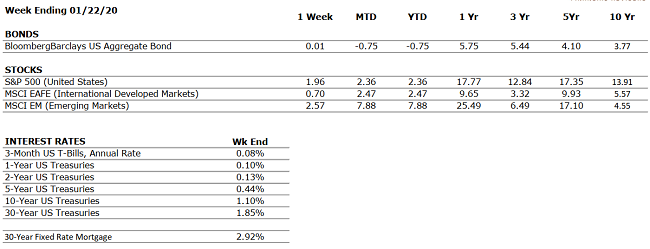

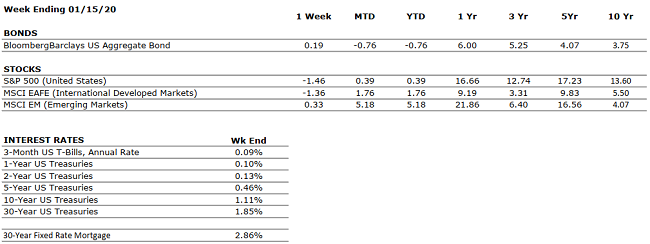

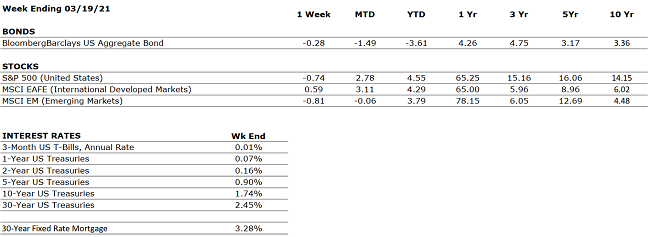

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The FOMC forecasts the U.S. economy will grow by 6.5% in 2021, while the unemployment rate will retreat to 4.5% by year’s end. |

|

CORPORATE EARNINGS |

POSITIVE |

S&P 500 Q4 profits grew 3.8% year-over-year, well in excess of analyst expectations, which figured that earnings would fall by 7%. Earnings in 2021 are set to look strong as they lap Q2-Q3 2020. |

|

EMPLOYMENT |

NEUTRAL |

The unemployment rate declined to 6.2% in February from 6.4% in January. Most of the added jobs last month were concentrated in the Leisure & Travel sector. Total employment remains 9.5 million jobs below the pre-pandemic peak. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden signed a $1.9 trillion fiscal bill last week. The U.S. economy has received a total of approximately $4 trillion in stimulus during the COVID-19 pandemic. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve continues to indicate that the monetary environment will remain very accommodative for the foreseeable future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April 2020 nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.