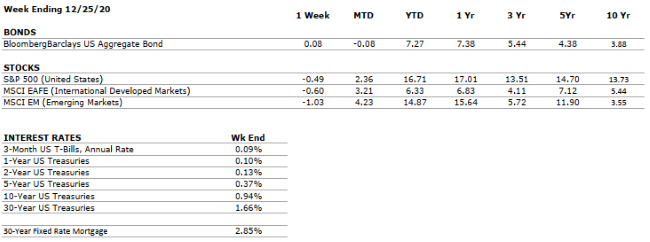

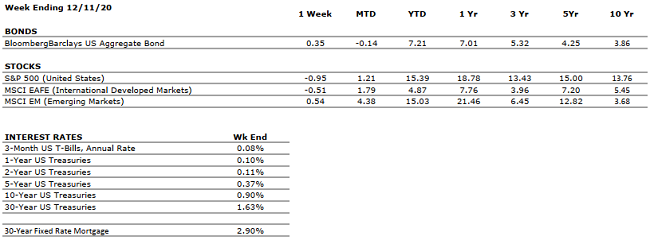

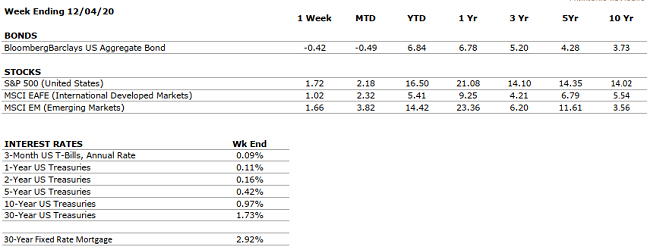

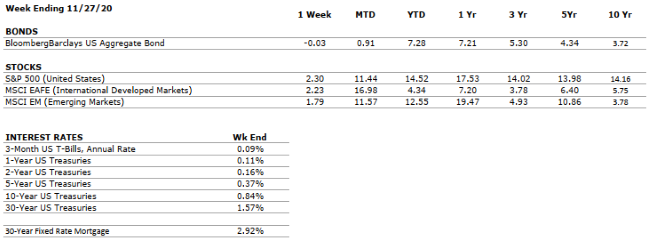

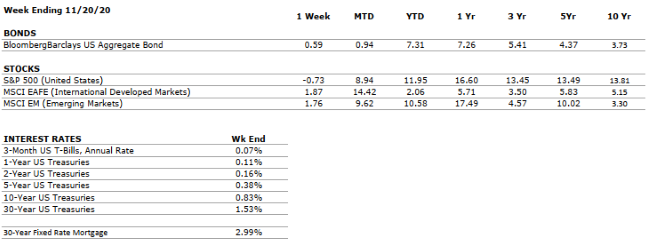

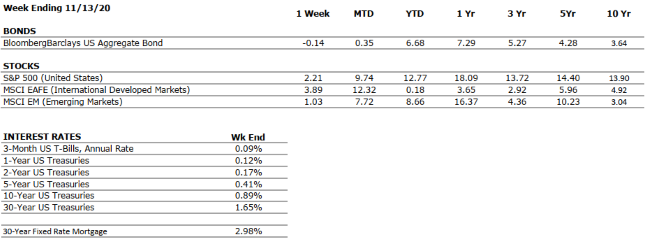

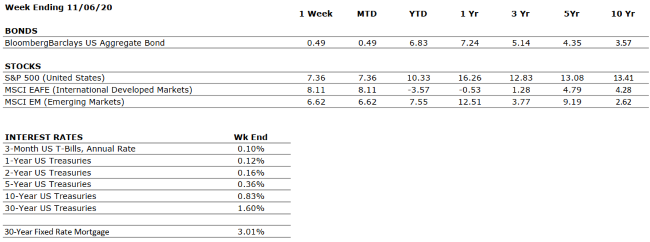

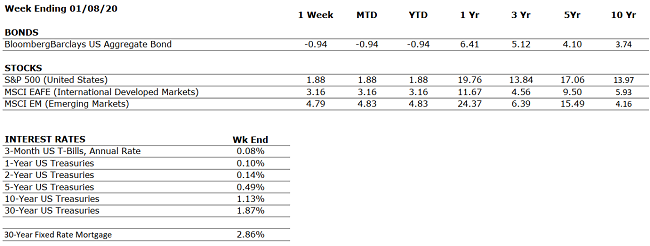

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its output lost to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

NEUTRAL |

In Q3, S&P 500 earnings were down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. Companies will begin reporting Q4 earnings in the coming weeks. |

|

EMPLOYMENT |

NEGATIVE |

The unemployment rate was stagnant in December at 6.7%. This is the first month since April in which the unemployment rate did not improve. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

Congress passed its second major fiscal relief package of 2020, the most recent one amounting to $900 billion in stimulus. The bill currently provides for $600 in cash payments to American citizens, however, Congress is in negotiation to deliver an additional check for up to $2,000, as President Trump has requested. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.