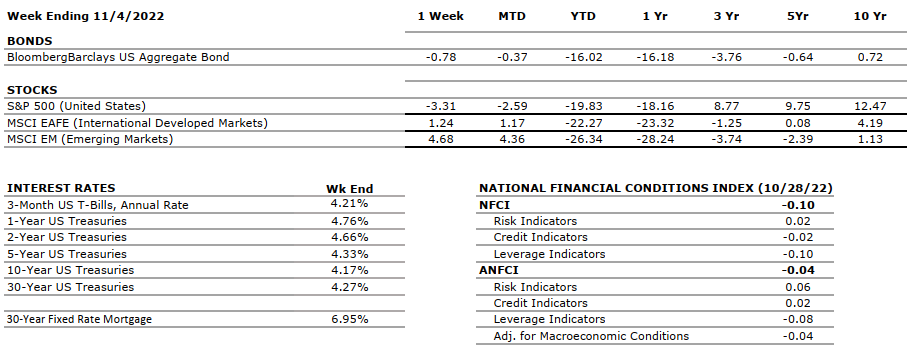

THE NUMBERS

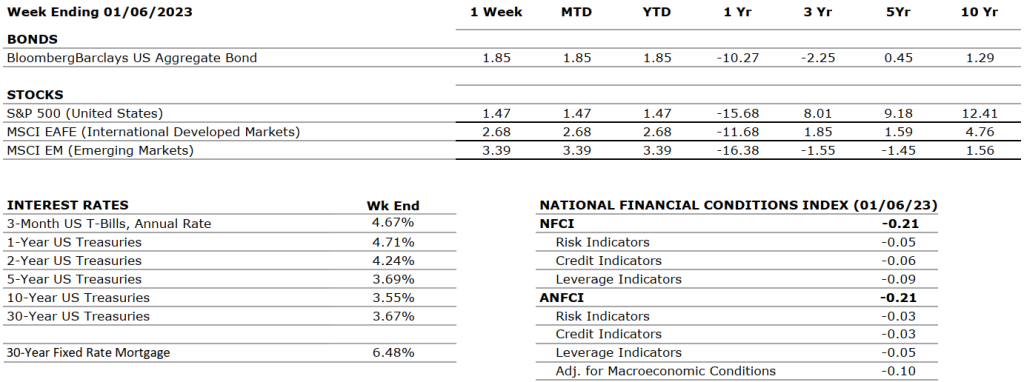

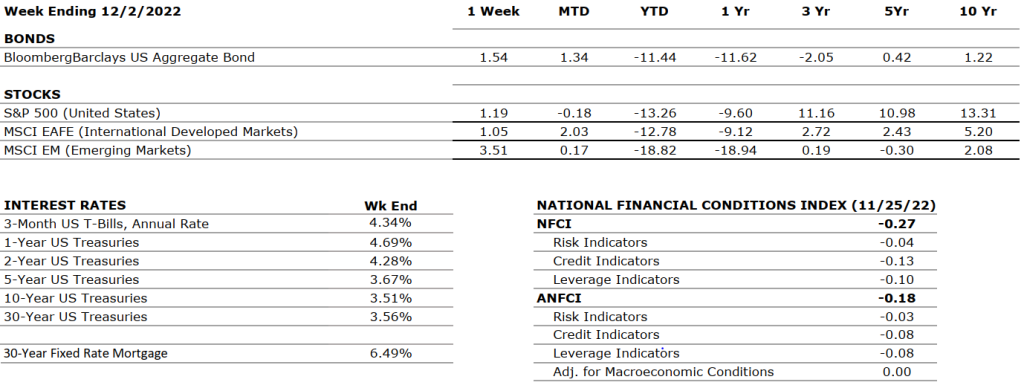

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

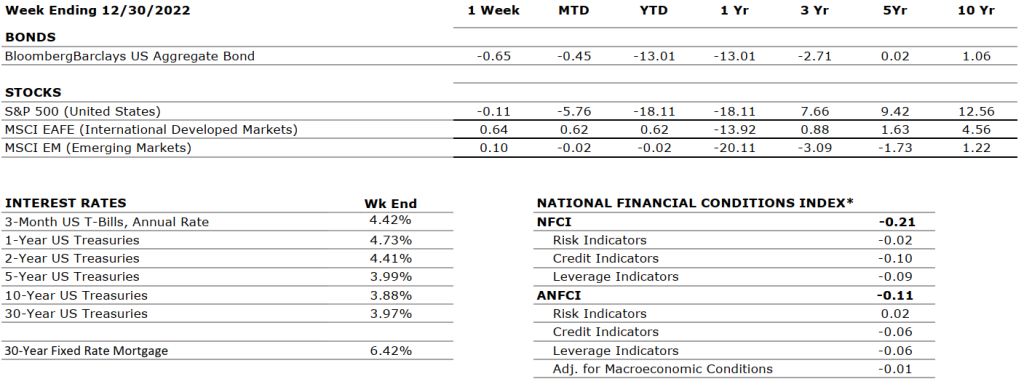

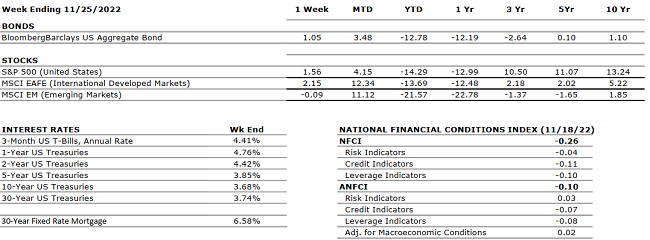

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, in contrast to a decrease of 0.6 percent in the second quarter. The increase in the third quarter primarily reflected increases in exports and consumer spending that were partly offset by a decrease in housing investment. The estimated growth rate for Q4 2022 Real GDP is now 3.8%. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q3 2022 was 2.4%. For Q4 2022, earnings are expected to decline by -4.1%, down from the previous estimate of -2.8%. This would be the first negative growth since Q3 2020 (-5.7%). So far, 20 S&P 500 companies have reported earnings, with 15 companies beating EPS estimates and 13 beating revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for December 2022 increased by 223,000, and the unemployment rate fell slightly to 3.5% from 3.7%. Leisure and hospitality, health care, construction, and social assistance were among the sectors with the most notable gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 7.1% for November 2022 compared to the expected 7.3% — showing some continued signs of deceleration. Core CPI was also reported below expectations at 6.0% versus the estimated 6.1%. Although energy prices have come down, energy, along with food and shelter, are still the main contributors to inflation. December inflation data is set to be released this Thursday, 01/12. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

Two weeks ago the Fed approved a 50 bps rate hike after four consecutive 75 bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot-plot, the expected terminal rate is now 5.1%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE | Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal.Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE | China seems to have abandoned its zero-Covid policy, which should help the global supply chain recover. On the other hand, the Russian-Ukraine war does not show signs of abating. Gas supplies from Russia to Europe have decreased by 88% over the past year, and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a significant diesel shortage, with national reserves at their lowest levels since 1951 and a ban on Russian products that will intensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

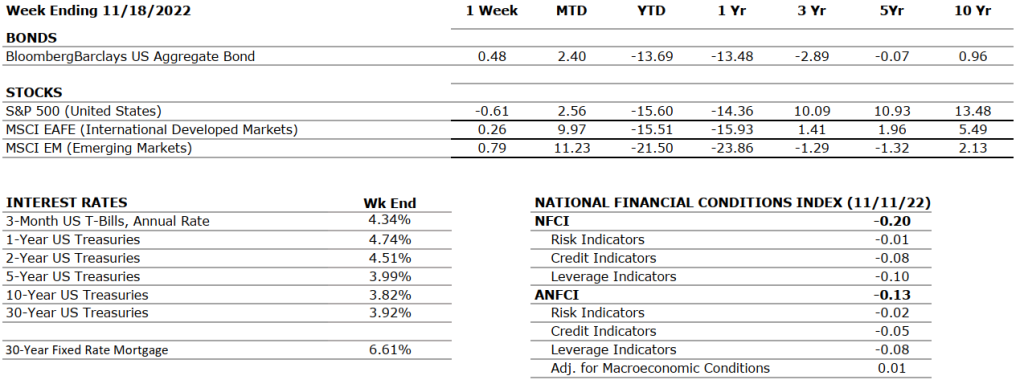

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

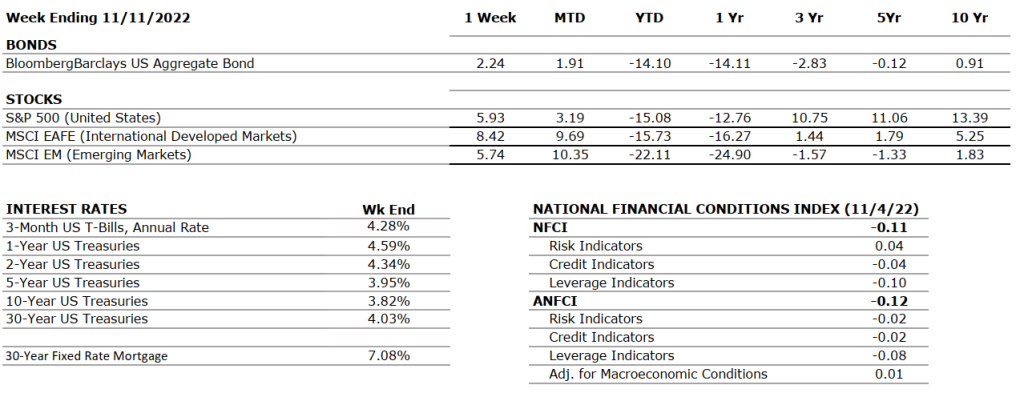

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

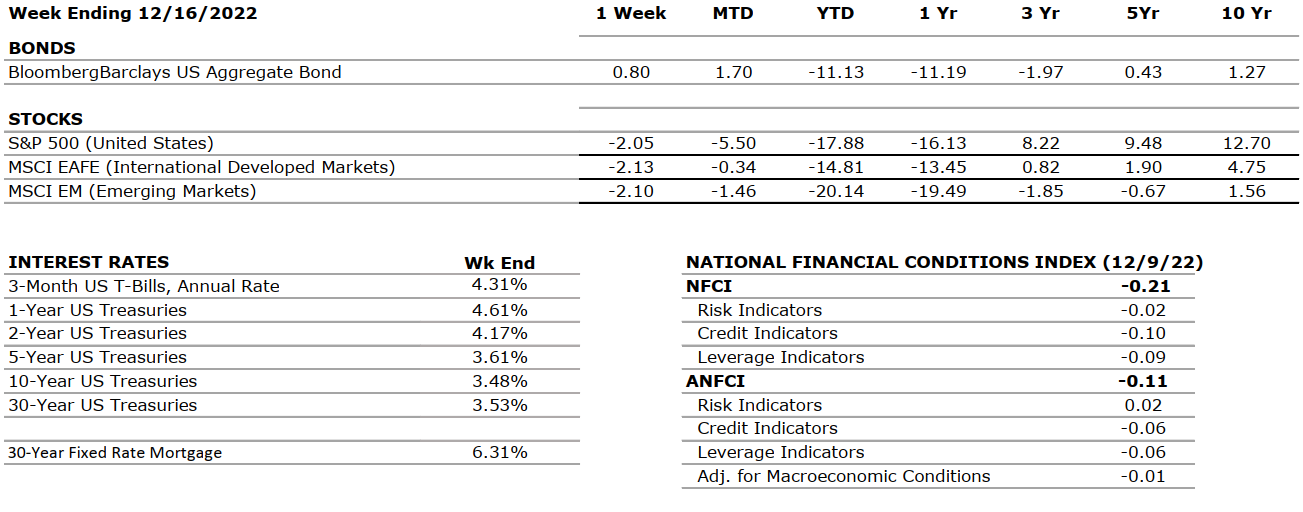

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

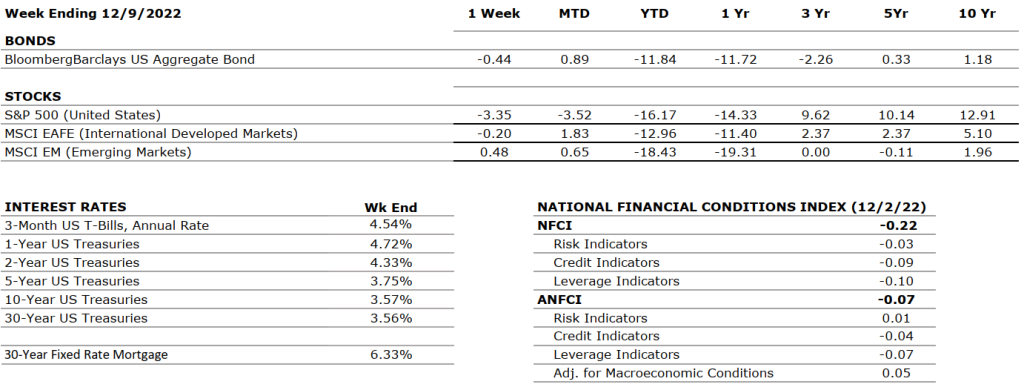

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association. THE NUMBERS

THE NUMBERS THE NUMBERS

THE NUMBERS