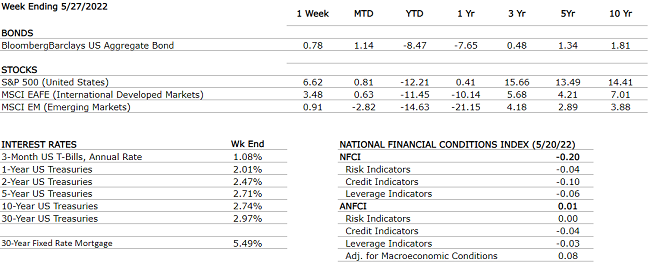

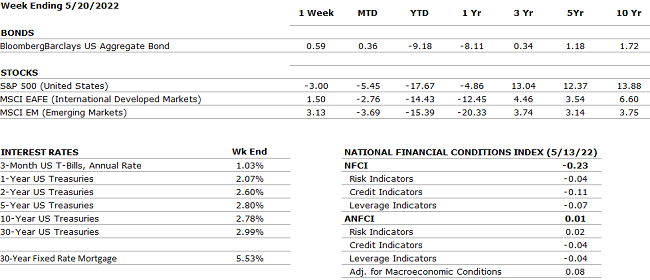

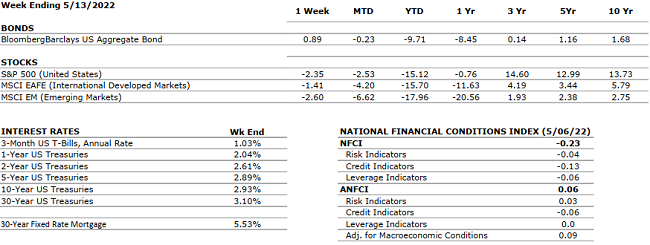

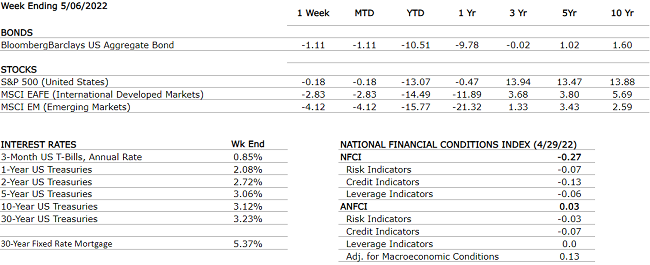

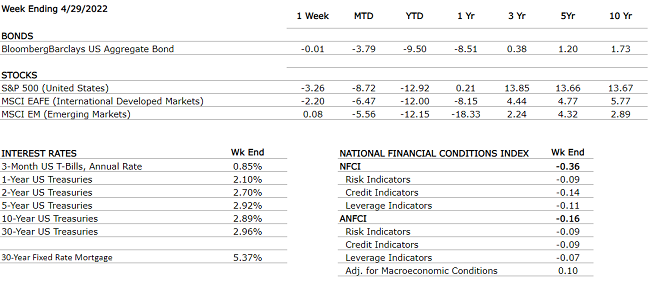

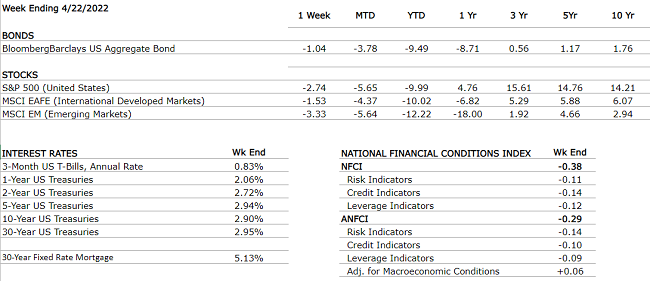

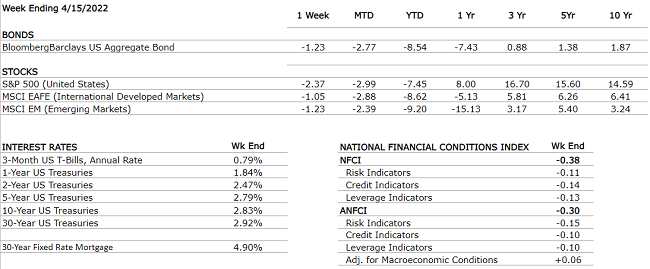

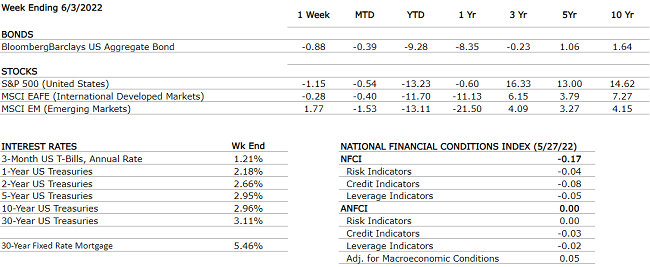

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.4% annual rate according to the first advance estimate. This is the first contraction since the beginning of the pandemic. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. This may be an indication that the U.S. economy has recovered faster than other countries. |

|

CORPORATE EARNINGS |

NEUTRAL |

For Q1 2022 the estimated earnings growth rate is 9.2% — the lowest since Q4 2020 (3.8%). This estimate was revised upward from the previous forecast of 7.1% in April. So far, 97% of S&P500 companies have reported earnings — 77% reported a positive EPS surprise and 73% beat revenue expectations. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 428,000 in April compared to an estimated 398,000. The unemployment rate remained constant at 3.6%. Job growth was widespread, led by gains in leisure and hospitality, manufacturing, and transportation and warehousing. |

|

INFLATION |

NEGATIVE |

CPI rose 8.3% year-over-year in April 2022, compared to an estimated increase of 8.1%. Core CPI recorded a 6.2% increase, and PPI increased by 11%. Shelter, food, airline fares, and new vehicles were the largest contributors to the soar in CPI. The energy index fell for the first time in recent months — gasoline decreased by 6.1% while natural gas and electricity increased. |

|

FISCAL POLICY |

NEUTRAL |

After passing a $13.6 billion package to support Ukraine a few weeks ago, the House approved an additional $40 billion military and humanitarian package for Ukraine. The bill was passed with 368 votes against 57 votes. The total of the two packages ($53 billion) is the largest foreign aid moved through Congress in over 20 years. |

|

MONETARY POLICY |

NEUTRAL |

The Fed raised rates by the expected 25 bps in March and 50 bps in May. Jay Powell projected a clear path for 2022 with as many as five additional rate hikes. The next decisions by the Fed will be data-driven based on future inflation numbers and estimated economic growth. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia was able to avoid default so far by making the required payment on its debt however, the U.S. has imposed additional sanctions barring Russia from using U.S. banks to make debt payments. The next coupons worth $400 million will be due on June 23rd and 24th and Russia is trying to leverage resources outside the Western financial infrastructure to make these payments. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. China is targeting June to end the Shanghai COVID-19 lockdown in hopes to revive its economy. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.