by William Henderson, Chief Investment Officer

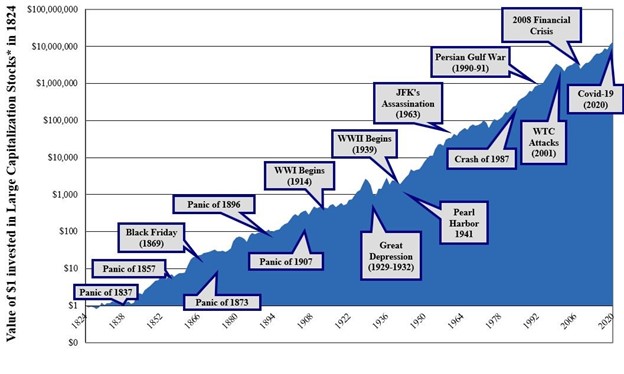

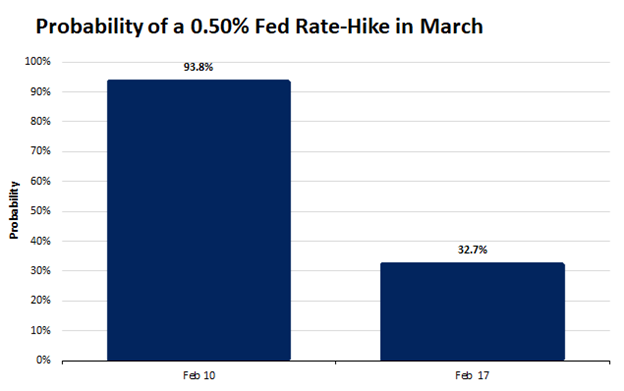

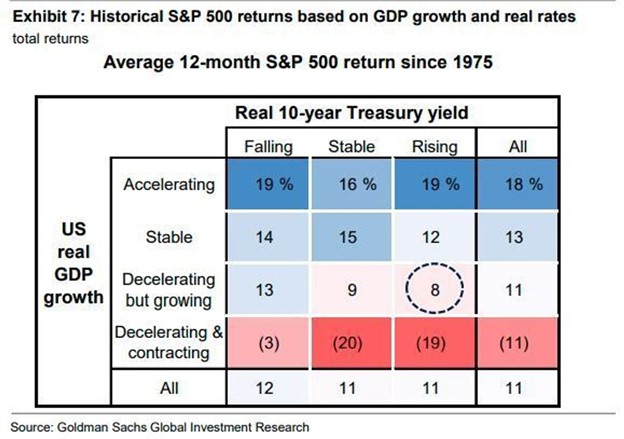

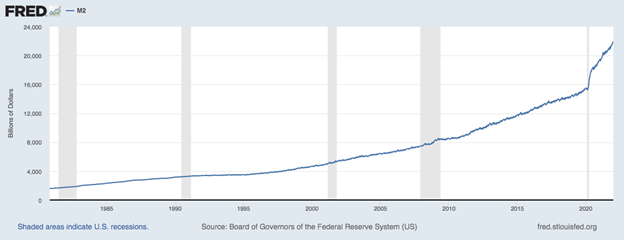

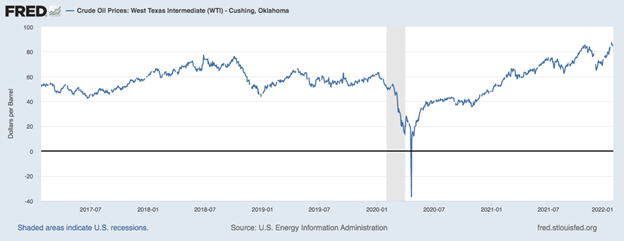

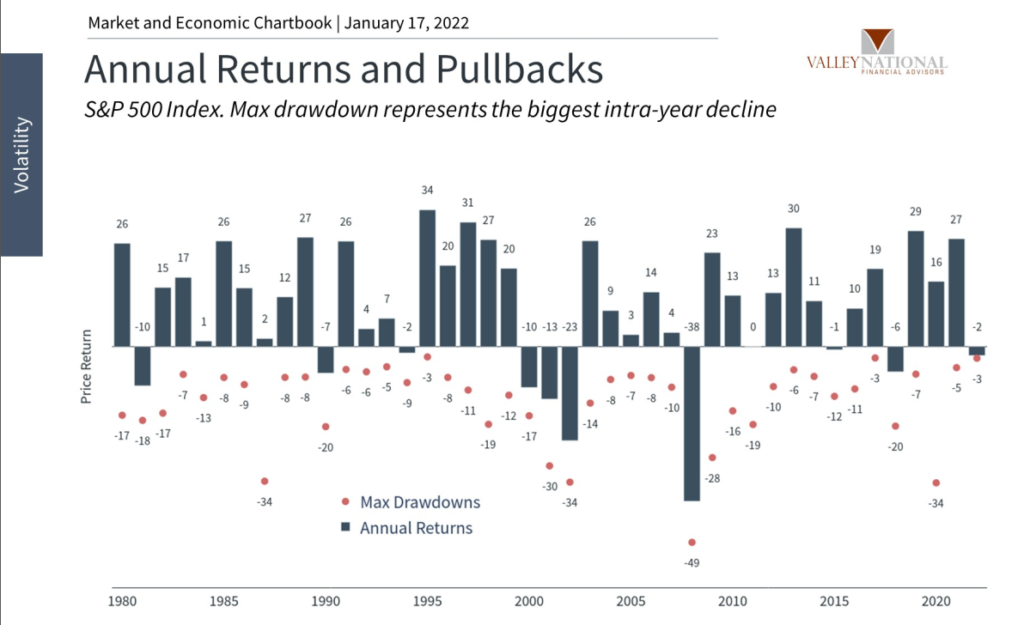

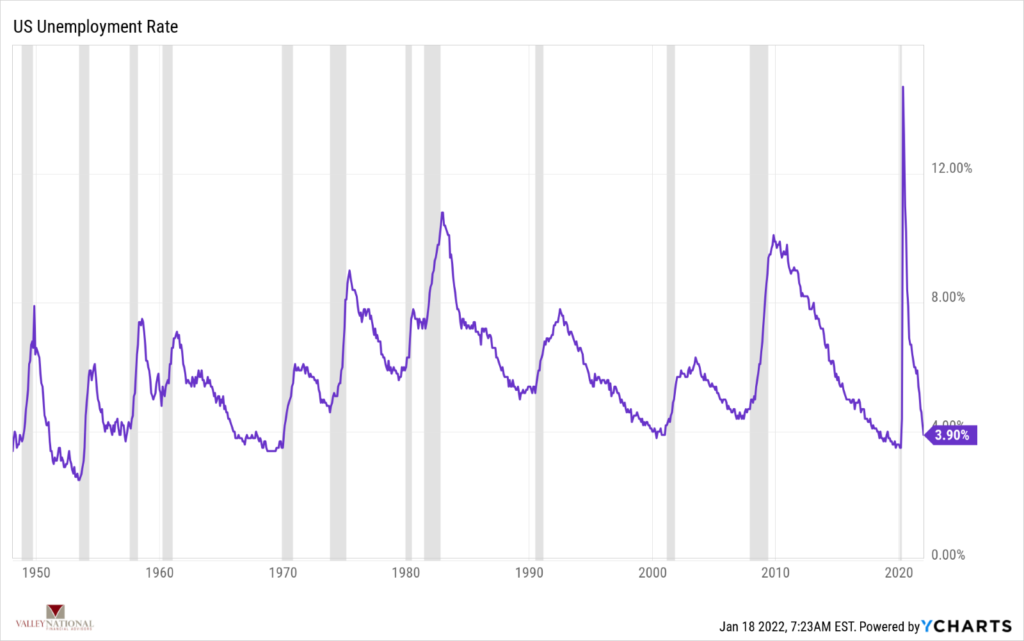

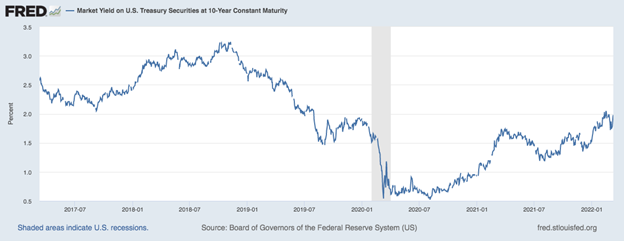

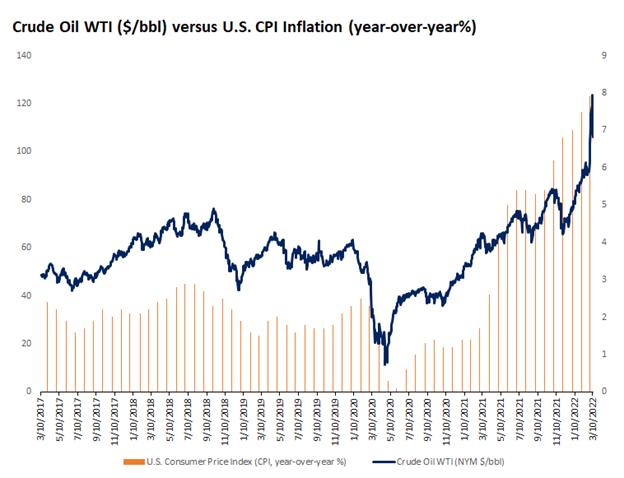

All major market indexes fell last week adding to an already poor start of the year in equity markets. Even a wild upward rally on Wednesday was not enough to thwart negative returns across the board. The Dow Jones Industrial Average fell -2.0%, the S&P 500 Index fell -2.9% and the NASDAQ lost -3.5%. Year-to-date returns have stayed well into negative territory for all three major market indexes. Year-to-date, the Dow Jones Industrial Average is down -8.9%, the S&P 500 Index is down -11.5% and the NASDAQ has moved into technical “Bear Market” territory being down -17.8%. The Russia / Ukraine war has taken a triple toll on the markets: pushing oil higher, further impacting overall inflation, and finally impacting U.S. Consumer Sentiment. Inflation fears and this week’s FOMC (Federal Open Market Committee) meeting, where markets are expecting the Fed to raise interest rates for the first time in three years, negatively impacted U.S. Treasury bonds leaving us with a very volatile week in fixed income markets. After finishing the previous week at 1.73%, the yield on the 10-Year U.S. Treasury bond jumped last week by 27 basis points to close at 2.00%. (See the chart below from the Federal Reserve Bank of St. Louis).

The yield on the 10-Year U.S. Treasury is now well off the dramatic all-time low of 0.50% hit during the peak of the COVID-19 outbreak and is working its way back to pre-pandemic levels. However, even as market participants are seeing higher yields, remember that if fear and uncertainty exist investors will need the risk management provided by fixed income securities.

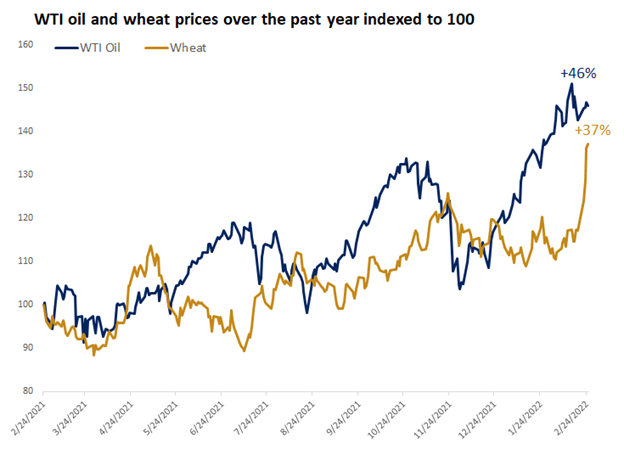

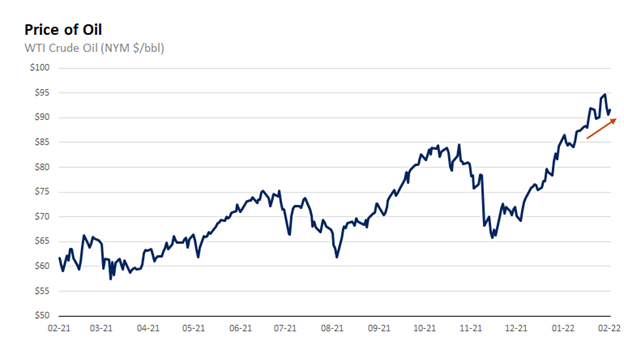

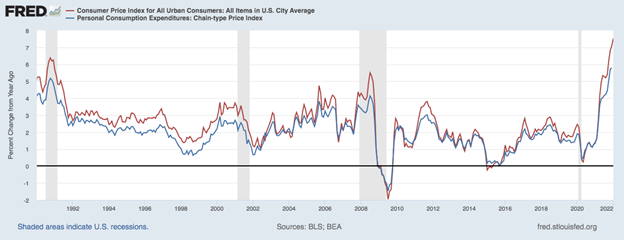

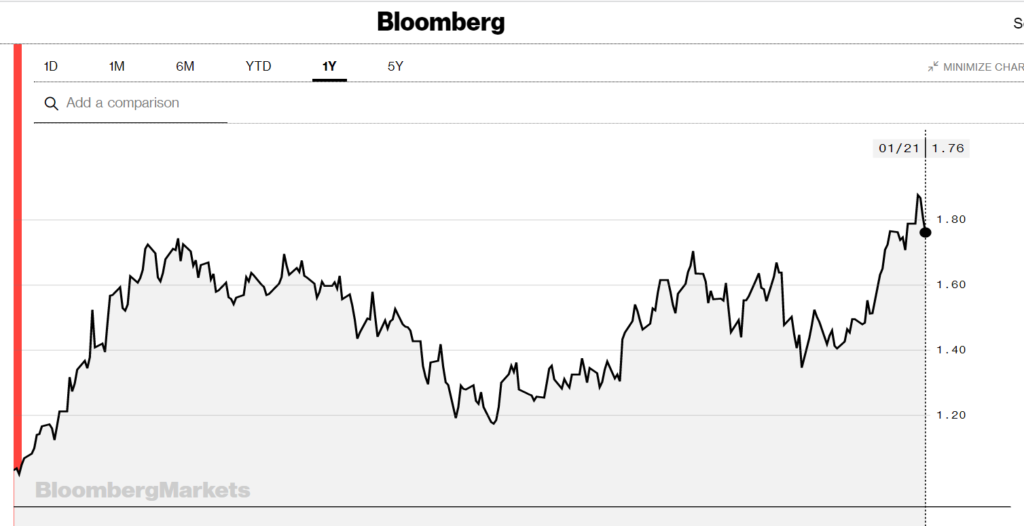

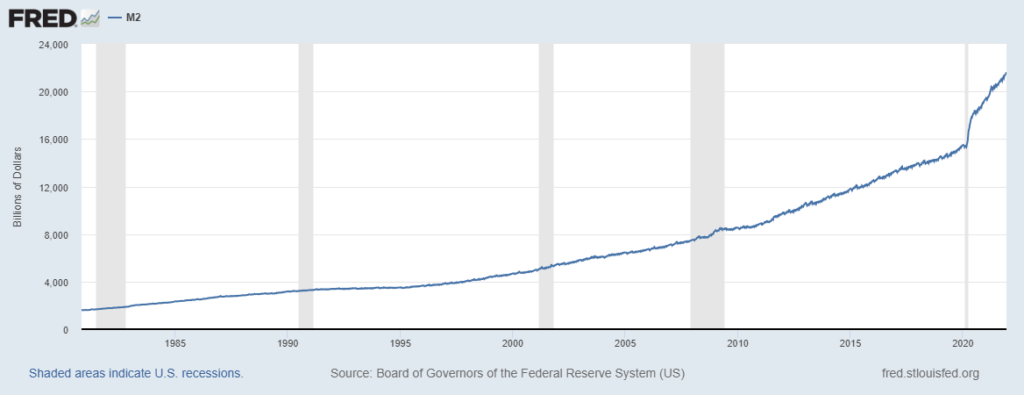

As mentioned, inflation, as measured by the U.S. CPI (Consumer Price Index), for February 2022 came in at 7.9% versus 2021, a 40-year high. All sectors, led by higher energy prices, showed increases including food and rent. See the chart below from FactSet showing oil prices (WTI Crude – left scale) and Inflation (U.S. CPI – right scale) and their close correlation.

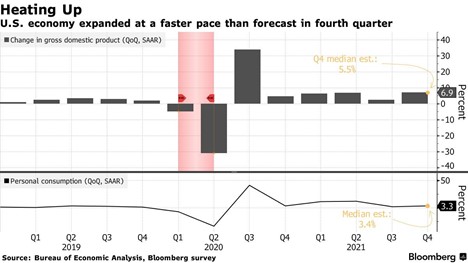

Critically, understand that the inflation data is backward looking information from February 2022 and therefore has not even considered the recent run up in oil prices during the month of March. This gives us a lot more confidence around the Fed’s plan for higher interest rates soon.

Another data point that has us worried was last week’s release of the March preliminary University of Michigan Consumer Sentiment Index (previously called Consumer Confidence Index), which came in lower than expected at 59.7, versus a Bloomberg estimate of 61.0. At that level, the measure of consumer sentiment is the lowest since 2011 and well off the highs hit at the beginning of 2021 when COVID-19 was waning, and the geopolitical climate was a lot calmer. Throw in significantly higher oil prices and you get a worried consumer. (See the chart below from YCharts and Valley National Financial Advisors showing U.S. Consumer Sentiment since April 2021).

We always talk about the efficiency of the markets, and we believe this to be the case today as always. Last week’s wild ride in the markets saw a 650-point (+2%) swing in the Dow Jones Industrial Average on Tuesday based on rumors of positive comments from Russian leader Vladmir Putin and hints of a ceasefire. This upward move was quickly reversed when peace talks fell apart and instead Russian invasions efforts into Ukraine intensified. As we write this report, ceasefire whispers are again underway, and markets are rallying. The international pressure on Russia and by decree on Vladmir Putin are enormous. Aside from blocking monetary transactions on SWIFT, an oil embargo by the west and severe sanctions elsewhere, the U.S. Department of Justice announced an intense “hunt” for assets held in the U.S. belonging to Russian Oligarchs. Putin was desperate enough to ask China for military and economic aid for its Ukraine war. This action was met swiftly with rebuke from Washington strongly advising China against any assistance whatsoever with Russia. In fact, this week, Washington officials are scheduled to meet with Chinese counterparts in Rome to discuss the war.

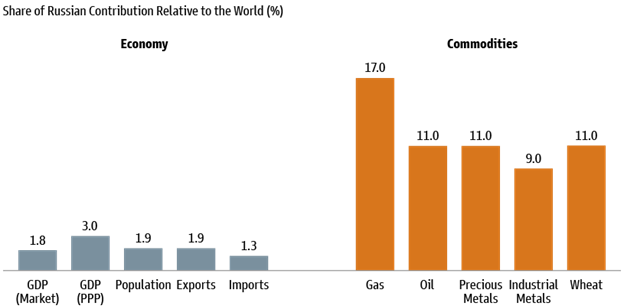

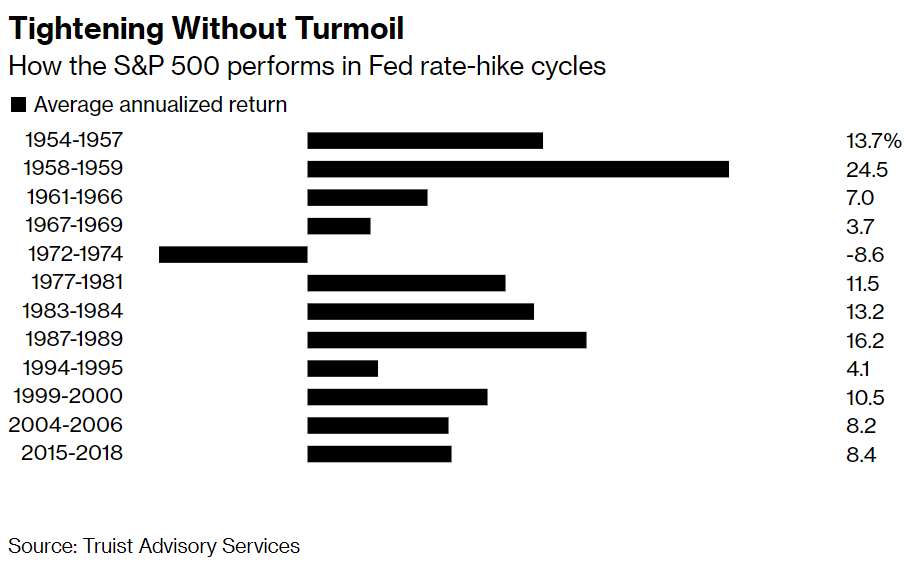

It is difficult to see any outcome for Russia that ends well. The only plausible endgame is for a negotiated solution between Ukraine and Russia that gives Putin something yet allows Ukraine to remain and independent state. Unfortunately, if the war drags on, uncertainty and fear will persist, and the markets will react accordingly. Beyond the humanitarian impact the war is having, prices of such commodities as oil, natural gas and palladium are skyrocketing and inflation is the result which further impacts consumers and eventually economic growth. Expect inflation to continue for longer but the Fed will be on the move this week and their new objective will be to combat inflation. This week’s FOMC meeting will be important for reasons beyond the expected 25 basis point rate hike. The markets will be watching for language around the pace of future hikes and the scope of balance sheet reduction. This may add some calm and clarity to the markets, but it could be overshadowed by any breakdown in peace talks or unwelcomed involvement from China.