View/Download PDF version of Q4 Commentary (or read text below)

Equities

In an eventful Q4, the stock market performed very well, as the S&P 500, Nasdaq 100, and Dow Jones Industrial Average were up 12.15%, 13.09%, and 10.73%, respectively. News was largely supportive of stocks this quarter, as a clear Presidential winner was announced, multiple vaccines entered distribution and a second fiscal relief bill was passed. On a full-year basis, the Nasdaq 100, which is populated mostly by technology companies, delivered a nearly 49% return, its best year since 2009, while the bellwether S&P 500 Index gained 18.4% and the “seasoned economy” Dow increased almost 10%. International and Emerging Market stocks also had strongly positive performance this year.

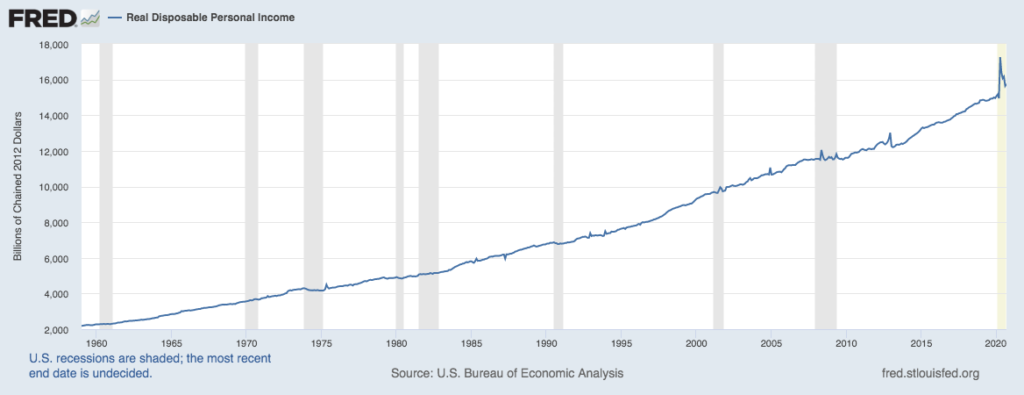

2020 was astonishing in that both the stock market and the economy (as measured by GDP) experienced their most rapid declines and corresponding recoveries in history. In response to lockdowns – which portended a nearly totally dormant nation – the Federal Reserve acted swiftly and vociferously by lowering interest rates and buying treasury bonds, thereby injecting much needed liquidity into a frightened financial market. Also buoyed by a large fiscal stimulus bill in March, the markets recovered as it became clear that COVID’s negative economic impacts would be mostly transient.

Fixed Income

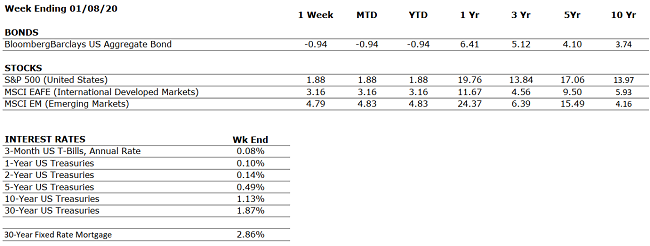

Interest rates collapsed to nearly zero in 2020 as a result of central bank action and investor flight to safe haven assets. Indeed, the 10-year treasury bond touched a historical nadir of 0.52% on August 4, down from 1.88% at the start of 2020. The 10-year treasury – a good proxy for the holistic interest rate environment – spent much of the year close to 0.70% and sits today just above 0.90%. Bond prices rise when interest rates fall, so investors experienced capital gains in their fixed income holdings. However, likely the most important impact that the rate decline had was on stocks, as investors passed on paltry bond yields in favor of equity investments.

Outlook

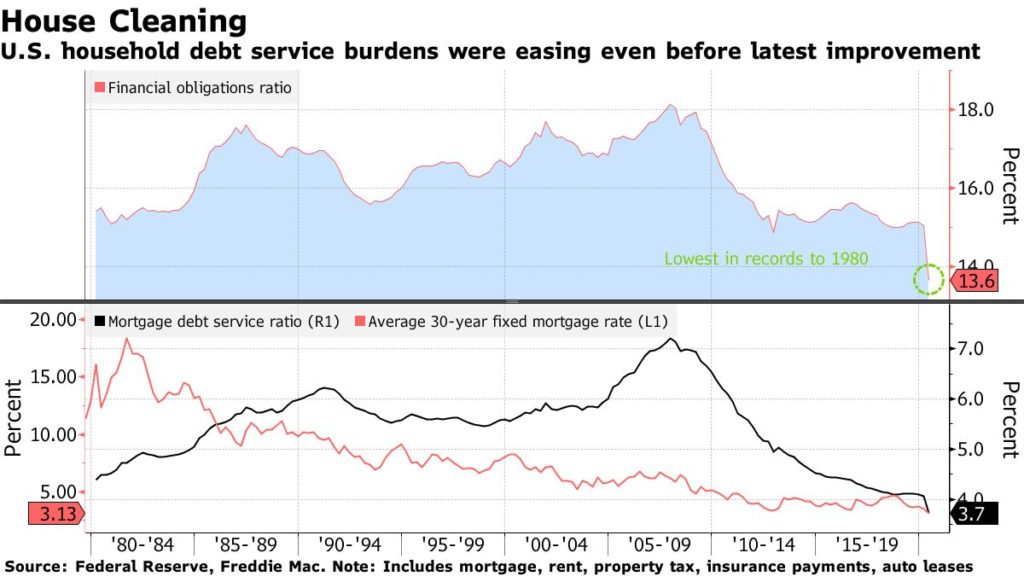

The economic fundamentals heading into 2021 are firmly optimistic: several vaccines are entering distribution, a second fiscal bill will have positive impacts, and yet, interest rates remain in the basement (which is both stimulative to the real economy and to stocks). The question, however, is to what extent such fundamentals are already reflected in asset prices after such a robust market recovery beginning on March 23. Another salient question on the mind of investors is to what degree trends which strengthened during the pandemic – such as e-commerce, food delivery and teleconferencing – will persist, or give way to “the old way” of doing things. We expect healthy economic performance as the American population gets inoculated through the year and, as always, will be following the markets closely and adjusting our views as fit.