by Connor Darrell CFA, Assistant

Vice President – Head of Investments

U.S.

equities generated gains for the second consecutive week as investors seemed to

grow more confident in efforts to keep the novel coronavirus contained. International

equities retreated on Thursday and Friday however after a significant surge in

the number of confirmed cases of the disease. The surge in confirmed cases

followed a diagnostic reclassification by Chinese authorities, which led to an

overnight increase of about 15,000 cases. Markets seemed to interpret the diagnostic

change more as a byproduct of shortages in available testing kits than as an

issue with the integrity of reporting (which has been a concern for some as a

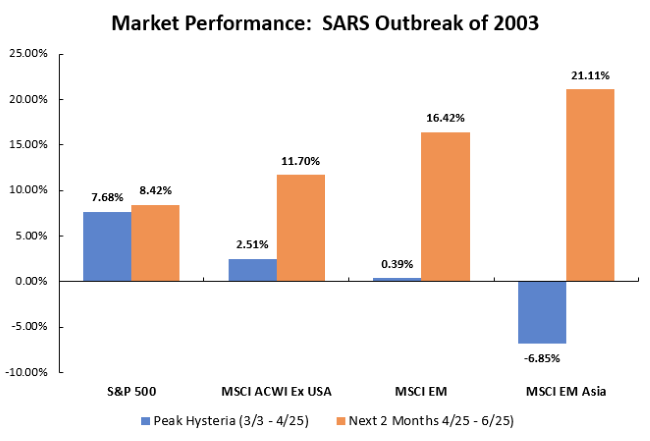

result of China’s questionable handling of the SARs epidemic in 2003).

For now, we see no reason to adjust our already elevated assessment of geopolitical risks (see this week’s Heat Map for more details). The World Health Organization suggested late last week that cases of the virus outside of China’s Hubei Province (the epicenter of the outbreak) were levelling off, which seemed to help contribute to the market’s muted response to the overnight rise in confirmed diagnoses. The greatest risk to the global economy at this time remains supply chain disruptions, which are likely to continue until after cases of the virus have peaked. Manufacturing within China has taken a significant hit due to factory and plant closures as well as travel restrictions within the country. We will get another glimpse at hard data on Chinese manufacturing at the end of February with the release of China’s monthly PMI data, which is likely to show contraction.

We would consider an additional elevation of our geopolitical risks rating should one of two things materialize; either a substantial increase in the death rate or evidence of an acceleration in the rate of contagion beyond infected provinces in mainland China (i.e. internationally). Currently, the death rate continues to hover right around 2%, though it has inched a little bit higher in recent weeks and currently stands at about 2.5%. Should that number begin increasing materially, it would suggest to us that either reporting integrity has been below standard or that the virus has been more severe than initially anticipated. With respect to contagion, the incredibly forceful travel restrictions imposed within China seem to have been effective in stalling the spread of the disease. However, should evidence begin to emerge that contagion has reaccelerated on an international scale, this would indicate to us that the significant economic impacts of the disease would not be confined to mainland China. We view such a scenario as low probability at this time, but it is a risk that deserves our ongoing attention.

Politics and Investing With so much news flow coming out of China with respect to the coronavirus, it has been easy to overlook all that has gone on in U.S. politics over the past several weeks. What is particularly interesting about the current state of domestic politics is that it seems there are those on both ends of the political spectrum who voice concerns about what an opposition victory might mean for their investment portfolios. Our belief is that investors should do their best to disentangle politics from investing, as the controlling political party has historically had very little influence on market returns over time. We anticipate that markets may experience short-term bouts of volatility simply as a result of how polarizing the 2020 campaign may be, but we expect the focus of markets to remain elsewhere until we have more clarity on who the Democratic candidate may be. Following the results in Iowa and New Hampshire, it appears that it may be quite some time before that clarity is realized. The first real opportunity to narrow the pack will come on March 3, when over 34% of available delegates will be up for grabs on “Super Tuesday”.