How to Deal with Volatility

Over the past 18 months or so, a variety of surfacing risks have taken their shot at derailing the bull market. Chief among them have been the deteriorating U.S./China trade relations, weakening (but not stalling) global economic growth, and of course the ever-present abundance of geopolitical tensions around the world. The market’s reaction to the setback in U.S./China trade negotiations last week led to a rough day of trading on Monday, and many investors were left wondering whether the markets would crater as they did back in 2018. But the fact of the matter is that for equity investors, volatility is to be expected. However, the very presence of volatility is the primary reason that equity returns tend to be higher than other asset classes over the long-term (we can think of returns in this context as our compensation for enduring the higher levels of risk and the stress that can come along with it). So how can we as investors better manage the emotional roller coaster that can accompany this volatility? We offer some thoughts on the subject below:

Understand your situation and your goals:

As with most aspects of personal finance, it is important to reflect upon your current stage of life. For example, if your distance from retirement can be measured in decades, it is reasonable (and likely prudent) to take no action, and perhaps even look at market weakness as a buying opportunity. On the other hand, investors who are near retirement or perhaps just recently retired are likely to look at market volatility in a drastically different light. For these investors, it is important to also consider the size of your nest egg and your specific income needs relative to your portfolio. A conversation with your financial advisor (and perhaps an update to your financial plan) can go a long way in helping you determine what the best course of action might be if you are becoming concerned with the volatility in your portfolio

Maintain a Bucket of Liquid Cash Reserves

When building a financial plan, we typically recommend maintaining at least 6-12 months’ worth of spending needs (this number might be lower for accumulators) in low-risk, interest-bearing assets, and refer to these assets as a liquid reserve. These reserves can serve as a source of income during periods of market weakness and can prevent you from needing to draw down your other assets after they have decreased in value. Given the still low rates offered by most checking and savings accounts, money market funds, CDs, and short-term high-quality bonds, these tend to be the best options for investors today. However, it is important to remember that these types of assets expose you to the potential opportunity costs associated with not holding investments with higher expected rates of return over the long haul.

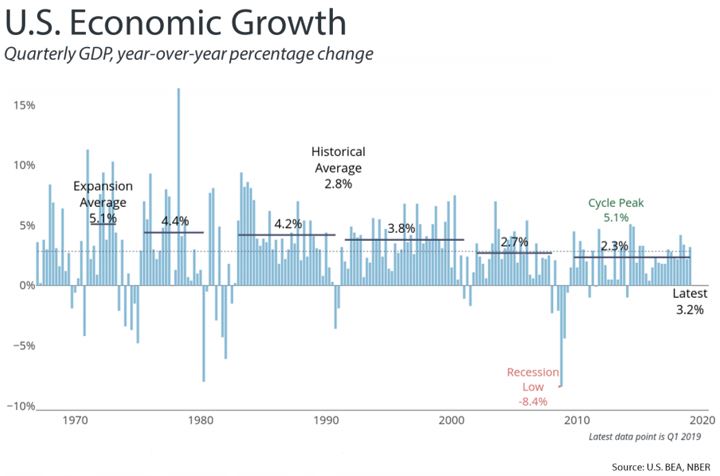

Remind Yourself of the Long-Term Wealth Generating Power of Markets

Perhaps the most important thing for long-term investors (which most of us are) to remember when volatility strikes is that the financial markets have a remarkable track record of generating and compounding wealth throughout history. Our Vice President and Financial Advisor Joe Goldfeder, CFP® recently recorded a great video on this very subject. In it, Joe shares some powerful statistics about long-term investing and the resilience of markets, and also discusses some of the above concepts in a little more detail. CLICK HERE TO WATCH