by Connor Darrell, Head of Investments

It was “Much Ado About Nothing” last week, as one of the busiest weeks of the year proved to be one of the least memorable in terms of market moves. The Trump Administration once again managed to make things interesting when it announced on Friday its intentions to impose a 25% tariff on up to $50 Billion of imported Chinese goods, prompting a small pullback in U.S. equities. The move wasn’t major, but it was enough to erase the small gains that had been posted over the week’s first four trading days. As is common when equity markets react to negative news, bonds produced small gains despite the Fed’s decision to increase interest rates.

There were no less than four key events last week (three of them were officially scheduled ahead of time) that had the potential to influence markets in a meaningful way. We go through the key details below:

- The Summit with North Korea

While historically significant, there were few details emerging from the summit that caught the attention of financial markets. In post-meeting press conferences, President Trump made a case for the North Korean Government to consider opening up to foreign investment, stating that Chairman Kim has a “great opportunity” to improve the livelihood of his people. In the long run, geopolitical uncertainties tend to be overtaken in significance by economic fundamentals, and it is unlikely that (short of a war) the ongoing concerns in North Korea will prove to have a lasting impact on markets. - Federal Reserve Policy Meeting

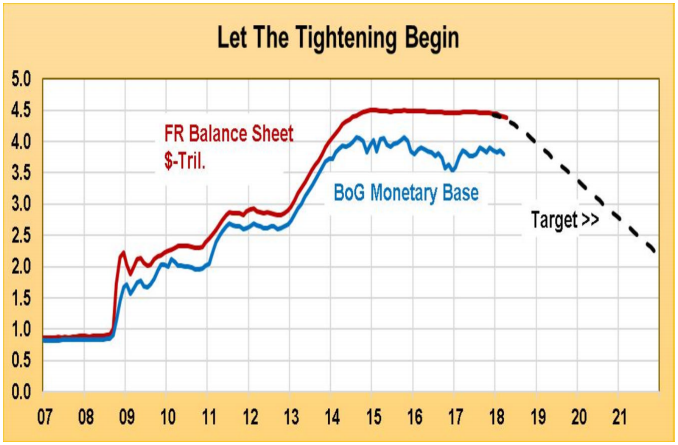

The Federal Reserve raised the federal funds rate a further 0.25% on Wednesday. The move was highly telegraphed and was already priced into markets, so the net impact was minimal. However, we did gain further insights into how the Fed views the current state of the economy (quite favorably) and learned that two more hikes this year are expected. - ECB Policy Meeting

The European Central Bank also held policy discussions this week, and officially announced its intention to wind down its massive bond-buying program. The European economy is a bit behind the U.S. in its recovery but has undergone the same type of monetary policy “stimulus” as has been experienced here in the U.S. The ECB made clear in its communications that while the aggressive bond purchases will cease, interest rates will remain unchanged until at least September 2019. The monetary policy environment overseas remains more accommodative; a sign that the U.S. economy stands on more solid footing. Markets took the news well, and any fears that the adjustments would lead to market turmoil proved unfounded. - Tariff Announcements

The most influential “event” of the week was the only one not officially listed on the calendar ahead of time, as the Trump Administration offered details on its plans to impose tariffs against Chinese goods. China was quick to respond with its own plans, and fears of an escalating trade war were stirred up yet again. Markets opened Friday sharply lower but managed to claw back a decent portion of early losses. The concerns over tariffs continue to linger, though the market has remained resilient overall.