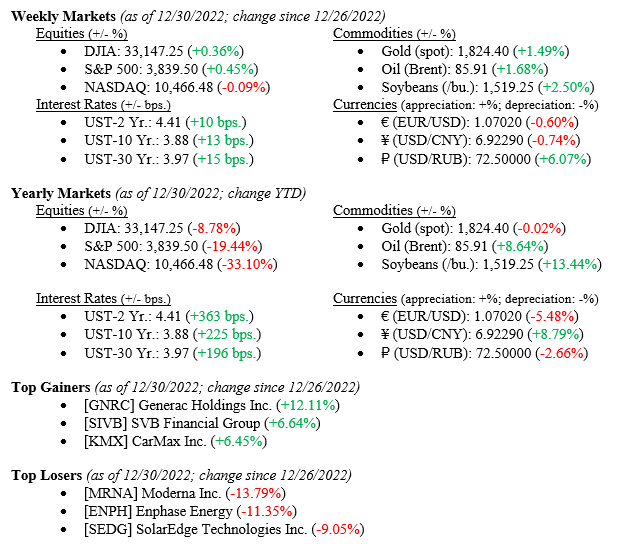

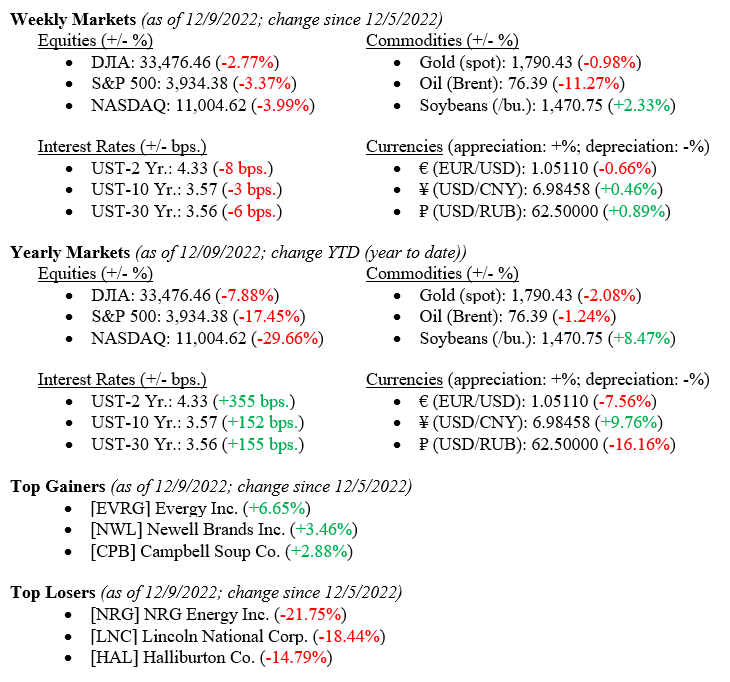

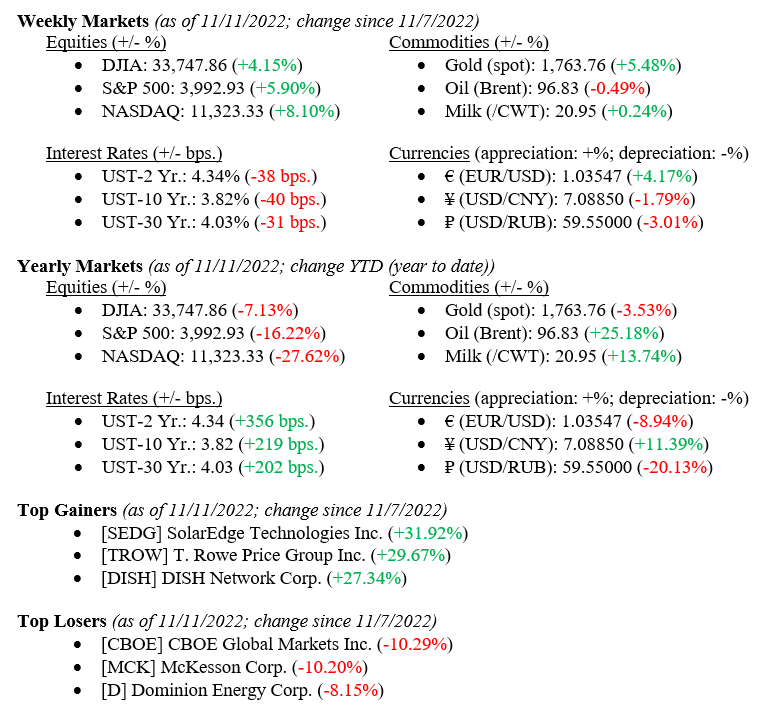

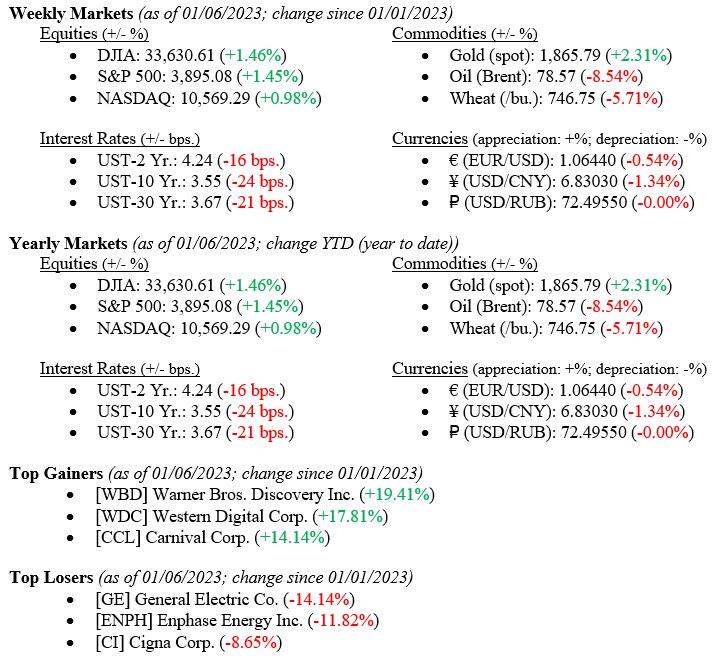

On Friday, a solid jobs report by the BLS (Bureau of Labor Statistics) pushed equity on bond markets higher as investors hung new hopes for an economic soft landing in 2023 rather than a Fed-induced recession. The economy added 223,000 jobs in December, beating consensus expectations and continuing the string of strong payroll gains. Further, job openings, a measure the Fed pays close attention to, stayed elevated. For the week ended January 6, 2023, the Dow Jones Industrial Average and the S&P 500 Index closed higher by +1.5%, while the NASDAQ moved higher by +1.0%. Lastly, the 10-year US Treasury fell a stunning 24 basis points to close the week at 3.55%.

Economy

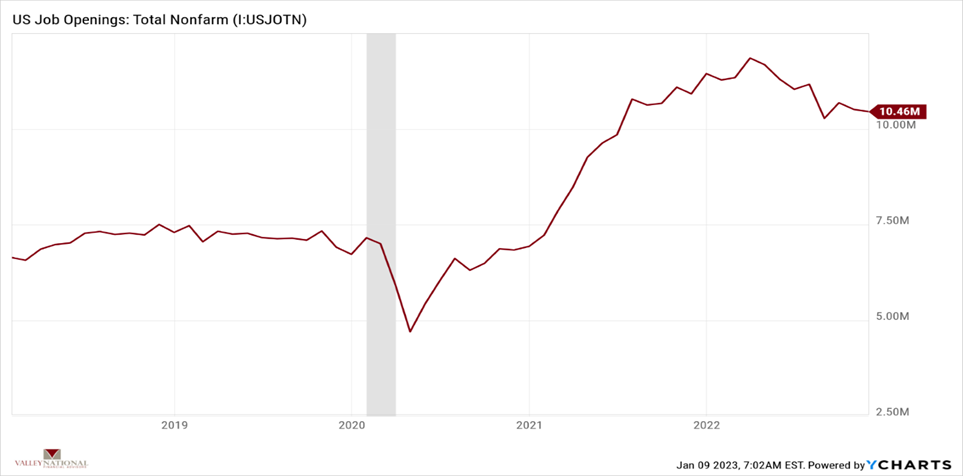

As mentioned, the BLS reported a strong number of jobs, and job openings also remained elevated. The unemployment rate fell to 3.5%, presenting yet another piece of stubborn employment data. Chart 1 below from Valley National Financial Advisors and Y Charts shows job openings are elevated and elevated not just from the pandemic period of 2020 but also from the pre-pandemic period before 2020. Although many companies are announcing job cuts, especially in technology (Amazon) and banking (Goldman), these industries also hired many employees during and after the pandemic, giving them reasonable amounts of job cuts to make without impacting the overall employment picture. The combination of elevated job openings and low unemployment dims the prospects for a hard landing (aka recession) in 2023.

Policy and Politics

Republican Representative Kevin McCarthy was elected Speaker of the House in a near-record set of 15 elections before the conclusion on January 7, 2023. The election was less critical than the November 2022 election. At that point, the Republicans took control of the US House of Representatives and thereby set a firmly divided government in place for at least two years. Historically, markets like a divided government for the sole reason that nothing drastic can happen that would impact the business environment. It is too early to see which direction our divided government will take, but we take solace in the fact that there are strong checks and balances.

What to Watch

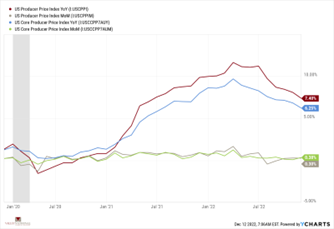

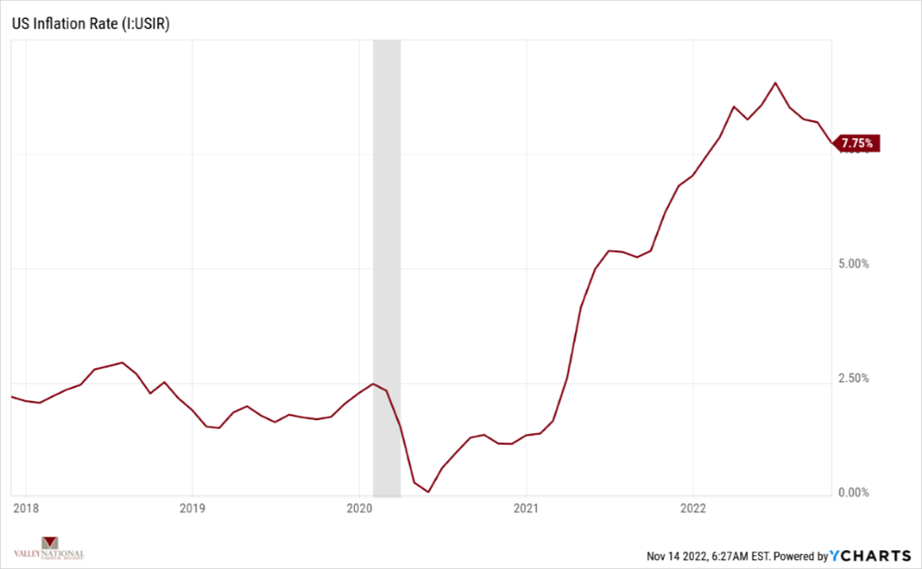

- U.S. Inflation Rate for December 2022, released 1/12/23, (Prior 7.11%)

- U.S. Core Consumer Price Index Year Over Year for December 2023, released 1/12/23, (Prior 5.96%)

- U.S. Index of Consumer Sentiment for January 2023, released 1/13/23, (Prior 59.7)

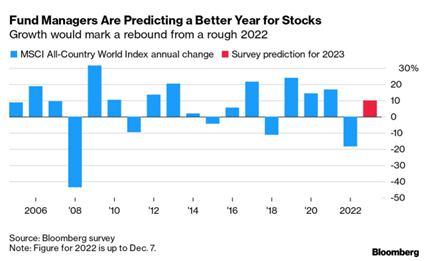

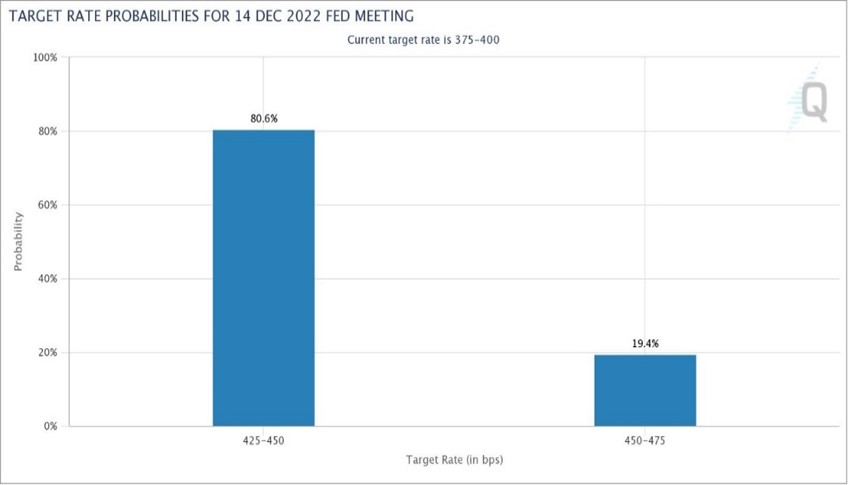

Markets are off to a good start thus far in 2023. Still, a week does not make a year, and uncertainty remains with the Fed, China’s reopening, the Russia/Ukraine War, ongoing painful inflation, and the long-running inverted yield curve in the U.S. Treasury market has historically preceded a recession. In the face of this uncertainty, we have conflicting employment information that shows layoffs by many companies while job openings remain high and unemployment remains low. Inflation continues to be the Fed’s primary concern, and we expect further rate hikes in 2023. We also expect the pace, tenor, and size of those rate hikes to soften as Chairman Powell balances higher rates with inflation and prospects for a recession. Lastly, wage growth, while moderate recently, is keeping consumers healthy. When you add in bank balance sheet health and corporate earnings growing modestly, it is difficult to see a recession in 2023 and much easier to see the hoped-for “Soft Landing.”